- Germany

- /

- Electrical

- /

- XTRA:EKT

Energiekontor (XTRA:EKT): Assessing Valuation After Earnings Guidance Cut and Project Delays

Reviewed by Kshitija Bhandaru

Energiekontor (XTRA:EKT) has cut its 2025 earnings guidance, citing delays in German projects as well as regulatory and operational changes affecting British wind developments. This shift has pushed expected earnings into 2026, shaking investor confidence.

See our latest analysis for Energiekontor.

Following the forecast revision, Energiekontor’s share price slumped nearly 19% in a single day, capping off a tough stretch where the 1-year total shareholder return is down almost 23%. With momentum clearly fading and sentiment pressured by shifting earnings timelines, Energiekontor is now contending with both operational delays and wary investors, even as its five-year total return remains in positive territory overall.

If recent market moves have you curious about broader opportunities, this could be a great moment to discover fast growing stocks with high insider ownership.

With Energiekontor’s shares sinking and earnings now pushed out another year, is the recent drop an opportunity to buy in at a discount, or has the market already priced in these shifting growth timelines?

Price-to-Earnings of 15.6x: Is it justified?

Energiekontor is currently trading at a price-to-earnings (P/E) ratio of 15.6x, notably below both the peer average and the broader European Electrical industry. With the last closing price at €38.95, this puts the stock in a position that screens as good value compared to its sector.

The P/E ratio measures how much investors are willing to pay for each euro of earnings. In capital goods and renewables, P/E helps assess market optimism about future profit growth and business stability. A lower ratio like this can indicate investors are cautious, or that the market has not fully appreciated the company’s earnings power.

Right now, Energiekontor’s multiple is not only below Germany’s market average but also well under industry peers. Compared to an industry average P/E of 23.7x and peer average of 36.8x, the gap is significant. Intriguingly, regression analysis suggests a fair P/E closer to 27x, which could signal room for the market to re-rate should growth and sentiment improve.

Explore the SWS fair ratio for Energiekontor

Result: Price-to-Earnings of 15.6x (UNDERVALUED)

However, ongoing regulatory uncertainty in Germany and persistent delays in UK wind projects could further dampen sentiment and limit any prospect of a quick recovery in the shares.

Find out about the key risks to this Energiekontor narrative.

Another View: Our DCF Model Paints a Different Picture

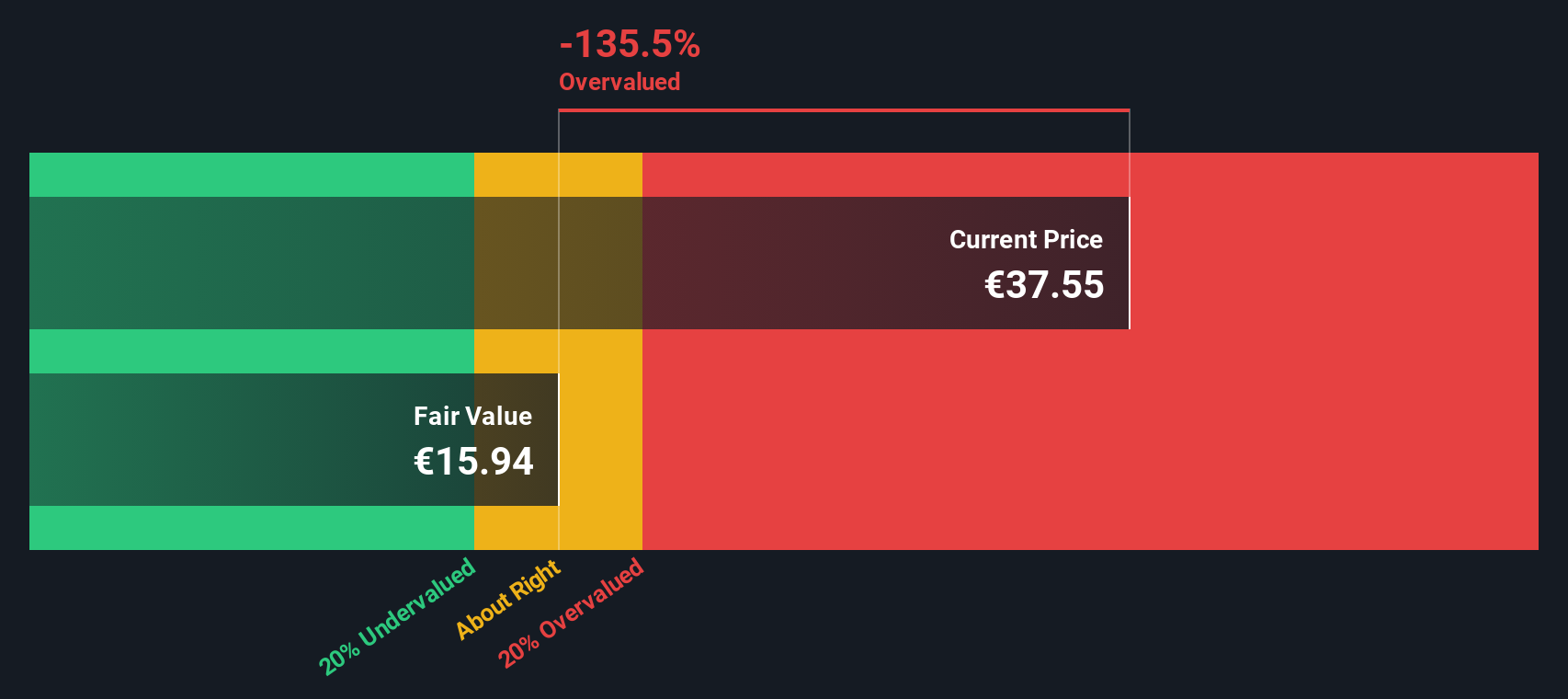

Switching lenses, our DCF model takes a deep dive into cash flows to estimate value. By this approach, Energiekontor’s share price of €38.95 is well above our fair value estimate of €19.45. That suggests the stock could be overvalued if current projections hold. Is the market right to look past this?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Energiekontor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Energiekontor Narrative

If this analysis does not fit your outlook or you would rather dig into the numbers firsthand, you can easily build your own view in just minutes, and Do it your way.

A great starting point for your Energiekontor research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait on just one stock. Give your portfolio the edge by tapping into new trends and opportunities shaping tomorrow’s market leaders.

- Discover companies boasting strong financials and growth stories by checking out these 3588 penny stocks with strong financials before the crowd notices.

- Find reliable income streams with these 19 dividend stocks with yields > 3% that pay high yields and are favored by smart money for their resilience.

- Explore the future of medicine by reviewing these 33 healthcare AI stocks powering the next era of healthcare breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Energiekontor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EKT

Energiekontor

A project developer, engages in the planning, construction, and operation of wind and solar parks in Germany, Portugal, Scotland, and the united States.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives