- Germany

- /

- Diversified Financial

- /

- XTRA:PBB

MTU Aero Engines And 2 Other Stocks On The German Exchange Possibly Priced Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As the European Central Bank's recent interest rate cuts have fueled expectations for further monetary easing, Germany's DAX index has shown resilience with a 1.46% gain. In this environment of potentially shifting economic policies, identifying stocks that may be priced below their intrinsic value can offer investors opportunities to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| technotrans (XTRA:TTR1) | €16.25 | €30.80 | 47.2% |

| init innovation in traffic systems (XTRA:IXX) | €37.00 | €52.17 | 29.1% |

| 2G Energy (XTRA:2GB) | €22.65 | €41.20 | 45% |

| Formycon (XTRA:FYB) | €51.60 | €81.68 | 36.8% |

| CeoTronics (DB:CEK) | €5.55 | €10.07 | 44.9% |

| Schweizer Electronic (XTRA:SCE) | €3.76 | €7.19 | 47.7% |

| Your Family Entertainment (DB:RTV) | €2.50 | €4.21 | 40.6% |

| LPKF Laser & Electronics (XTRA:LPK) | €9.06 | €12.42 | 27% |

| Basler (XTRA:BSL) | €6.20 | €12.00 | 48.3% |

| MTU Aero Engines (XTRA:MTX) | €310.50 | €563.64 | 44.9% |

We're going to check out a few of the best picks from our screener tool.

MTU Aero Engines (XTRA:MTX)

Overview: MTU Aero Engines AG develops, manufactures, markets, and maintains commercial and military aircraft engines and aero-derivative industrial gas turbines globally, with a market cap of €16.71 billion.

Operations: The company's revenue is primarily derived from its Commercial Maintenance Business (MRO), contributing €4.45 billion, and the Commercial and Military Engine Business (OEM), which accounts for €1.32 billion.

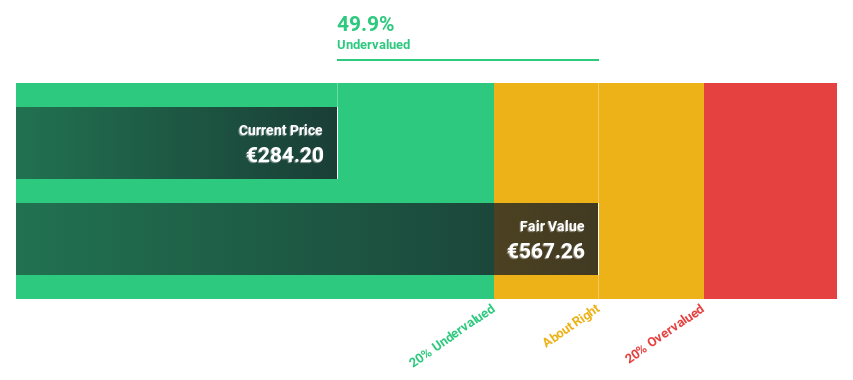

Estimated Discount To Fair Value: 44.9%

MTU Aero Engines is trading significantly below its estimated fair value of €563.64, with a current price of €310.5, highlighting its potential undervaluation based on cash flows. The company's revenue growth forecast of 11.9% annually surpasses the German market average, and earnings are expected to grow by 34.31% per year, becoming profitable within three years. Recent financial activities include a €745.88 million fixed-income offering at a 3.875% coupon rate due in 2031.

- Our growth report here indicates MTU Aero Engines may be poised for an improving outlook.

- Dive into the specifics of MTU Aero Engines here with our thorough financial health report.

Deutsche Pfandbriefbank (XTRA:PBB)

Overview: Deutsche Pfandbriefbank AG offers commercial real estate and public investment finance services across Europe and the United States, with a market cap of €722.13 million.

Operations: The company's revenue is primarily derived from Real Estate Finance (€223 million) and Non-Core activities (€103 million).

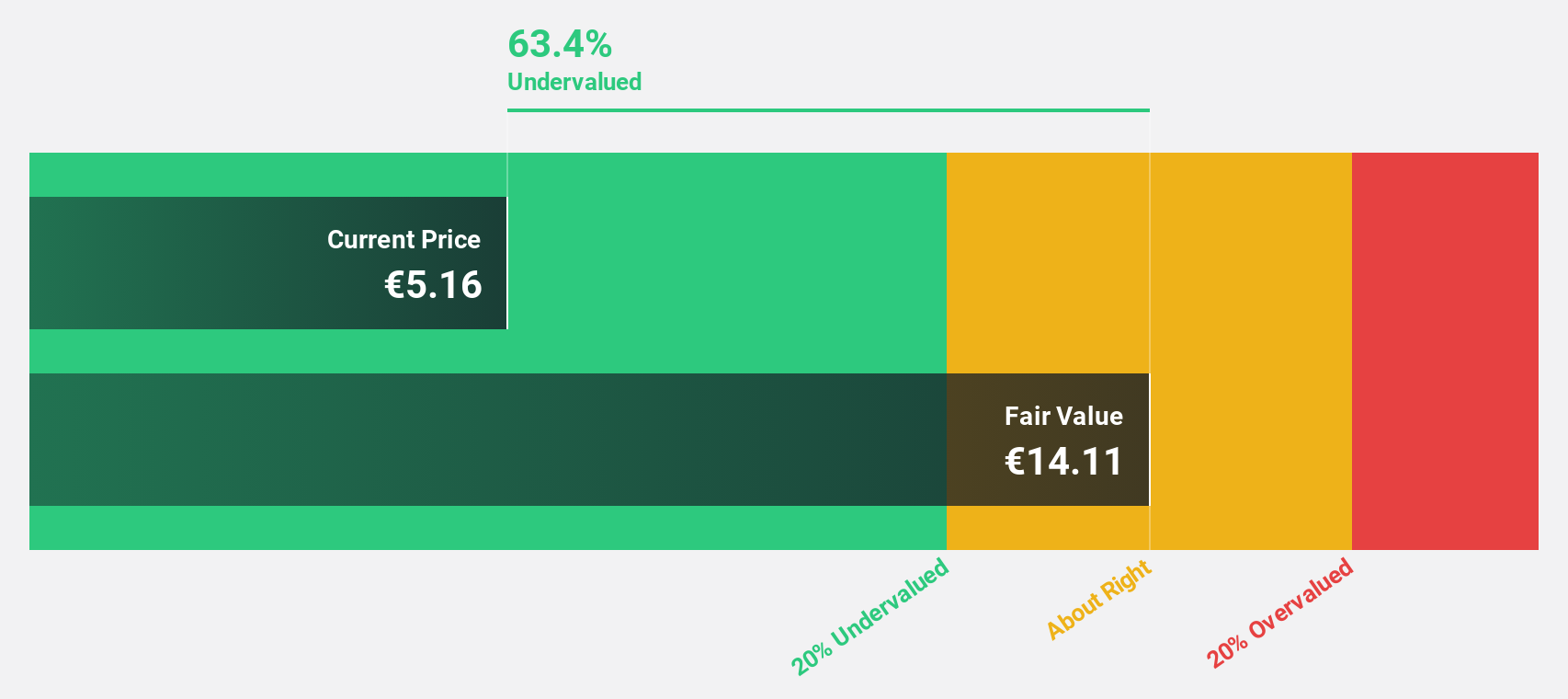

Estimated Discount To Fair Value: 25.7%

Deutsche Pfandbriefbank is trading at €5.37, below its estimated fair value of €7.22, suggesting undervaluation based on cash flows. Despite a high level of bad loans (4.1%) and a significant drop in net income to €40 million for the first half of 2024, earnings are projected to grow significantly at 38.6% annually over the next three years, outpacing the German market's growth rate and highlighting potential long-term value despite current challenges.

- In light of our recent growth report, it seems possible that Deutsche Pfandbriefbank's financial performance will exceed current levels.

- Get an in-depth perspective on Deutsche Pfandbriefbank's balance sheet by reading our health report here.

Schaeffler (XTRA:SHA0)

Overview: Schaeffler AG, along with its subsidiaries, develops, manufactures, and sells components and systems for industrial applications across Europe, the Americas, China, and the Asia Pacific region with a market cap of approximately €4.74 billion.

Operations: The company's revenue is primarily derived from three segments: Automotive Technologies (€9.80 billion), Vehicle Lifetime Solutions (€2.43 billion), and Bearings & Industrial Solutions (€4.10 billion).

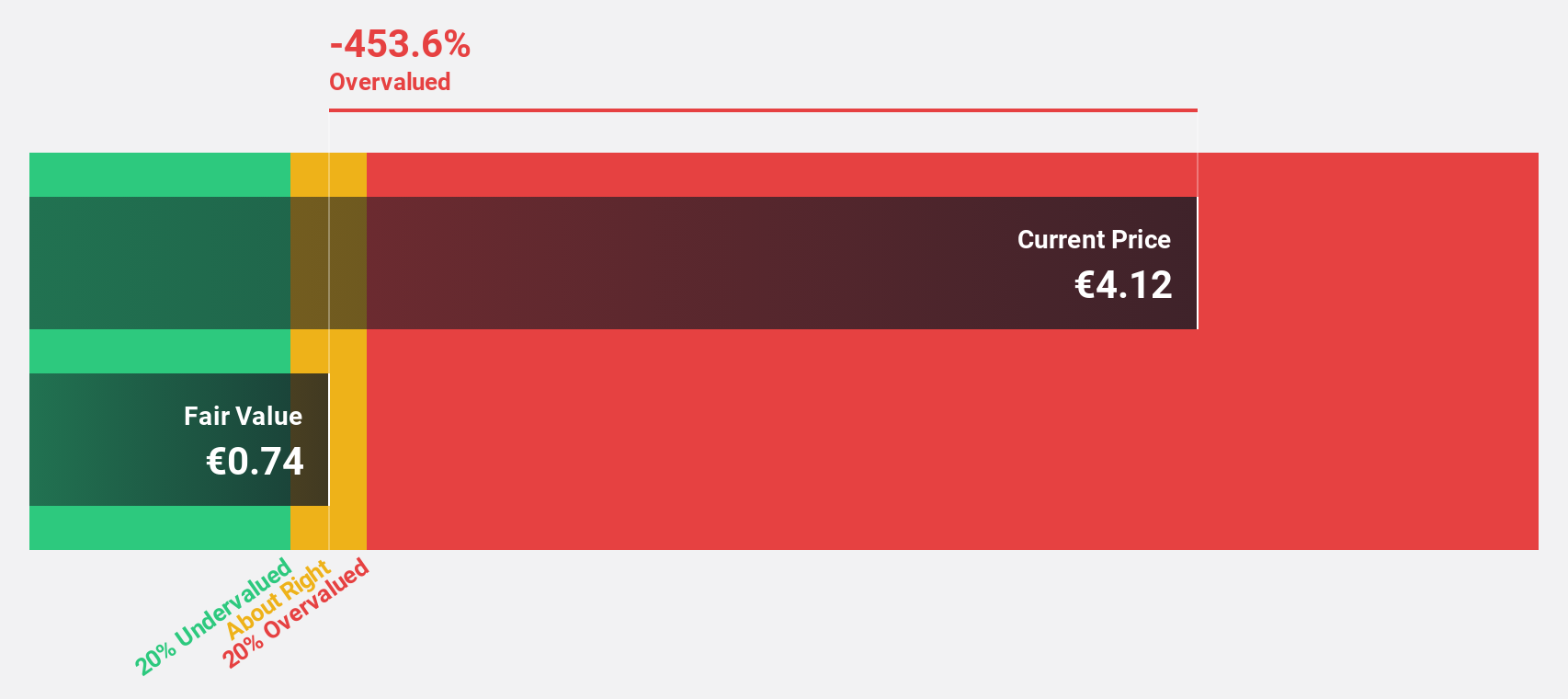

Estimated Discount To Fair Value: 16.6%

Schaeffler is trading at €5.02, below its fair value estimate of €6.02, indicating potential undervaluation based on cash flows. Despite a decline in profit margins and net income for recent quarters, earnings are expected to grow significantly at 38% annually over the next three years, surpassing the German market's growth rate. However, interest payments remain poorly covered by earnings, which could pose financial challenges despite promising revenue forecasts.

- Upon reviewing our latest growth report, Schaeffler's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Schaeffler with our detailed financial health report.

Seize The Opportunity

- Unlock more gems! Our Undervalued German Stocks Based On Cash Flows screener has unearthed 16 more companies for you to explore.Click here to unveil our expertly curated list of 19 Undervalued German Stocks Based On Cash Flows.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PBB

Deutsche Pfandbriefbank

Provides commercial real estate and public investment finance in Europe and the United States of America.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives