- Poland

- /

- Food and Staples Retail

- /

- WSE:DNP

Three Stocks That May Be Undervalued In September 2024

Reviewed by Simply Wall St

As global markets react to the Federal Reserve's first rate cut in over four years, U.S. stocks have reached new highs, indicating a positive sentiment among investors. In this environment, identifying undervalued stocks can be particularly rewarding for those looking to capitalize on market inefficiencies and potential growth opportunities.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vestel Beyaz Esya Sanayi ve Ticaret (IBSE:VESBE) | TRY17.47 | TRY34.83 | 49.8% |

| Densan System Holdings (TSE:4072) | ¥2664.00 | ¥5318.84 | 49.9% |

| APR (KOSE:A278470) | ₩262000.00 | ₩523160.77 | 49.9% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2171.75 | ₹4332.55 | 49.9% |

| Western Alliance Bancorporation (NYSE:WAL) | US$84.19 | US$168.11 | 49.9% |

| Burjeel Holdings (ADX:BURJEEL) | AED2.43 | AED4.85 | 49.9% |

| Defence Tech Holding (BIT:DTH) | €3.50 | €6.98 | 49.9% |

| SBI ARUHI (TSE:7198) | ¥845.00 | ¥1687.52 | 49.9% |

| Vogo (ENXTPA:ALVGO) | €3.19 | €6.37 | 49.9% |

| Ming Yuan Cloud Group Holdings (SEHK:909) | HK$2.38 | HK$4.75 | 49.9% |

Here's a peek at a few of the choices from the screener.

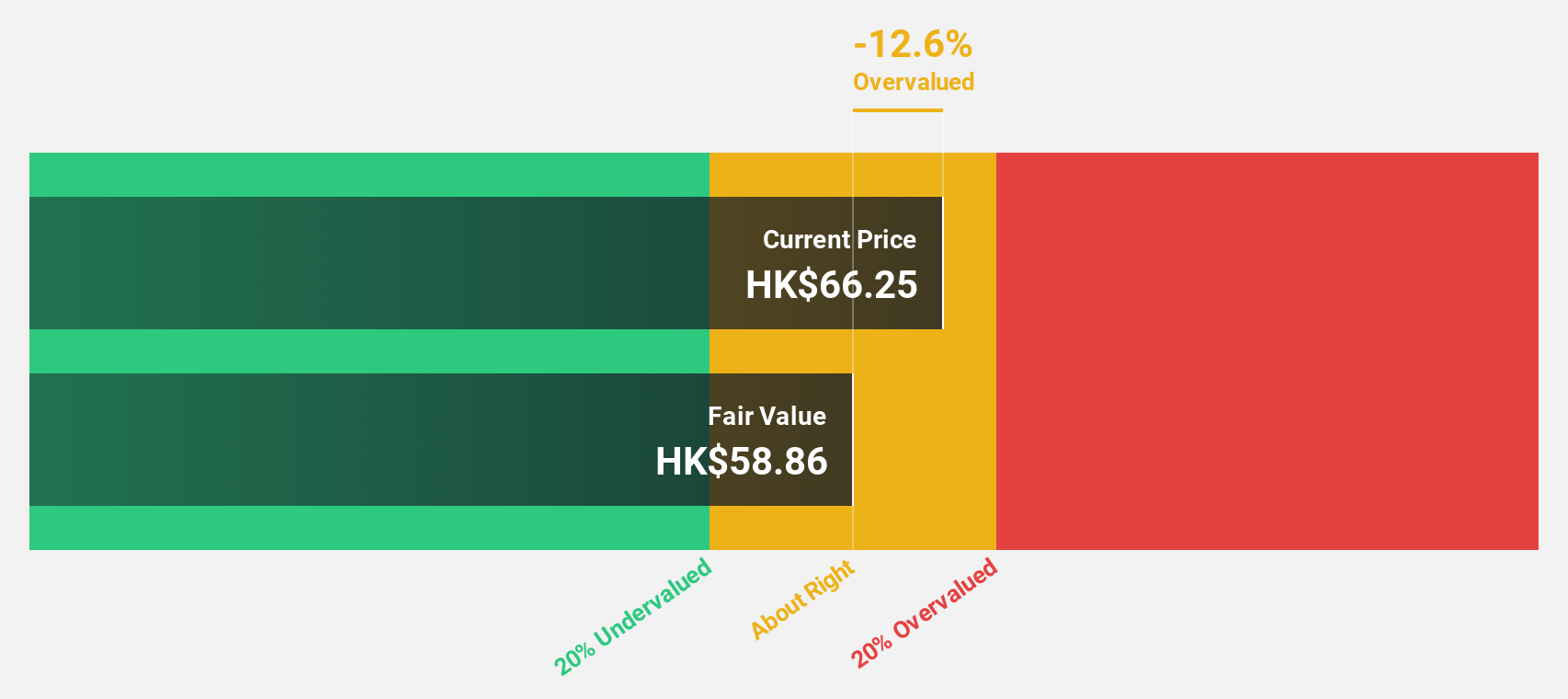

Kuaishou Technology (SEHK:1024)

Overview: Kuaishou Technology, an investment holding company, offers live streaming, online marketing, and other services in the People’s Republic of China with a market cap of HK$191.43 billion.

Operations: The company's revenue segments include CN¥117.32 billion from domestic operations and CN¥3.57 billion from overseas activities.

Estimated Discount To Fair Value: 46.6%

Kuaishou Technology is trading at HK$47.95, significantly below its estimated fair value of HK$89.73, indicating it may be undervalued based on discounted cash flow analysis. Recent earnings reports show substantial revenue growth from CNY 27.74 billion to CNY 30.98 billion year-over-year and net income rising from CNY 1.48 billion to CNY 3.98 billion, reflecting strong financial health and profitability improvements that support its valuation premise.

- Our expertly prepared growth report on Kuaishou Technology implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Kuaishou Technology here with our thorough financial health report.

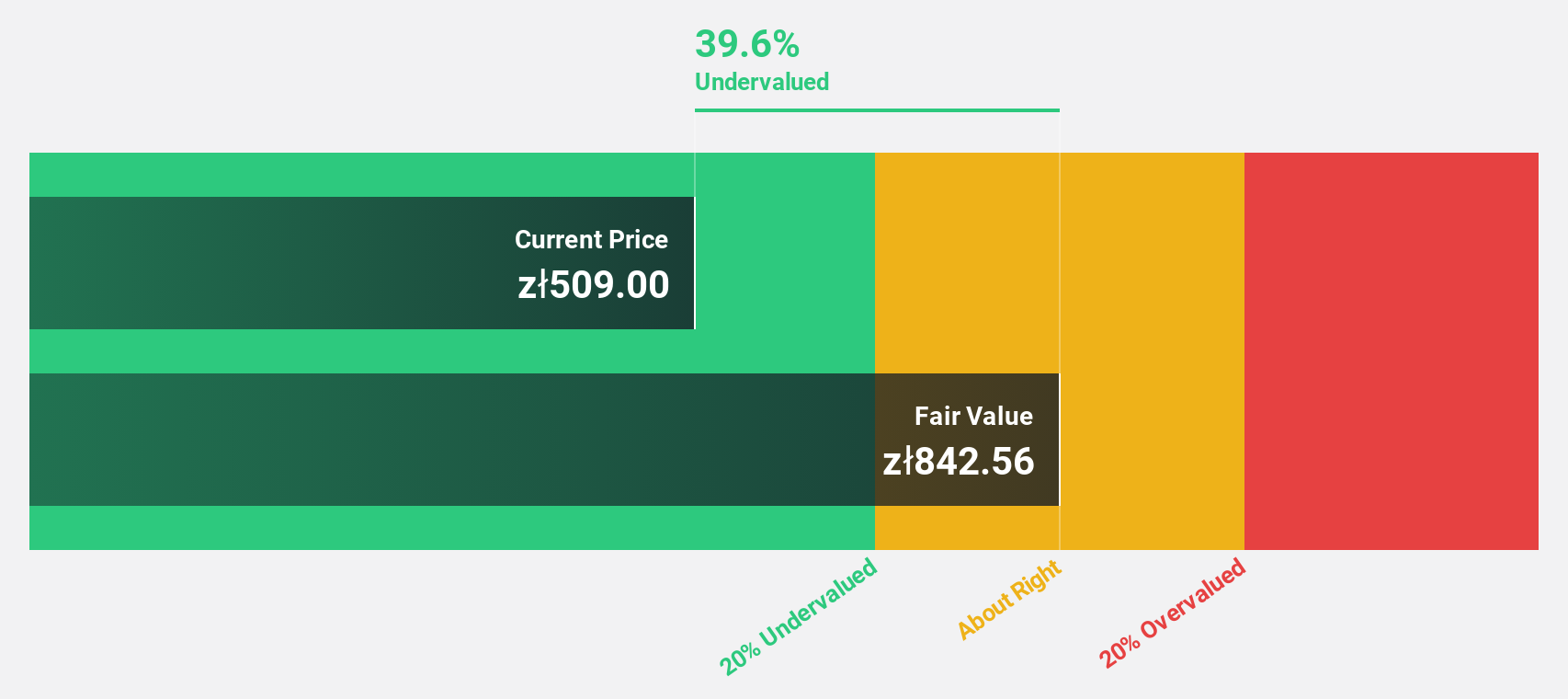

Dino Polska (WSE:DNP)

Overview: Dino Polska S.A., with a market cap of PLN34.80 billion, operates a network of mid-sized grocery supermarkets under the Dino brand name in Poland.

Operations: The company's revenue segments include sales from its network of mid-sized grocery supermarkets in Poland, totaling PLN10.13 billion.

Estimated Discount To Fair Value: 41.4%

Dino Polska is trading at PLN 355, significantly below its estimated fair value of PLN 606.23, highlighting potential undervaluation based on cash flows. Despite a slight decline in net income for Q2 2024 to PLN 347.87 million from PLN 362.19 million the previous year, earnings are forecast to grow at an annual rate of 17.54%. Revenue growth is also expected to outpace the Polish market at 14.7% per year, reinforcing its strong financial outlook.

- Insights from our recent growth report point to a promising forecast for Dino Polska's business outlook.

- Unlock comprehensive insights into our analysis of Dino Polska stock in this financial health report.

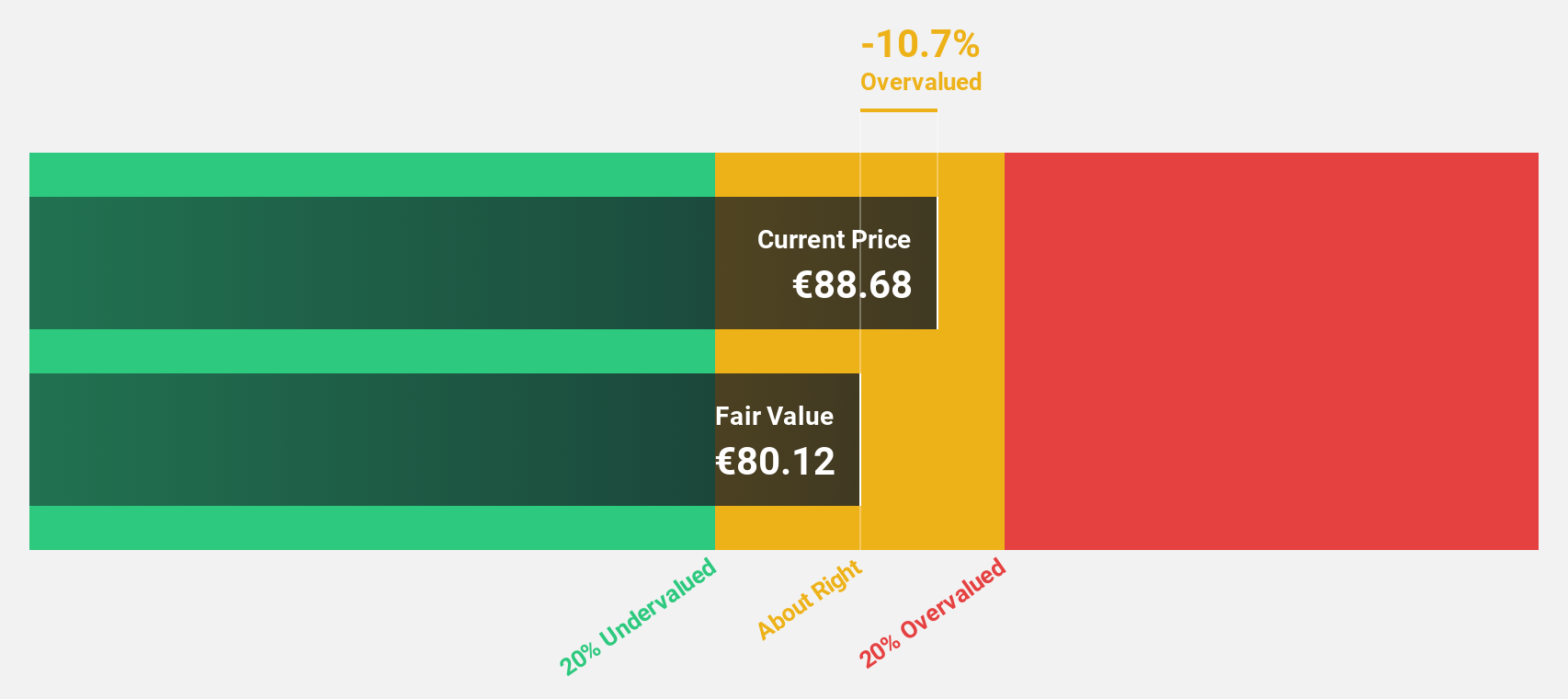

Siemens Energy (XTRA:ENR)

Overview: Siemens Energy AG operates as a global energy technology company with a market cap of approximately €26.33 billion.

Operations: The company's revenue segments include Gas Services (€10.85 billion), Siemens Gamesa (€9.52 billion), Grid Technologies (€8.60 billion), and Transformation of Industry (€4.95 billion).

Estimated Discount To Fair Value: 19.6%

Siemens Energy is currently trading at €33.67, below its estimated fair value of €41.90, suggesting potential undervaluation based on cash flows. The company reported a significant turnaround with net income of €1.48 billion for the nine months ending June 30, 2024, compared to a loss last year. Revenue growth is forecasted at 6.2% annually, slightly above the German market average of 5.5%, with earnings expected to grow significantly at 21.1% per year over the next three years.

- Upon reviewing our latest growth report, Siemens Energy's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Siemens Energy with our detailed financial health report.

Turning Ideas Into Actions

- Embark on your investment journey to our 942 Undervalued Stocks Based On Cash Flows selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:DNP

Dino Polska

Operates a network of mid-sized grocery supermarkets under the Dino brand name in Poland.

Excellent balance sheet with reasonable growth potential.