- Germany

- /

- Auto Components

- /

- DB:ED4

Is EDAG Engineering Group AG's (FRA:ED4) Stock Available For A Good Price After Accounting For Growth?

EDAG Engineering Group AG (FRA:ED4) is considered a high-growth stock, but its last closing price of €14.98 left some investors wondering if this high future earnings potential can be rationalized by its current price tag. Below I will be talking through a basic metric which will help answer this question.

Check out our latest analysis for EDAG Engineering Group

What can we expect from ED4 in the future?

EDAG Engineering Group's extremely high growth potential in the near future is attracting investors. The consensus forecast from 6 analysts is extremely positive with earnings per share estimated to rise from today's level of €1.019 to €1.566 over the next three years. This indicates an estimated earnings growth rate of 17% per year, on average, which illustrates a highly optimistic outlook in the near term.

Is ED4's share price justifiable by its earnings growth?

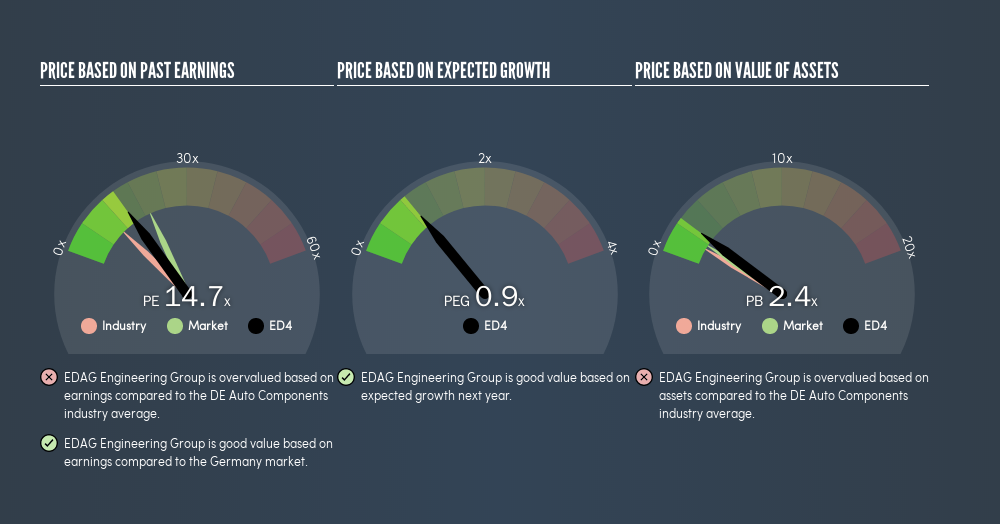

Stocks like EDAG Engineering Group, with a price-to-earnings (P/E) ratio of 14.7x, always catch the eye of investors on the hunt for a bargain. In isolation, this metric can be a bit too simplistic but in comparison to benchmarks, it tells us that ED4 is undervalued relative to the current DE market average of 19.52x , and overvalued based on current earnings compared to the Auto Components industry average of 10.47x .

We already know that ED4 appears to be overvalued when compared to its industry average. However, since EDAG Engineering Group is a high-growth stock, we must also account for its earnings growth by using calculation called the PEG ratio. A PE ratio of 14.7x and expected year-on-year earnings growth of 17% give EDAG Engineering Group a low PEG ratio of 0.87x. So, when we include the growth factor in our analysis, EDAG Engineering Group appears fairly valued , based on its fundamentals.

What this means for you:

ED4's current undervaluation could signal a potential buying opportunity to increase your exposure to the stock, or it you're a potential investor, now may be the right time to buy. However, basing your investment decision off one metric alone is certainly not sufficient. There are many things I have not taken into account in this article and the PEG ratio is very one-dimensional. If you have not done so already, I highly recommend you to complete your research by taking a look at the following:

- Financial Health: Are ED4’s operations financially sustainable? Balance sheets can be hard to analyze, which is why we’ve done it for you. Check out our financial health checks here.

- Past Track Record: Has ED4 been consistently performing well irrespective of the ups and downs in the market? Go into more detail in the past performance analysis and take a look at the free visual representations of ED4's historicals for more clarity.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About DB:ED4

EDAG Engineering Group

Engages in the development of vehicles, derivatives, modules, and production facilities for the automotive and commercial vehicle industries worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)