US Truck Tariffs Could Be a Game Changer for Daimler Truck Holding (XTRA:DTG)

Reviewed by Sasha Jovanovic

- In recent days, President Donald Trump announced that 25% duties on medium- and heavy-duty truck imports to the US would begin November 1, directly impacting international manufacturers such as Daimler Truck Holding. This move comes as Daimler Truck consolidates its Mitsubishi Fuso operations in Japan, including the sale of its Nakatsu plant, amid an ongoing merger with Toyota Motors.

- The US tariff announcement could materially affect Daimler Truck's competitiveness and cost structure in a key market, highlighting how global trade policies can reshape automakers' operational priorities.

- We'll examine how the new US tariffs on truck imports may alter Daimler Truck's investment narrative, particularly around margin and market access risks.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Daimler Truck Holding Investment Narrative Recap

To be a Daimler Truck Holding shareholder, you need to believe that global scale and innovation in zero-emission vehicles will offset cyclical downturns and margin pressure, especially as regulatory and trade risks intensify. The latest US tariff announcement is significant, it exacerbates Daimler Truck’s single biggest near-term risk: North American sales and profitability, given softening truck demand and heightened cost sensitivity in that region.

Among recent company updates, Daimler Truck’s decision to consolidate Mitsubishi Fuso operations and exit the Nakatsu plant in Japan stands out. While primarily aimed at streamlining Asian operations, it echoes the company's broader push to adjust capacity and cost structures as demand and trade policy risks become more complex worldwide.

But with tariffs adding more uncertainty around sales, investors should be alert to volatility in Daimler Truck’s most important revenue source, because…

Read the full narrative on Daimler Truck Holding (it's free!)

Daimler Truck Holding is projected to generate €58.3 billion in revenue and €3.8 billion in earnings by 2028. This outlook is based on an annual revenue growth rate of 3.6% and reflects a €1.4 billion earnings increase from the current €2.4 billion level.

Uncover how Daimler Truck Holding's forecasts yield a €43.46 fair value, a 24% upside to its current price.

Exploring Other Perspectives

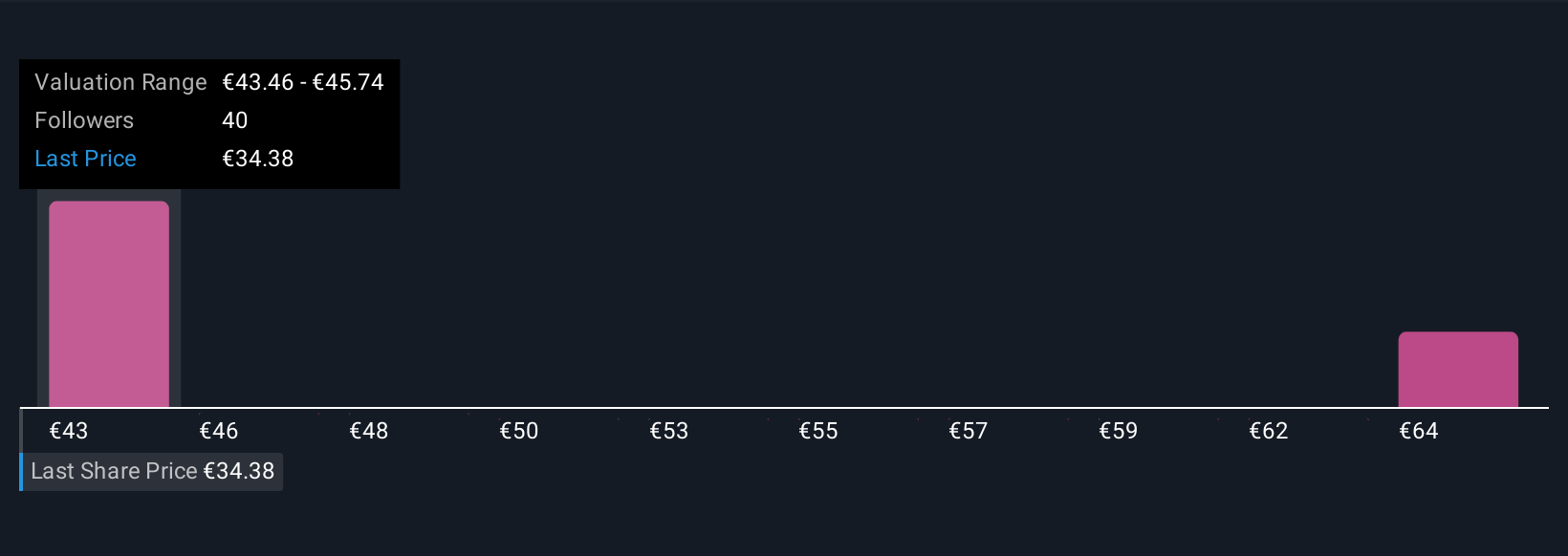

Four fair value estimates from the Simply Wall St Community range from €43.46 to €66.49, reflecting sharply different views on Daimler Truck’s prospects. With US trade policy risks now front and center, it’s worth comparing these varied outlooks as you assess long-term pressure on margins and growth.

Explore 4 other fair value estimates on Daimler Truck Holding - why the stock might be worth as much as 90% more than the current price!

Build Your Own Daimler Truck Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Daimler Truck Holding research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Daimler Truck Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Daimler Truck Holding's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DTG

Daimler Truck Holding

Manufactures and sells light, medium- and heavy-duty trucks and buses in Europe, North America, Asia, Latin America, and internationally.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives