As European markets navigate a landscape of cautious optimism and renewed trade concerns, major indices like Germany's DAX and Italy’s FTSE MIB have shown modest gains. In this environment, dividend stocks often appeal to investors seeking stability and income, as they can offer potential resilience against market fluctuations while providing regular cash flow.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.34% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.75% | ★★★★★☆ |

| Telekom Austria (WBAG:TKA) | 4.36% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.76% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.63% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.98% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.89% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 4.27% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.50% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.72% | ★★★★★★ |

Click here to see the full list of 224 stocks from our Top European Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

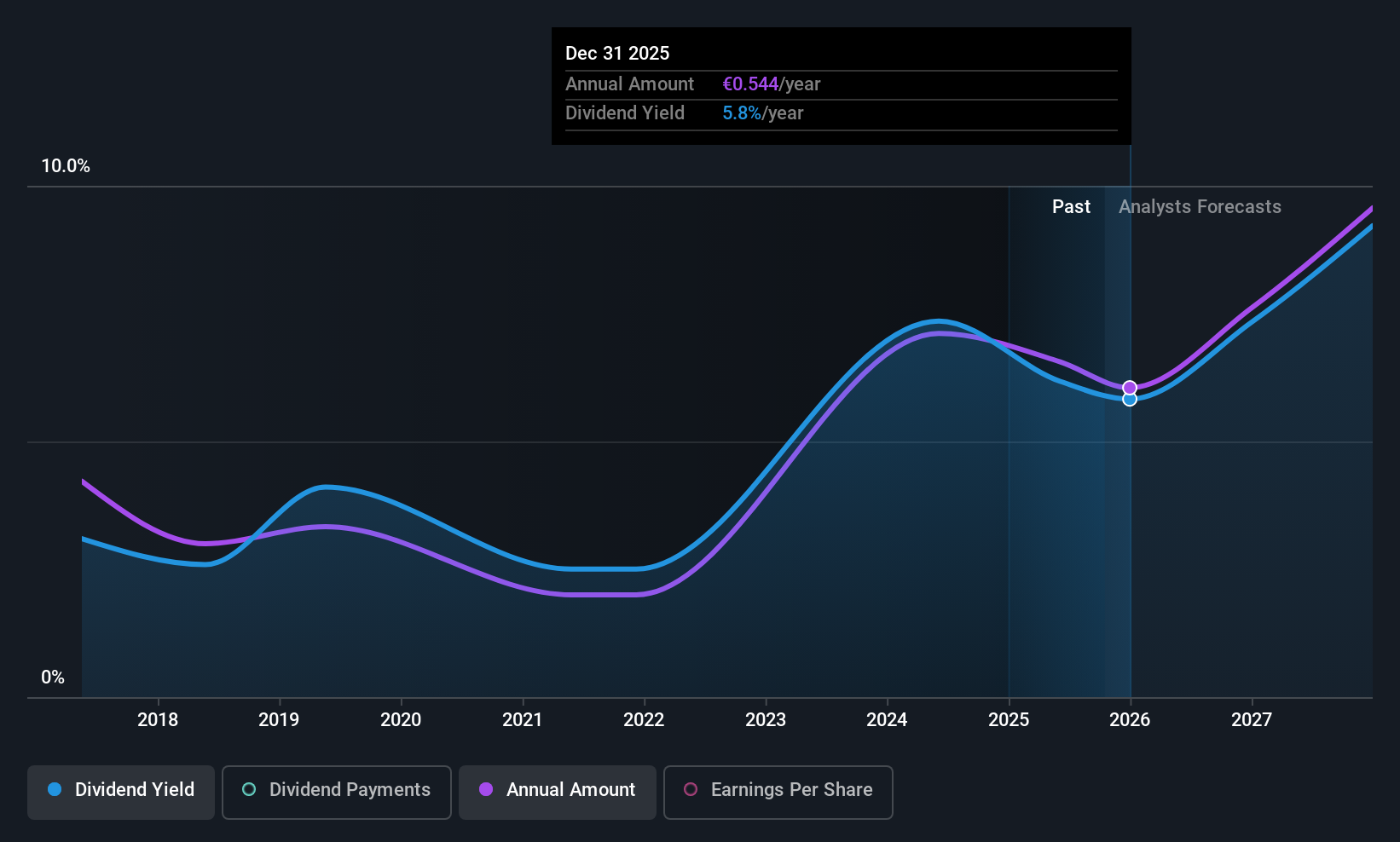

F.I.L.A. - Fabbrica Italiana Lapis ed Affini (BIT:FILA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: F.I.L.A. - Fabbrica Italiana Lapis ed Affini S.p.A. operates in the production and distribution of art materials, including pencils and other writing instruments, with a market capitalization of €482.22 million.

Operations: F.I.L.A. - Fabbrica Italiana Lapis ed Affini S.p.A. generates €598.26 million in revenue from its office supplies segment.

Dividend Yield: 84.3%

F.I.L.A. - Fabbrica Italiana Lapis ed Affini presents a complex picture for dividend investors. Despite offering a high dividend yield in the top 25% of the Italian market, its sustainability is questionable due to an unsustainable cash payout ratio and volatile dividend history. Recent earnings showed a decline in net income to €23.3 million, impacting financial stability. The stock trades at a good value with a low P/E ratio of 7.7x, but high debt levels and declining profit margins raise concerns about future dividends' reliability and growth potential.

- Click to explore a detailed breakdown of our findings in F.I.L.A. - Fabbrica Italiana Lapis ed Affini's dividend report.

- The analysis detailed in our F.I.L.A. - Fabbrica Italiana Lapis ed Affini valuation report hints at an deflated share price compared to its estimated value.

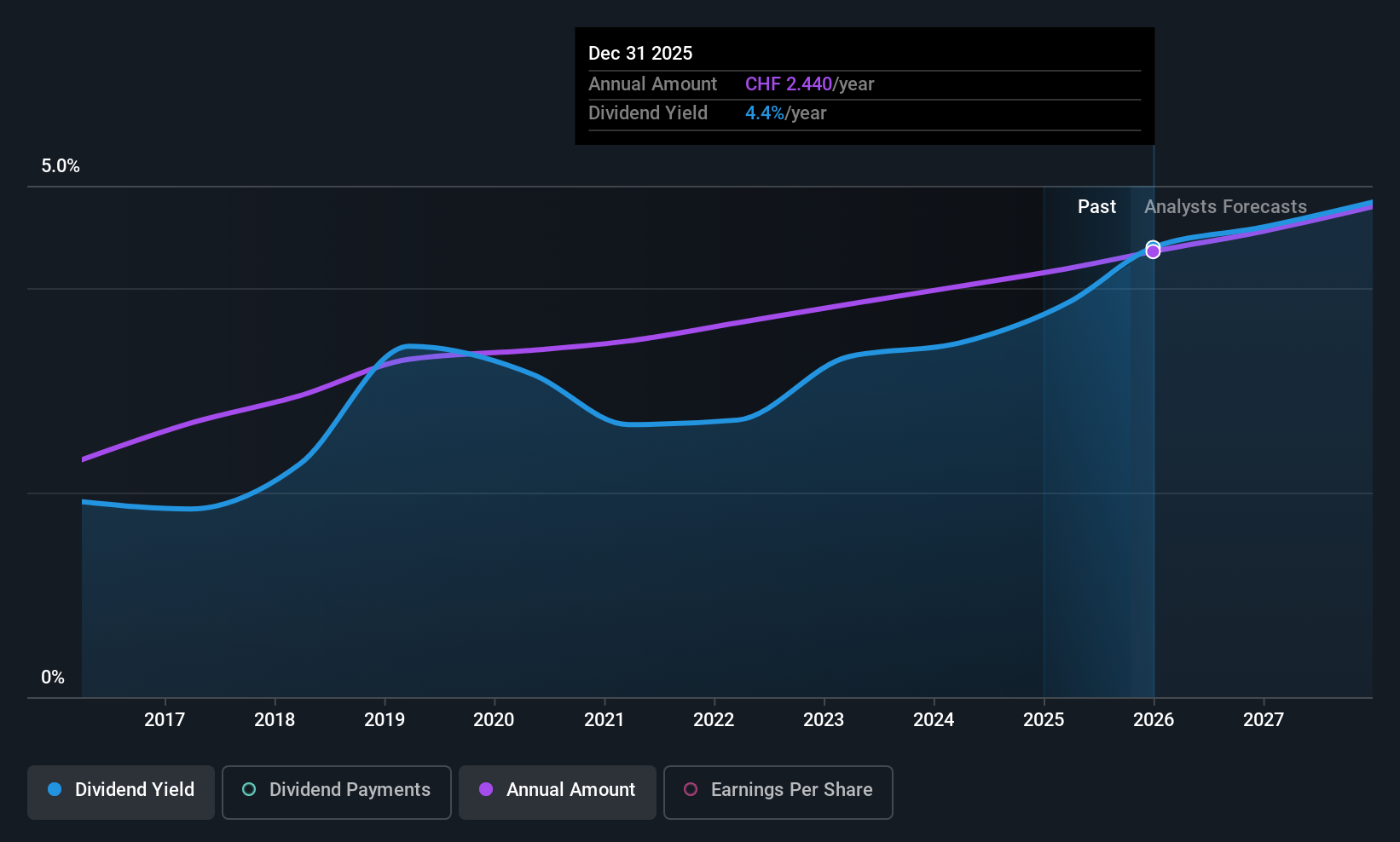

DKSH Holding (SWX:DKSH)

Simply Wall St Dividend Rating: ★★★★★★

Overview: DKSH Holding AG offers market expansion services across Thailand, Greater China, Malaysia, Singapore, and the Asia Pacific region with a market cap of CHF3.57 billion.

Operations: DKSH Holding AG generates its revenue through four main segments: Healthcare (CHF5.81 billion), Consumer Goods (CHF3.43 billion), Performance Materials (CHF1.39 billion), and Technology (CHF543.30 million).

Dividend Yield: 4.3%

DKSH Holding offers a stable dividend profile, with payments covered by both earnings and cash flows. Its dividend yield of 4.27% ranks in the top quarter of Swiss market payers, supported by a consistent growth history over the past decade. Despite recent declines in net income, DKSH's strategic partnerships, such as with Nextfood Global Limited to expand in Singapore's health-conscious market, underscore its commitment to growth and diversification within profitable sectors.

- Take a closer look at DKSH Holding's potential here in our dividend report.

- Our expertly prepared valuation report DKSH Holding implies its share price may be lower than expected.

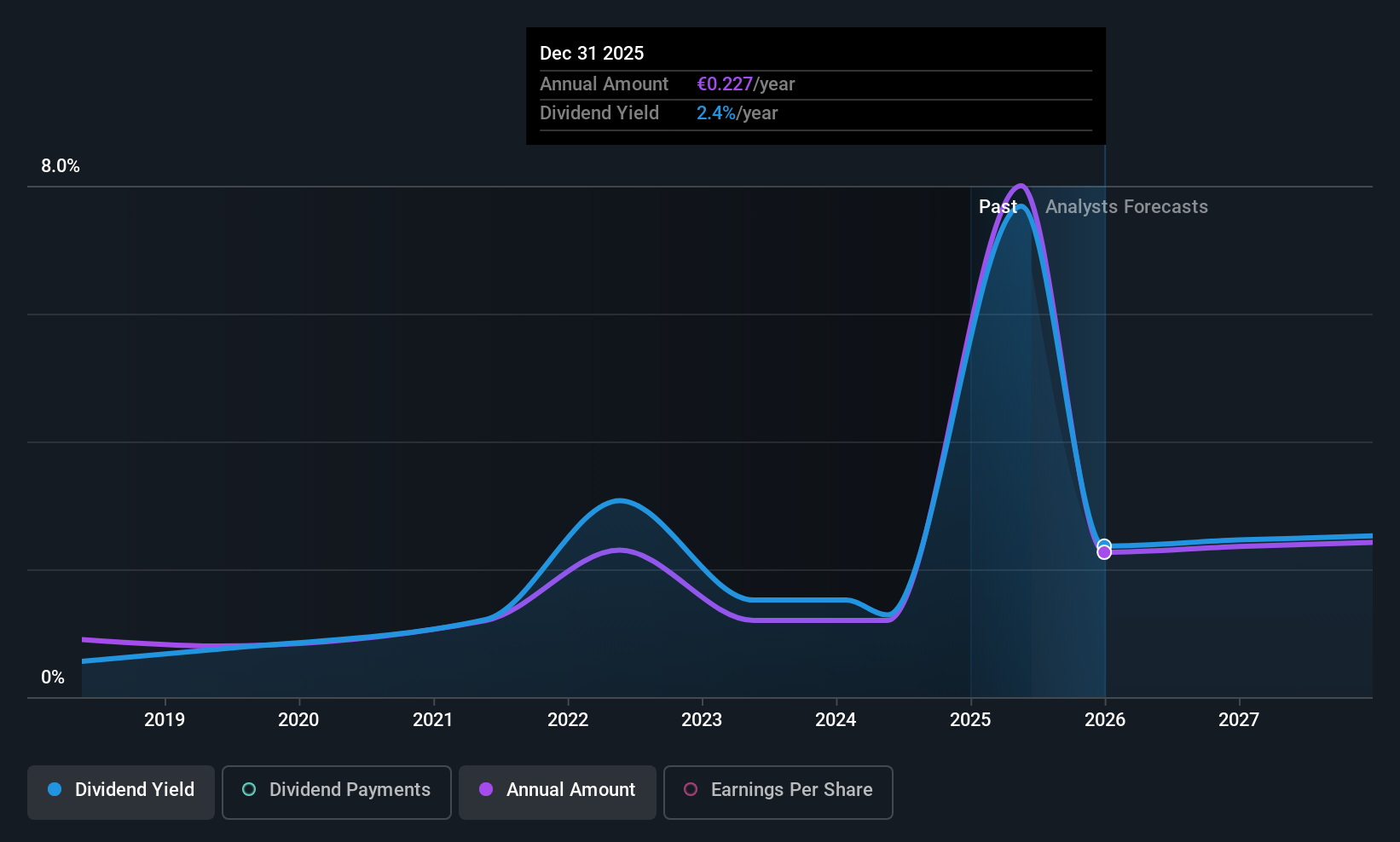

ProCredit Holding (XTRA:PCZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ProCredit Holding AG, with a market cap of €560.71 million, offers commercial banking products and services to small and medium enterprises as well as private customers across Europe, South America, and Germany.

Operations: ProCredit Holding AG generates revenue primarily through its banking segment, which accounted for €449.56 million.

Dividend Yield: 6.2%

ProCredit Holding's dividend yield of 6.2% places it among the top 25% in Germany, with a sustainable payout ratio of 37.1%. While its dividend history is less than a decade old and marked by volatility, current payments are well-covered by earnings and expected to remain so, with a forecasted payout ratio of 32.4%. Recent inclusion in the S&P Global BMI Index highlights its growing recognition despite challenges like high non-performing loans at 2.1%.

- Click here to discover the nuances of ProCredit Holding with our detailed analytical dividend report.

- Our valuation report here indicates ProCredit Holding may be undervalued.

Next Steps

- Gain an insight into the universe of 224 Top European Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PCZ

ProCredit Holding

Provides commercial banking products and services for small and medium enterprises and private customers in Europe, South America, and Germany.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives