- Poland

- /

- Professional Services

- /

- WSE:GPP

3 Stocks Estimated To Be Trading At Discounts Of Up To 40.1%

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with U.S. indices showing resilience despite economic headwinds and European markets experiencing varied performances, investors are increasingly on the lookout for opportunities that may be trading at significant discounts. In such an environment, identifying undervalued stocks can be crucial for those looking to capitalize on potential market inefficiencies; these stocks often present attractive entry points when broader sentiment is cautious or uncertain.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Dime Community Bancshares (NasdaqGS:DCOM) | US$30.89 | US$61.61 | 49.9% |

| Wasion Holdings (SEHK:3393) | HK$7.05 | HK$14.02 | 49.7% |

| Tourmaline Oil (TSX:TOU) | CA$66.79 | CA$133.01 | 49.8% |

| Camden National (NasdaqGS:CAC) | US$42.08 | US$83.90 | 49.8% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Zhende Medical (SHSE:603301) | CN¥21.00 | CN¥41.99 | 50% |

| Ally Financial (NYSE:ALLY) | US$35.85 | US$71.62 | 49.9% |

| Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥23.89 | CN¥47.76 | 50% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.45 | NZ$2.89 | 49.8% |

| LG Energy Solution (KOSE:A373220) | ₩356000.00 | ₩709677.60 | 49.8% |

Let's dive into some prime choices out of the screener.

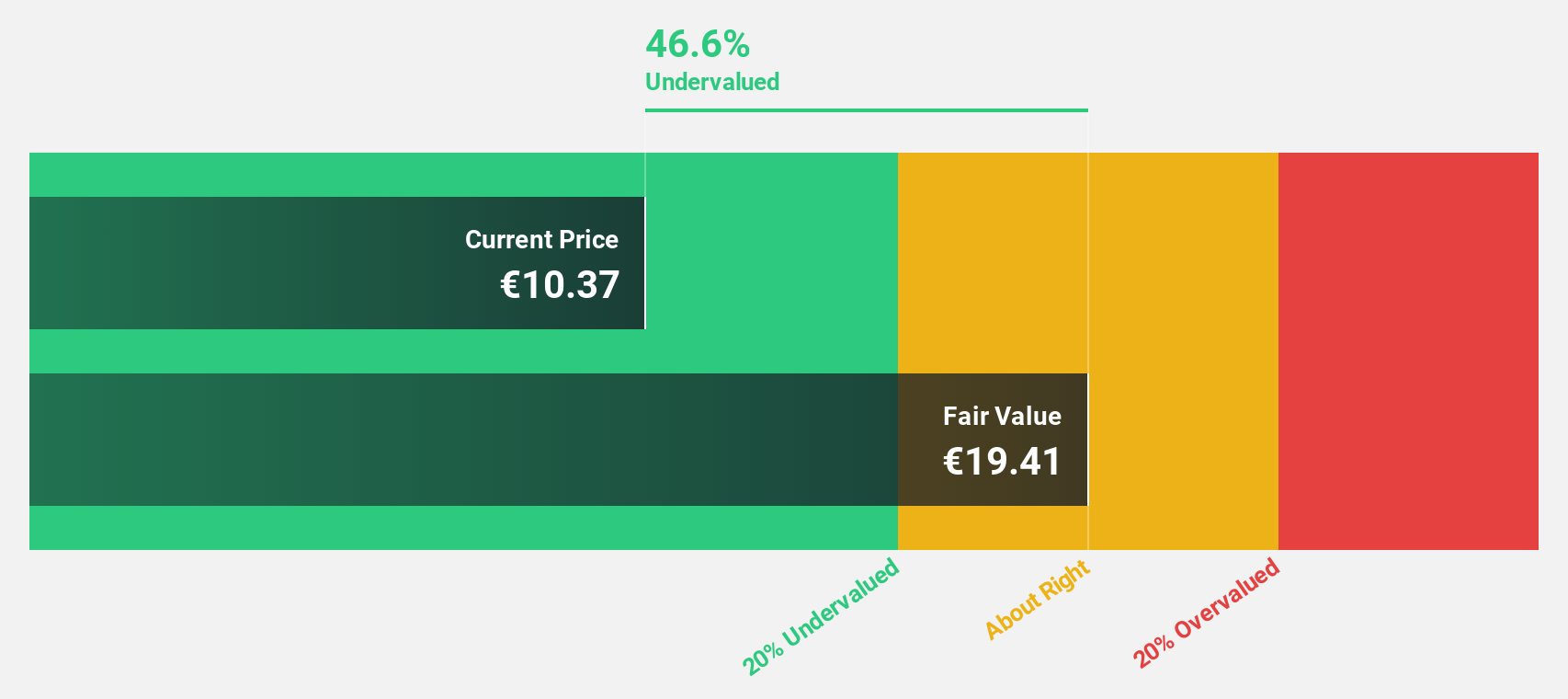

Acerinox (BME:ACX)

Overview: Acerinox, S.A. and its subsidiaries manufacture, process, and market stainless steel products across various regions including Spain, the United States, Africa, Asia, and Europe with a market cap of approximately €2.41 billion.

Operations: The company's revenue is primarily derived from its Stainless Steel Business, generating approximately €4.35 billion, and its High Performance Alloys segment, contributing around €1.37 billion.

Estimated Discount To Fair Value: 33.3%

Acerinox is trading at €9.67, significantly below its estimated fair value of €14.51, indicating it may be undervalued based on cash flows. Earnings are forecast to grow substantially by 38.8% annually, outpacing the Spanish market's growth rate of 8.4%. However, profit margins have decreased from last year and the dividend yield of 6.41% isn't well covered by earnings, presenting potential risks despite strong revenue growth forecasts of 11.6% per year.

- Our earnings growth report unveils the potential for significant increases in Acerinox's future results.

- Navigate through the intricacies of Acerinox with our comprehensive financial health report here.

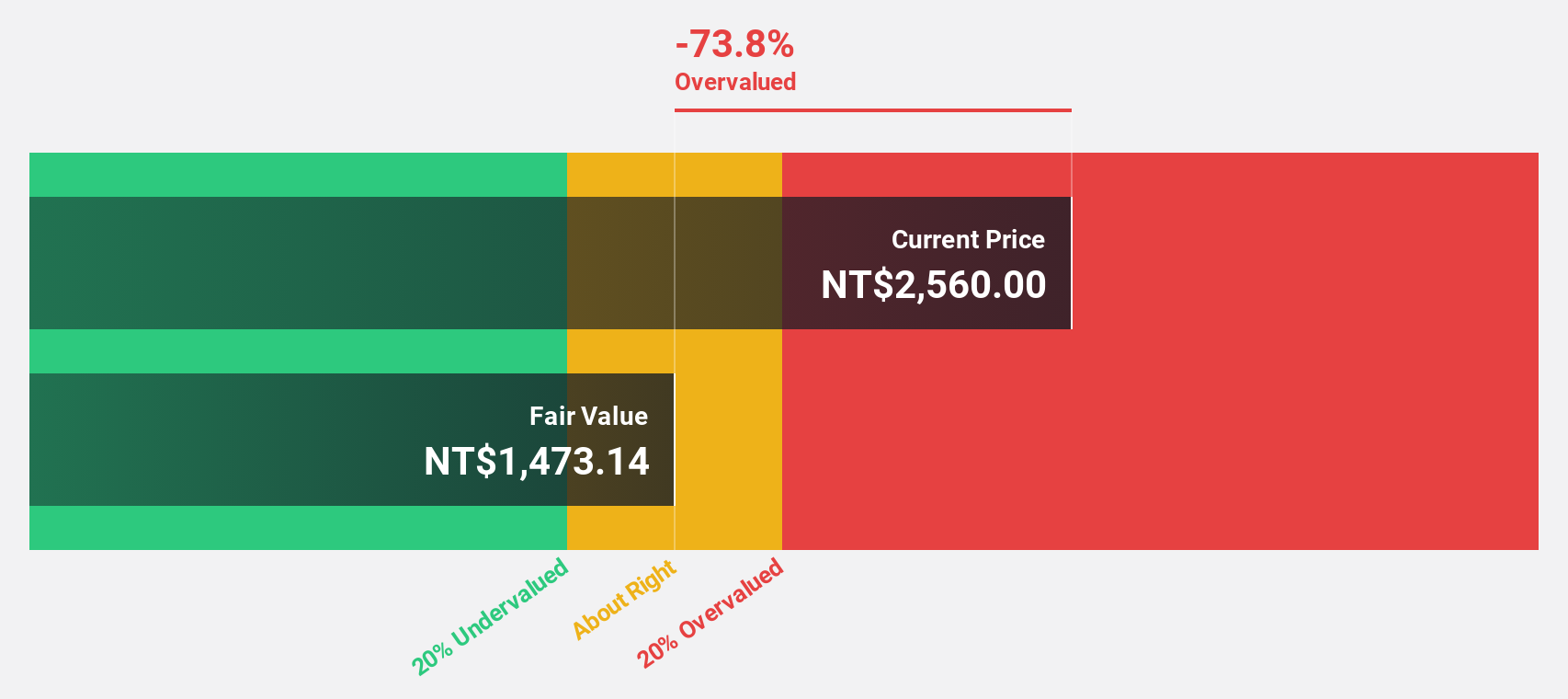

Wiwynn (TWSE:6669)

Overview: Wiwynn Corporation manufactures and sells servers and storage products for cloud infrastructure and hyperscale data centers globally, with a market cap of NT$485.04 billion.

Operations: The company generates revenue primarily from its Computer Hardware segment, amounting to NT$303.48 billion.

Estimated Discount To Fair Value: 32%

Wiwynn is trading at NT$2610, below its estimated fair value of NT$3835.57, suggesting it may be undervalued based on cash flows. Earnings are expected to grow significantly at 22.15% annually, surpassing the Taiwan market's average growth rate of 18.9%. Recent earnings reports show strong performance with Q3 sales reaching TWD 97.82 billion and net income TWD 6.33 billion, despite past shareholder dilution and high non-cash earnings levels.

- According our earnings growth report, there's an indication that Wiwynn might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Wiwynn.

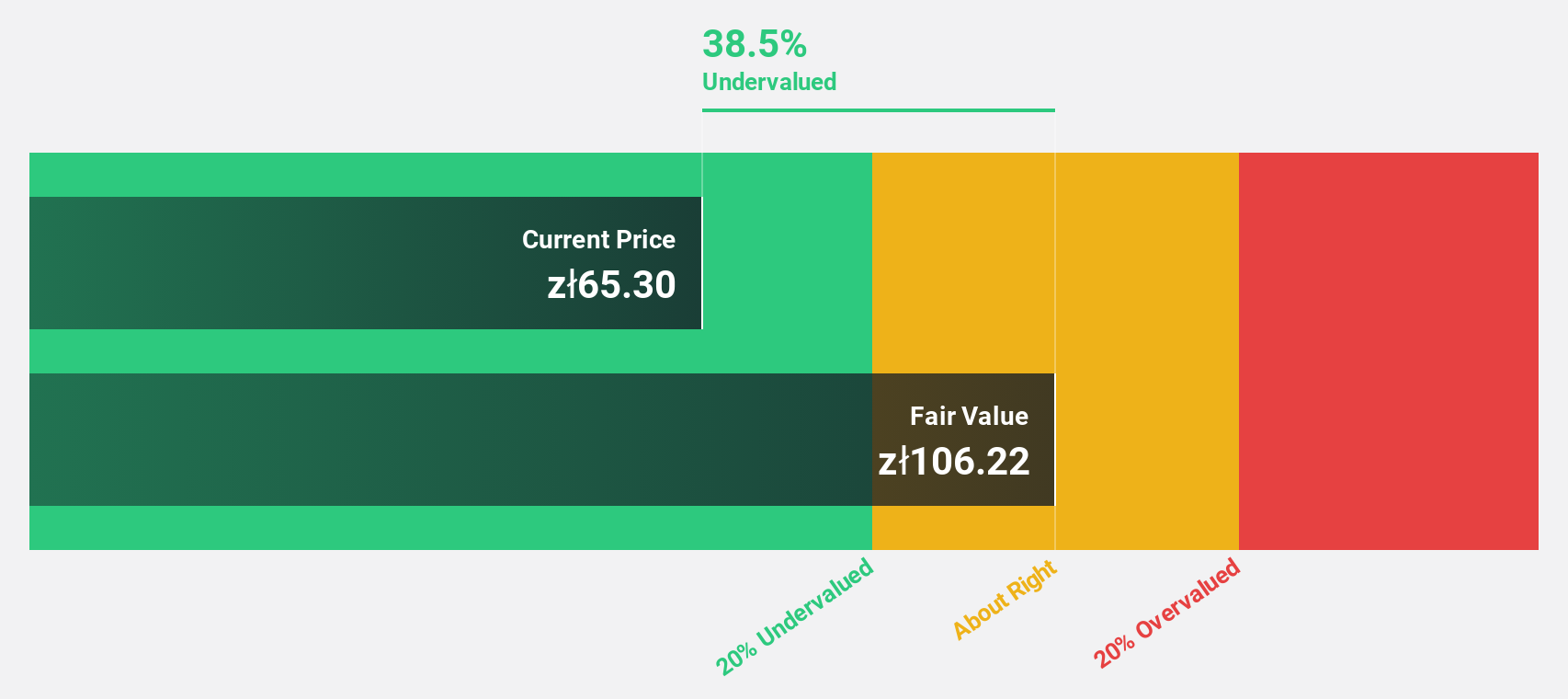

Grupa Pracuj (WSE:GPP)

Overview: Grupa Pracuj S.A. operates in the digital recruitment market across Poland, Ukraine, and Germany with a market cap of PLN4.16 billion.

Operations: The company's revenue from Staffing & Outsourcing Services amounts to PLN756.07 million.

Estimated Discount To Fair Value: 40.1%

Grupa Pracuj is trading at PLN 61, considerably below its estimated fair value of PLN 101.9, highlighting potential undervaluation based on cash flows. Earnings are projected to grow significantly at 20.21% annually, outpacing the Polish market's growth rate. Recent earnings results show robust performance with Q3 sales reaching PLN 192.95 million and net income of PLN 60.59 million, despite an unstable dividend track record and slower revenue growth compared to high benchmarks.

- Upon reviewing our latest growth report, Grupa Pracuj's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Grupa Pracuj with our detailed financial health report.

Turning Ideas Into Actions

- Dive into all 899 of the Undervalued Stocks Based On Cash Flows we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:GPP

Grupa Pracuj

Operates in the digital recruitment market in Poland, Ukraine, and Germany.

High growth potential with solid track record.