3 Reliable Dividend Stocks To Consider With At Least 4.9% Yield

Reviewed by Simply Wall St

As global markets react to recent political developments and economic shifts, U.S. stocks have been buoyed by optimism surrounding potential trade deals and AI investments, leading major indexes like the S&P 500 to reach new highs. In this evolving landscape, investors often seek stability through dividend stocks that offer consistent returns; those with yields of at least 4.9% can provide a reliable income stream amid market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.51% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.97% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.78% | ★★★★★★ |

Click here to see the full list of 1948 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

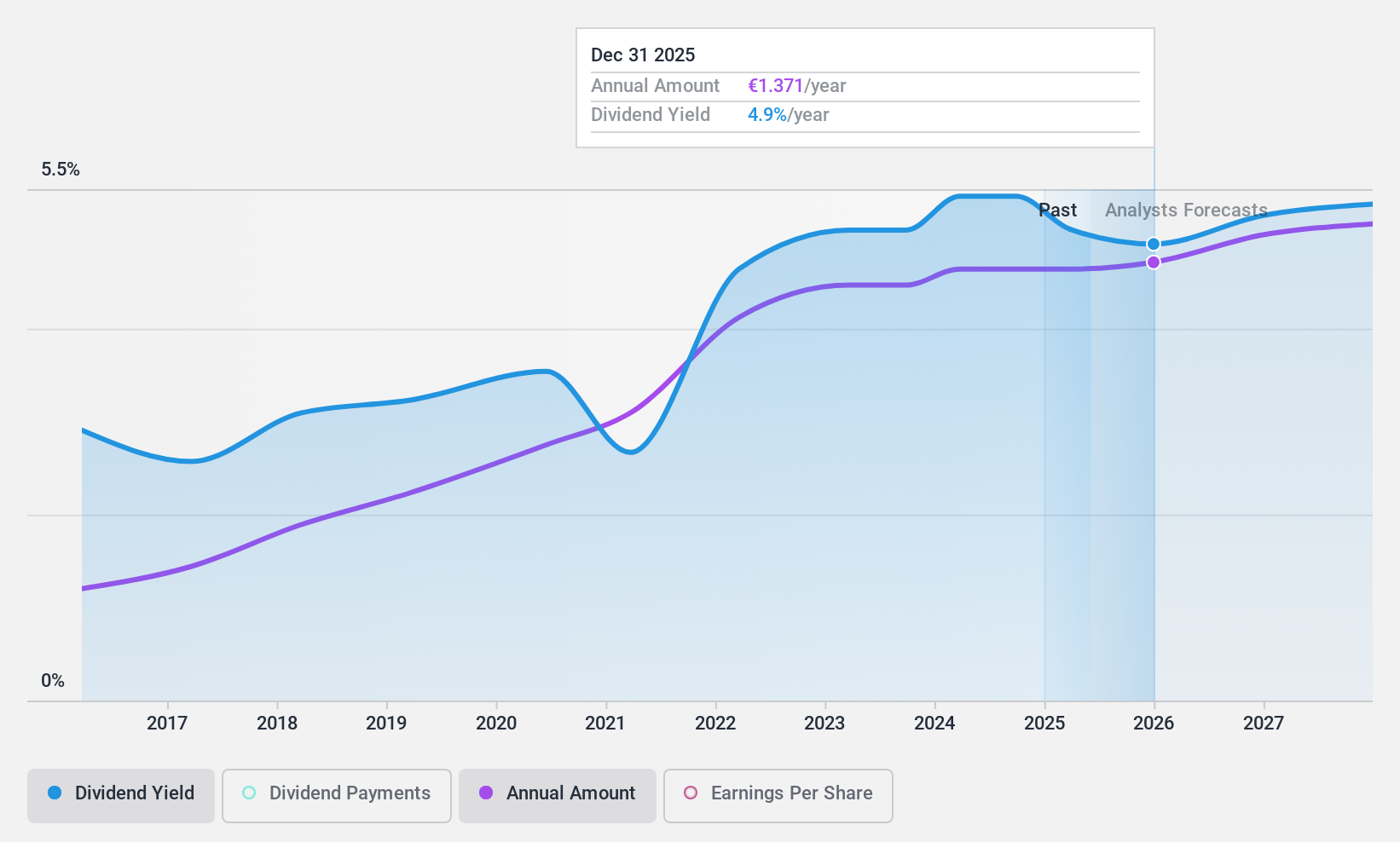

Valmet Oyj (HLSE:VALMT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Valmet Oyj is a company that develops and supplies process technologies, automation, and services for the pulp, paper, and energy industries across various regions including North America, South America, China, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of €4.96 billion.

Operations: Valmet Oyj's revenue is comprised of €1.84 billion from Services, €1.39 billion from Automation, and €2.10 billion from Process Technologies.

Dividend Yield: 5%

Valmet Oyj's dividend situation presents mixed signals. While its dividends have been stable and growing over the past decade, the high payout ratio of 130.5% indicates dividends are not well covered by earnings, though they are supported by cash flows with a 63.9% cash payout ratio. The dividend yield of 4.98% is below the Finnish market's top tier, potentially limiting its appeal among high-yield-seeking investors. Recent executive changes may impact future strategic directions but don't directly affect dividend stability at present.

- Click here to discover the nuances of Valmet Oyj with our detailed analytical dividend report.

- According our valuation report, there's an indication that Valmet Oyj's share price might be on the cheaper side.

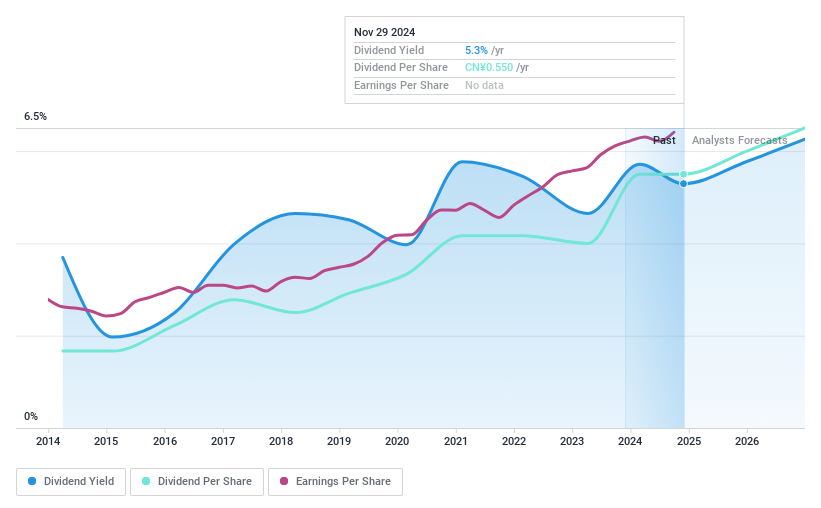

Huangshan NovelLtd (SZSE:002014)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Huangshan Novel Co., Ltd manufactures and sells packaging materials both in China and internationally, with a market cap of CN¥6.36 billion.

Operations: Huangshan Novel Co., Ltd generates its revenue from the manufacturing and sale of packaging materials both domestically and internationally.

Dividend Yield: 5.3%

Huangshan Novel Ltd offers a compelling dividend profile with its high 5.29% yield, placing it in the top 25% of CN market payers. The dividends are reliably covered by earnings and cash flows, with payout ratios of 79.7% and 65.1%, respectively, ensuring sustainability. Over the past decade, dividends have been stable and consistently growing without volatility, while trading at a discount to estimated fair value enhances its attractiveness for value-conscious investors.

- Click here and access our complete dividend analysis report to understand the dynamics of Huangshan NovelLtd.

- Our comprehensive valuation report raises the possibility that Huangshan NovelLtd is priced lower than what may be justified by its financials.

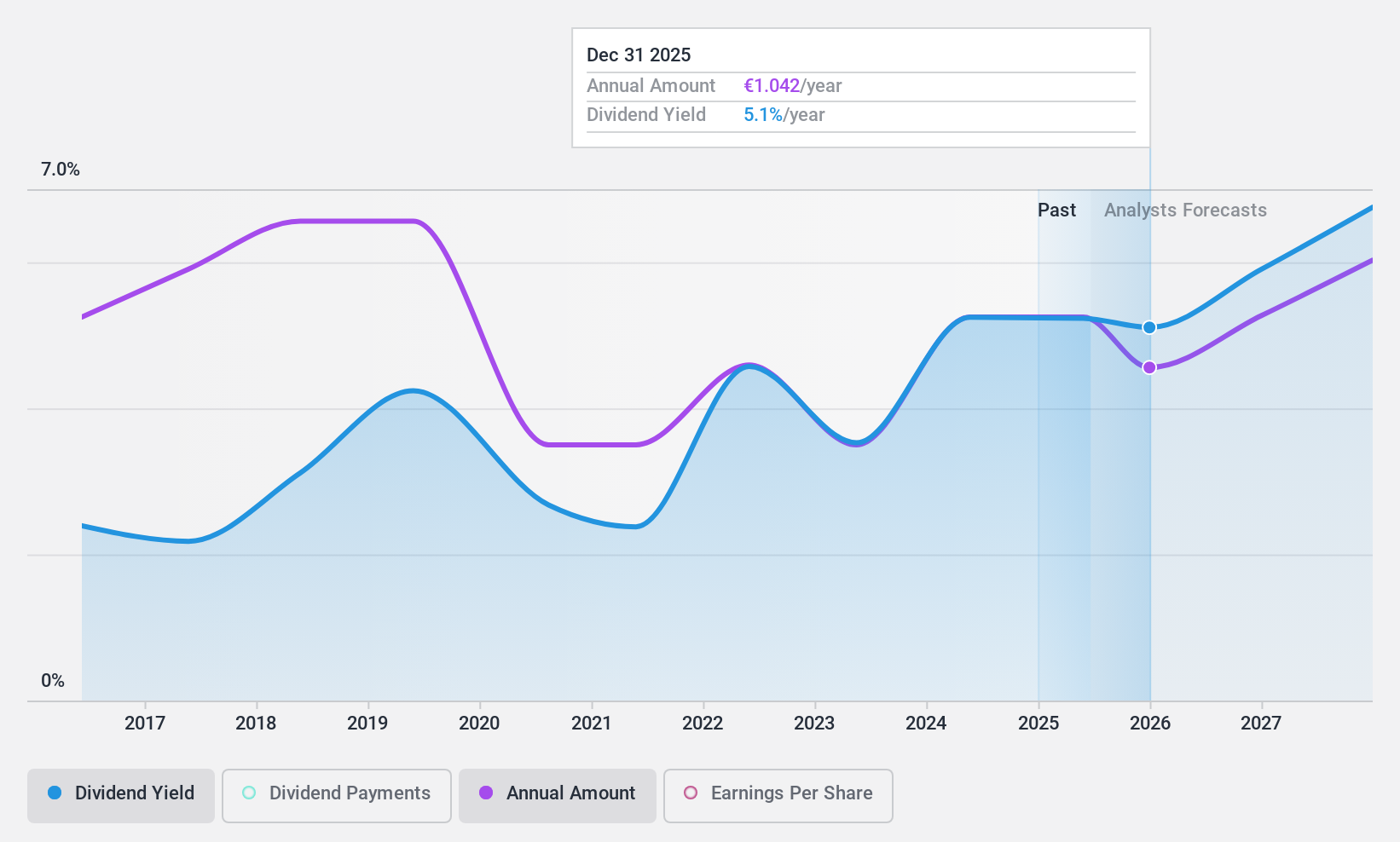

INDUS Holding (XTRA:INH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: INDUS Holding AG is a private equity firm that focuses on mergers, acquisitions, and corporate spin-offs, with a market cap of €527.69 million.

Operations: INDUS Holding AG generates revenue from its key segments, which include Materials (€573.57 million), Engineering (€585.87 million), and Infrastructure (€562.75 million).

Dividend Yield: 5.8%

INDUS Holding's dividend yield of 5.84% ranks in the top 25% of German market payers, supported by sustainable payout ratios of 51.1% from earnings and 24.6% from cash flows, despite a history of volatility. The stock is trading at a significant discount to fair value estimates, offering potential value for investors. However, recent financials show declining sales and net income compared to the previous year, highlighting some operational challenges amidst its high debt levels.

- Unlock comprehensive insights into our analysis of INDUS Holding stock in this dividend report.

- The valuation report we've compiled suggests that INDUS Holding's current price could be quite moderate.

Summing It All Up

- Delve into our full catalog of 1948 Top Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:VALMT

Valmet Oyj

Develops and supplies process technologies, automation, and services for the pulp, paper, and energy industries in North America, South America, China, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives