As European markets experience a lift from improved sentiment following the de-escalation of U.S.-China trade tensions, major indices like the STOXX Europe 600 and Germany's DAX have seen notable gains. In this environment, dividend stocks can offer investors a blend of income and potential stability, particularly when selecting companies with strong fundamentals that can weather economic fluctuations.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.37% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.81% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.40% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.39% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.95% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.87% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 8.91% | ★★★★★★ |

| ERG (BIT:ERG) | 5.70% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.52% | ★★★★★★ |

Click here to see the full list of 239 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Banco de Sabadell (BME:SAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco de Sabadell, S.A. offers a range of banking products and services to personal, business, and private customers both in Spain and internationally, with a market cap of €15.20 billion.

Operations: Banco de Sabadell's revenue segments include €189 million from its banking operations in Mexico and €1.29 billion from its banking business in the United Kingdom.

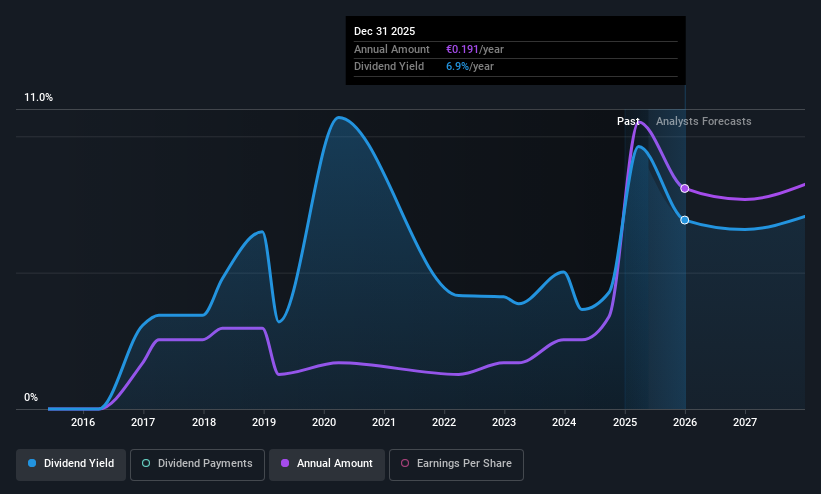

Dividend Yield: 8.8%

Banco de Sabadell's dividend yield is among the top 25% in Spain, supported by a reasonable payout ratio of 57.3%, indicating dividends are currently covered by earnings. However, its dividend history is less stable, with payments being volatile over the past nine years. Recent M&A rumors involving Unicaja Banco highlight potential strategic shifts amid competition concerns with BBVA. Despite completing a €247 million share buyback, challenges include high bad loans at 2.5%.

- Unlock comprehensive insights into our analysis of Banco de Sabadell stock in this dividend report.

- The valuation report we've compiled suggests that Banco de Sabadell's current price could be quite moderate.

Decora (WSE:DCR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Decora S.A. operates in Poland, focusing on the production, distribution, sale, and export of flooring products and accessories, with a market cap of PLN818.45 million.

Operations: Decora S.A.'s revenue primarily comes from its activities in producing, distributing, selling, and exporting flooring products and accessories in Poland.

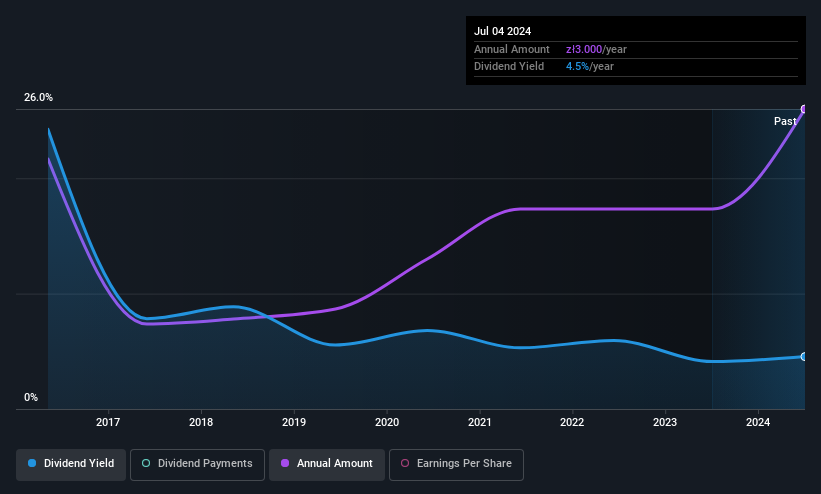

Dividend Yield: 3.9%

Decora S.A. recently announced an annual dividend of PLN 4 per share, highlighting a growth trend in dividends over the past decade despite historical volatility. The dividend is well-covered by both earnings and cash flows, with payout ratios of 38.1% and 49.1%, respectively, suggesting sustainability. However, its current yield of 3.87% is lower than the top Polish market payers. The company reported Q1 revenue growth to PLN 170.36 million but a slight decline in net income to PLN 20.12 million year-over-year, reflecting some financial pressures despite overall profitability improvements from previous years.

- Dive into the specifics of Decora here with our thorough dividend report.

- Our valuation report here indicates Decora may be overvalued.

PWO (XTRA:PWO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PWO AG is engaged in the development, production, and sale of metal components and systems for the mobility industry across Germany, Czechia, Canada, Mexico, Serbia, and China with a market cap of €93.75 million.

Operations: PWO AG's revenue is primarily derived from its Auto Parts & Accessories segment, which generated €545.76 million.

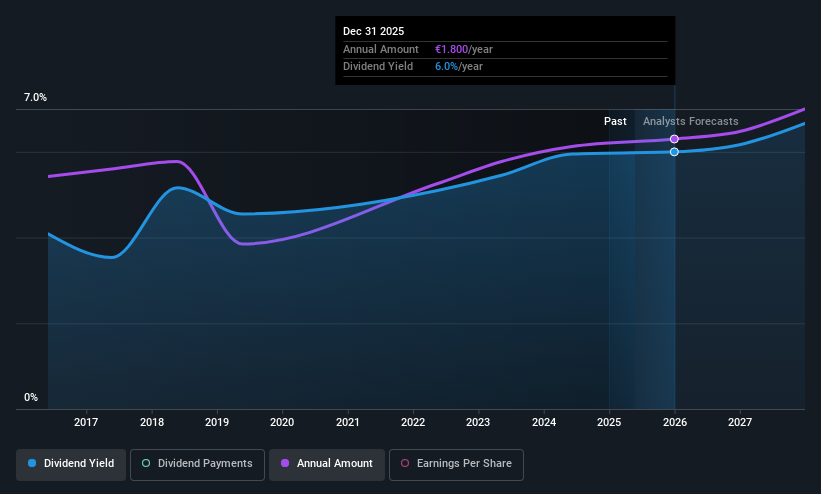

Dividend Yield: 5.8%

PWO AG's dividend, though historically volatile, is covered by earnings and cash flows with payout ratios of 50.1% and 51.4%, respectively. The dividend yield of 5.83% ranks in the top quartile in Germany, yet interest coverage remains a concern. Recent Q1 results show a decline in net income to €1.7 million from €3.32 million year-over-year, while annual dividends remain steady at €1.75 per share amidst unchanged revenue guidance for 2025 at approximately €530 million.

- Delve into the full analysis dividend report here for a deeper understanding of PWO.

- In light of our recent valuation report, it seems possible that PWO is trading behind its estimated value.

Make It Happen

- Discover the full array of 239 Top European Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco de Sabadell might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:SAB

Banco de Sabadell

Provides banking products and services to personal, business, and private customers in Spain and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives