- Germany

- /

- Electrical

- /

- XTRA:CEA

FRIWO (ETR:CEA) shareholder returns have been respectable, earning 80% in 5 years

When we invest, we're generally looking for stocks that outperform the market average. And in our experience, buying the right stocks can give your wealth a significant boost. To wit, the FRIWO share price has climbed 75% in five years, easily topping the market decline of 2.1% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 57% in the last year.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

See our latest analysis for FRIWO

Given that FRIWO didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last half decade FRIWO's revenue has actually been trending down at about 9.6% per year. Despite the lack of revenue growth, the stock has returned a respectable 12%, compound, over that time. To us that suggests that there probably isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

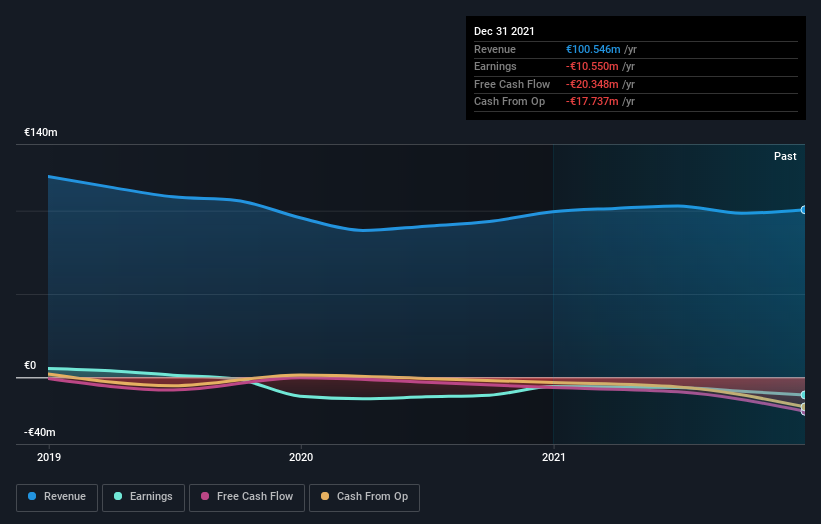

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling FRIWO stock, you should check out this FREE detailed report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between FRIWO's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. FRIWO's TSR of 80% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

It's nice to see that FRIWO shareholders have received a total shareholder return of 57% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 12% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for FRIWO that you should be aware of.

Of course FRIWO may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:CEA

FRIWO

Develops, manufactures, and sells power supplies units and drive solutions in Germany, Europe, Asia, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives