- Germany

- /

- Electrical

- /

- XTRA:CEA

FRIWO (ETR:CEA) dips 12% this week as increasing losses might not be inspiring confidence among its investors

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Investors in FRIWO AG (ETR:CEA) have tasted that bitter downside in the last year, as the share price dropped 29%. That falls noticeably short of the market return of around 7.4%. At least the damage isn't so bad if you look at the last three years, since the stock is down 6.3% in that time. Even worse, it's down 17% in about a month, which isn't fun at all. Importantly, this could be a market reaction to the recently released financial results. You can check out the latest numbers in our company report.

Since FRIWO has shed €27m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for FRIWO

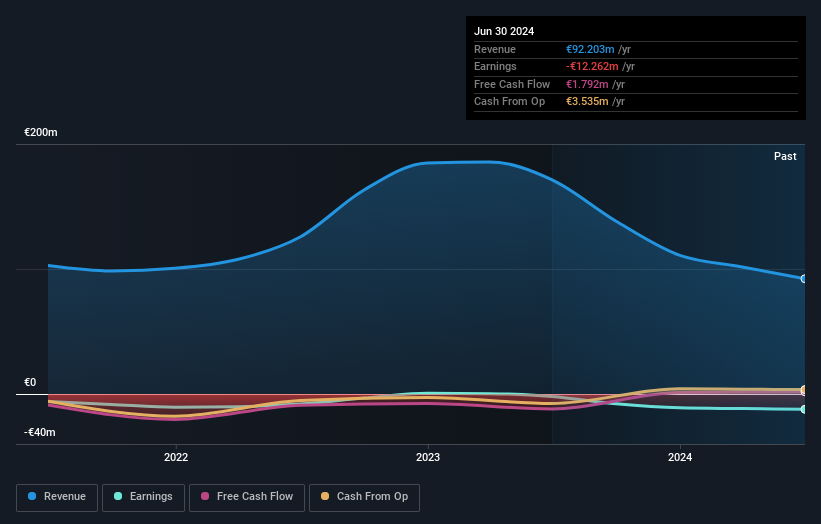

Given that FRIWO didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In just one year FRIWO saw its revenue fall by 46%. That looks pretty grim, at a glance. The stock price has languished lately, falling 29% in a year. That seems pretty reasonable given the lack of both profits and revenue growth. We think most holders must believe revenue growth will improve, or else costs will decline.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at FRIWO's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 7.4% in the last year, FRIWO shareholders lost 29%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 0.5%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for FRIWO (1 is a bit unpleasant!) that you should be aware of before investing here.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

If you're looking to trade FRIWO, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:CEA

FRIWO

Develops, manufactures, and sells power supplies units and drive solutions in Germany, Europe, Asia, and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives