- Poland

- /

- Entertainment

- /

- WSE:PLW

Discovering Undiscovered Gems with Potential In January 2025

Reviewed by Simply Wall St

As we step into 2025, global markets are navigating a mixed landscape with the S&P 500 and Nasdaq Composite achieving significant gains over the past two years, despite recent economic indicators like the Chicago PMI revealing challenges in manufacturing. Amid this backdrop of robust indices performance and fluctuating economic signals, identifying potential "undiscovered gems" in small-cap stocks becomes crucial for investors seeking opportunities that align with current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Südwestdeutsche Salzwerke (DB:SSH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Südwestdeutsche Salzwerke AG, along with its subsidiaries, is engaged in the mining, production, and sale of salt across Germany, the European Union, and internationally, with a market capitalization of approximately €588.42 million.

Operations: The primary revenue stream for Südwestdeutsche Salzwerke AG is derived from its salt segment, generating €283.67 million, followed by waste management at €62.46 million. The company also reports a reconciliation figure of -€17.18 million and additional segments contributing €17.80 million to the overall revenue structure.

Südwestdeutsche Salzwerke, a small cap player in the industry, has shown impressive financial performance with earnings skyrocketing by 4290.9% over the past year. This growth far outpaces the food industry's average of 48.7%, suggesting robust operational efficiency and market positioning. Trading at about 90% below its estimated fair value, there seems to be significant upside potential for investors seeking undervalued opportunities. Despite a highly volatile share price recently, SSH's strong balance sheet—with more cash than total debt—reinforces its financial stability and capacity to manage interest obligations effectively without concern for future cash runway challenges.

PlayWay (WSE:PLW)

Simply Wall St Value Rating: ★★★★★☆

Overview: PlayWay S.A. is a global producer and publisher of PC and mobile games, with a market capitalization of PLN1.93 billion.

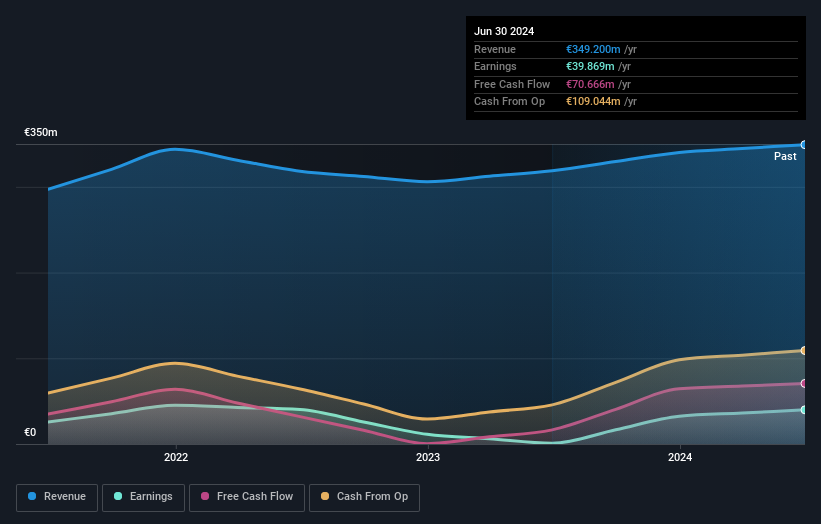

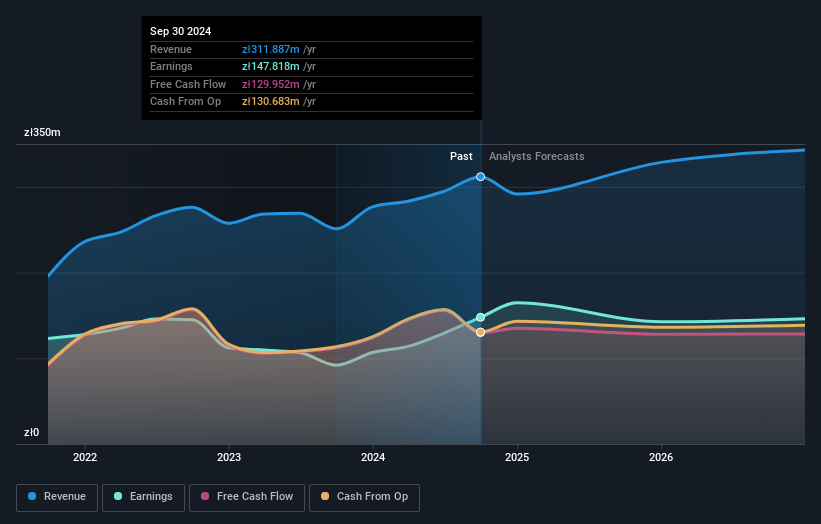

Operations: The company generates revenue primarily from its Computer Graphics segment, amounting to PLN311.89 million.

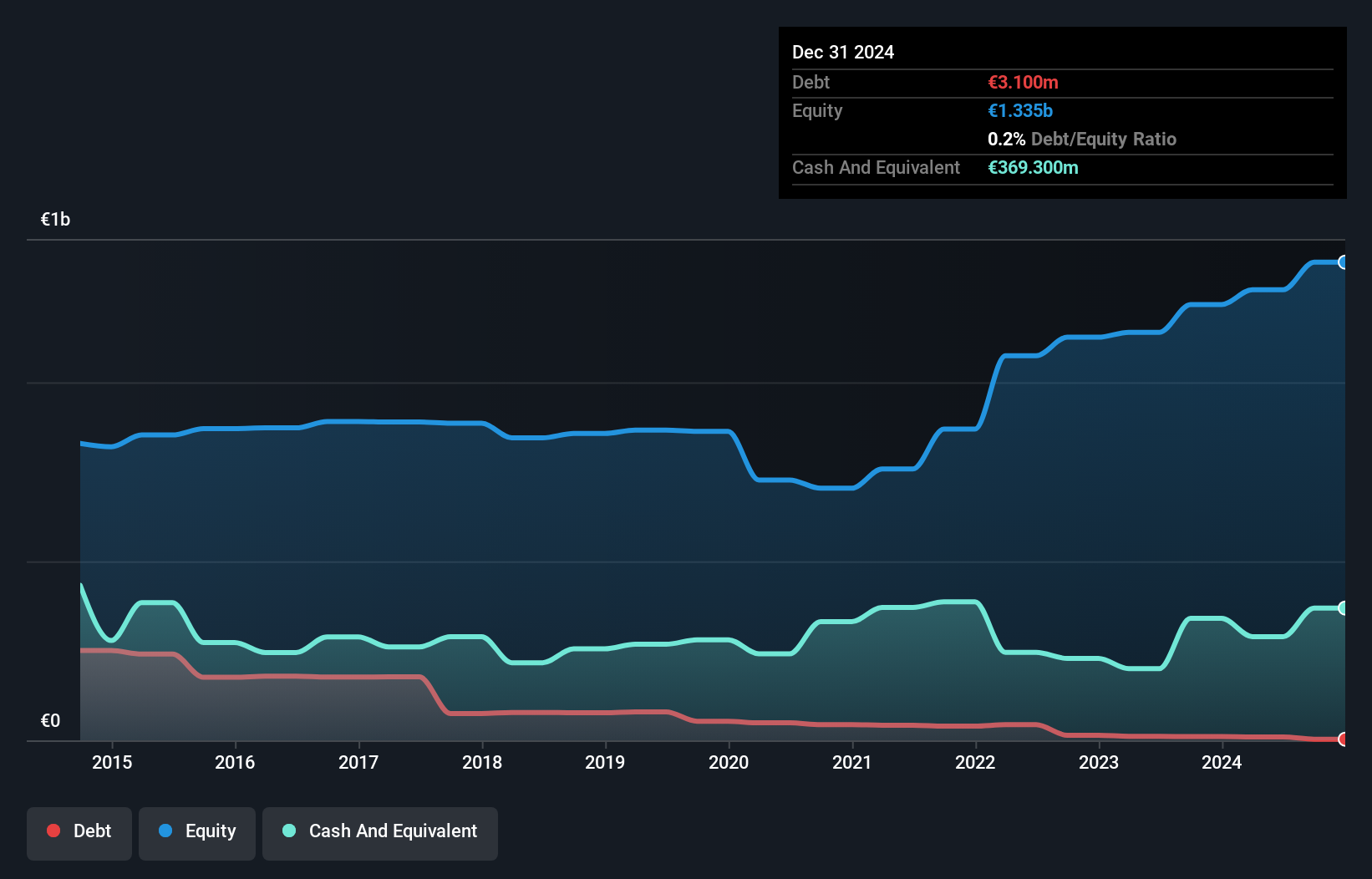

PlayWay, a nimble contender in the gaming industry, showcases impressive financial health with cash reserves surpassing its total debt. Over five years, its debt-to-equity ratio nudged up to 0.08%, yet it comfortably covers interest obligations. Recent earnings surged by 60.8%, overshadowing the industry's 26.6% growth rate, highlighting its robust performance and high-quality earnings profile. The company trades at an attractive valuation, about 30% below fair value estimates, suggesting potential upside for investors seeking undervalued opportunities. With net income climbing to PLN 132 million over nine months in 2024 from PLN 91 million previously, PlayWay's trajectory appears promising.

- Take a closer look at PlayWay's potential here in our health report.

Understand PlayWay's track record by examining our Past report.

KSB SE KGaA (XTRA:KSB)

Simply Wall St Value Rating: ★★★★★★

Overview: KSB SE & Co. KGaA, along with its subsidiaries, is involved in the global manufacturing and supply of pumps, valves, and related services, with a market capitalization of approximately €1.10 billion.

Operations: KSB SE & Co. KGaA generates revenue from three main segments: Pumps (€1.52 billion), Fittings (€370.94 million), and KSB Supremeserv (€978.20 million).

KSB SE KGaA, a smaller player in the machinery sector, has been showing impressive financial resilience. Its earnings surged by 16.8% last year, outpacing the industry average of -8.6%. Despite a significant one-off loss of €102 million impacting recent results, KSB's debt situation is favorable with more cash than total debt and a reduced debt-to-equity ratio from 9.2% to 0.8% over five years. The company seems undervalued, trading at 76% below estimated fair value while maintaining positive free cash flow and strong interest coverage, suggesting robust financial health amidst challenging market conditions.

- Unlock comprehensive insights into our analysis of KSB SE KGaA stock in this health report.

Explore historical data to track KSB SE KGaA's performance over time in our Past section.

Key Takeaways

- Reveal the 4659 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade PlayWay, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:PLW

Solid track record with excellent balance sheet.

Market Insights

Community Narratives