- Germany

- /

- Electrical

- /

- XTRA:ENR

adidas And 2 Other Stocks On The German Exchange That May Be Undervalued

Reviewed by Simply Wall St

The German market has shown a mixed performance recently, with the DAX index managing only a slight gain amid broader European caution following the U.S. Federal Reserve's interest rate cut. As investors navigate these uncertain times, identifying undervalued stocks becomes crucial for potentially maximizing returns. In this context, a good stock often displays strong fundamentals and resilience in challenging economic conditions. This article will explore three such stocks on the German exchange that may be undervalued, starting with adidas.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| init innovation in traffic systems (XTRA:IXX) | €36.80 | €52.65 | 30.1% |

| technotrans (XTRA:TTR1) | €18.80 | €31.53 | 40.4% |

| Formycon (XTRA:FYB) | €52.70 | €72.28 | 27.1% |

| Gerresheimer (XTRA:GXI) | €96.90 | €193.02 | 49.8% |

| Verbio (XTRA:VBK) | €17.87 | €28.26 | 36.8% |

| elumeo (XTRA:ELB) | €2.16 | €3.89 | 44.4% |

| LPKF Laser & Electronics (XTRA:LPK) | €8.86 | €12.45 | 28.8% |

| Vectron Systems (XTRA:V3S) | €12.10 | €17.28 | 30% |

| MTU Aero Engines (XTRA:MTX) | €284.60 | €490.51 | 42% |

| Basler (XTRA:BSL) | €8.90 | €13.93 | 36.1% |

We'll examine a selection from our screener results.

adidas (XTRA:ADS)

Overview: adidas AG, with a market cap of €41.74 billion, designs, develops, produces, and markets athletic and sports lifestyle products across Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific region, and Latin America.

Operations: Revenue segments for adidas AG include €3.26 billion from Greater China, €2.39 billion from Latin America, and €5.07 billion from North America.

Estimated Discount To Fair Value: 15.8%

adidas AG's recent earnings report shows strong performance, with Q2 2024 net income rising to €190 million from €84 million a year ago. The company has raised its full-year guidance, expecting operating profit around €1 billion. Trading below its estimated fair value of €277.64 at approximately €233.8, adidas is considered undervalued based on discounted cash flow analysis. Forecasts indicate significant annual earnings growth of 42.1%, outpacing the German market's 20%.

- The growth report we've compiled suggests that adidas' future prospects could be on the up.

- Take a closer look at adidas' balance sheet health here in our report.

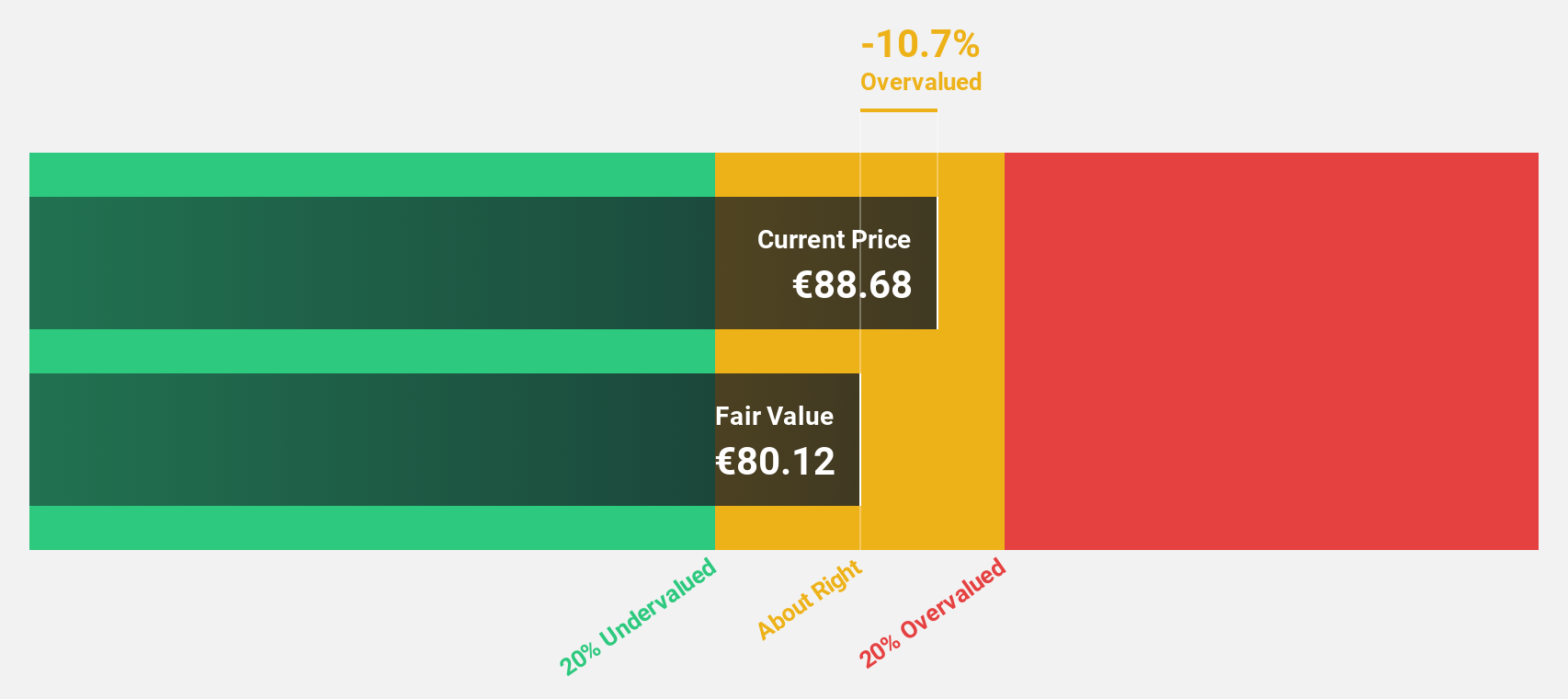

Siemens Energy (XTRA:ENR)

Overview: Siemens Energy AG operates as a global energy technology company with a market cap of approximately €26.08 billion.

Operations: The company's revenue segments include Gas Services (€10.85 billion), Siemens Gamesa (€9.52 billion), Grid Technologies (€8.60 billion), and Transformation of Industry (€4.95 billion).

Estimated Discount To Fair Value: 20.4%

Siemens Energy is trading at €33.35, below its estimated fair value of €41.89, making it undervalued based on discounted cash flow analysis. The company recently became profitable and forecasts suggest earnings will grow 21.1% annually, outpacing the German market's 20%. Despite lower revenue growth expectations of 6.2% per year, recent strategic agreements and improved financials underscore its potential for strong future cash flows and operational efficiencies.

- Our earnings growth report unveils the potential for significant increases in Siemens Energy's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Siemens Energy.

Formycon (XTRA:FYB)

Overview: Formycon AG, a biotechnology company with a market cap of €930.52 million, develops biosimilar drugs in Germany and Switzerland.

Operations: Formycon's revenue primarily comes from its Drug Delivery Systems segment, which generated €60.80 million.

Estimated Discount To Fair Value: 27.1%

Formycon AG, trading at €52.7, is significantly undervalued with an estimated fair value of €72.28 based on discounted cash flow analysis. Despite a recent net loss of €10.09 million for H1 2024 and shareholder dilution over the past year, analysts forecast strong earnings growth of 30.52% annually and revenue growth of 31.8%, outpacing the German market's average. The company's high non-cash earnings quality further supports its potential for future profitability improvements.

- Our growth report here indicates Formycon may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Formycon stock in this financial health report.

Taking Advantage

- Click this link to deep-dive into the 19 companies within our Undervalued German Stocks Based On Cash Flows screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ENR

High growth potential and fair value.