- Germany

- /

- Renewable Energy

- /

- XTRA:RWE

Exploring Dividend Stocks: Choosing One Over RWE For Better Opportunities

Reviewed by Sasha Jovanovic

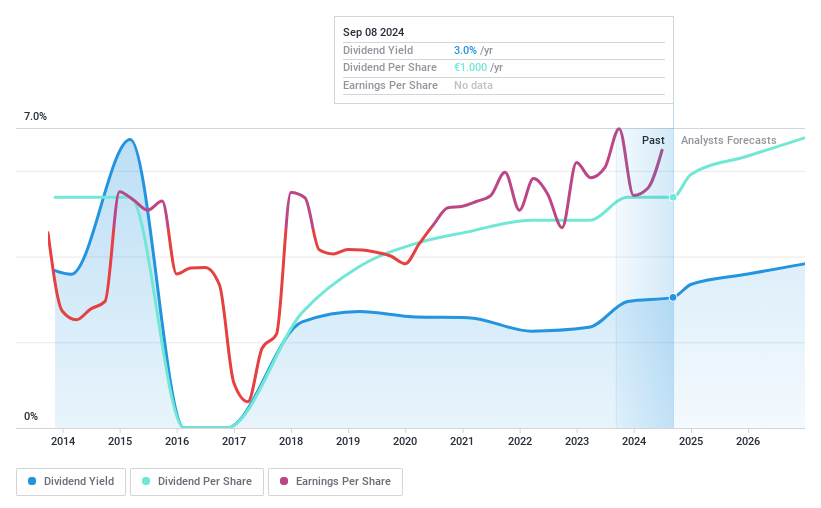

Investors often look to dividend stocks in Germany for a reliable income stream. However, it's important to scrutinize the stability of these dividends. Companies like RWE have experienced significant fluctuations in their dividend payouts, presenting a higher risk for those dependent on consistent dividend income.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.32% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.90% | ★★★★★★ |

| Brenntag (XTRA:BNR) | 3.34% | ★★★★★☆ |

| Südzucker (XTRA:SZU) | 6.62% | ★★★★★☆ |

| DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.62% | ★★★★★☆ |

| MLP (XTRA:MLP) | 5.24% | ★★★★★☆ |

| INDUS Holding (XTRA:INH) | 4.99% | ★★★★★☆ |

| Deutsche Telekom (XTRA:DTE) | 3.28% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.21% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.14% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top Dividend Stocks screener.

Let's take a closer look at one of our picks from the screened companies and one you may wish to avoid.

Top Pick

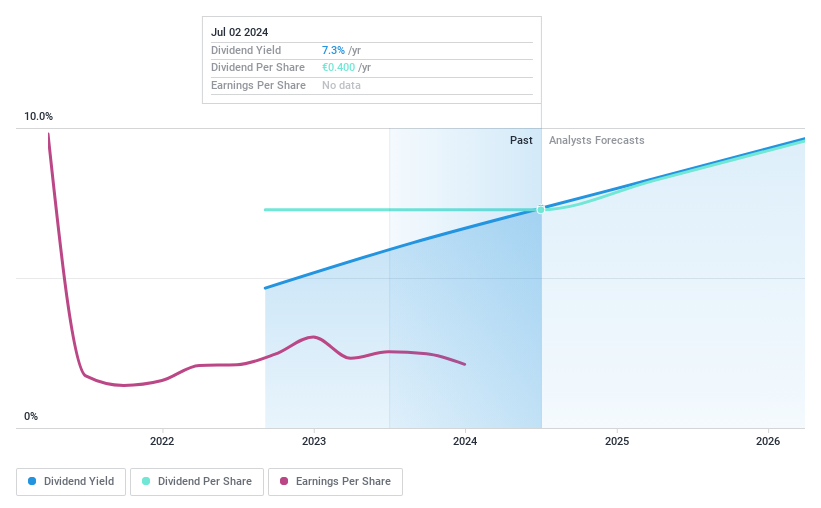

Novem Group (XTRA:NVM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Novem Group S.A. is a Luxembourg-based company specializing in the development and supply of trim elements and decorative function elements for car interiors, operating globally with a market capitalization of approximately €0.25 billion.

Operations: The company generates €0.64 billion in revenue from its Auto Parts & Accessories segment.

Dividend Yield: 7.0%

Novem Group S.A., with a dividend yield of 6.99%, stands out in the top 25% of German dividend payers. The company's dividends are well-supported by earnings and cash flows, with payout ratios at 37.7% and 36.1%, respectively, indicating sustainability despite recent declines in sales and net income for FY2024 to EUR 635.5 million and EUR 34.8 million from previous higher figures. However, its short dividend history and lack of growth in payments highlight potential concerns for long-term stability.

- Click to explore a detailed breakdown of our findings in Novem Group's dividend report.

- Upon reviewing our latest valuation report, Novem Group's share price might be too pessimistic.

One To Reconsider

RWE (XTRA:RWE)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: RWE Aktiengesellschaft operates in the generation and supply of electricity from both renewable and conventional sources across Germany, the UK, other parts of Europe, North America, and internationally, with a market capitalization of approximately €23.77 billion.

Operations: RWE's revenue segments include €2.44 billion from Offshore Wind, €29.53 billion from Supply & Trading, €3.56 billion from Onshore Wind/Solar, €10.58 billion from Flexible Generation, and €4.84 billion from Phaseout Technologies.

Dividend Yield: 3.1%

RWE's dividend attractiveness is marred by its history of unstable payouts, with significant reductions over the past decade. Despite a low payout ratio of 41.9%, dividends have not grown, and recent earnings suggest a disconnect between profit and cash flow adequacy for dividends. The company's recent sales drop to €6.68 billion from €9.38 billion further complicates its financial stability, casting doubt on the sustainability of future dividends amid ongoing capital-intensive projects like potential divestitures in its grid operations.

Seize The Opportunity

- Unlock our comprehensive list of 30 Top Dividend Stocks by clicking here.

- Have a stake in one of these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RWE

RWE

Generates and supplies electricity from renewable and conventional sources in Germany, the United Kingdom, rest of Europe, North America, and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives