- Germany

- /

- Auto Components

- /

- XTRA:CON

Analyst Revenue Cuts After Munich Conference Could Be a Game Changer for Continental (XTRA:CON)

Reviewed by Sasha Jovanovic

- Continental Aktiengesellschaft recently presented at the 14th Baader Investment Conference in Munich, where senior investor relations representatives engaged with the investment community.

- Following this event, analysts have made a major downward revision to Continental's near-term revenue outlook, signaling shifting sentiment about the company's future prospects.

- We'll review how sharply reduced revenue forecasts by analysts after the conference could shift Continental's overall investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Continental Investment Narrative Recap

To be a shareholder in Continental right now, you need to believe in the company’s ability to withstand tough market cycles and benefit from long-range trends in e-mobility and vehicle technology. The recent sharp downgrade in analyst revenue forecasts following the Baader Conference is material and puts additional focus on the sustainability of core business volumes, elevating near-term sales execution as the most important catalyst and intensifying existing risks tied to disappointing volume recovery.

Against this backdrop, Continental’s recent announcement to spin off the Automotive division remains highly relevant. A successful separation is expected to streamline operations, but with analyst expectations now revised lower, any execution issues or associated restructuring costs could amplify financial pressures and reduce the upside from this catalyst.

By contrast, the scale of recent volume weakness could have knock-on effects for profitability that investors should be aware of...

Read the full narrative on Continental (it's free!)

Continental's outlook calls for €41.4 billion in revenue and €2.1 billion in earnings by 2028. This is based on a 1.5% annual revenue growth rate, and a €1.0 billion increase in earnings from €1.1 billion today.

Uncover how Continental's forecasts yield a €74.93 fair value, a 31% upside to its current price.

Exploring Other Perspectives

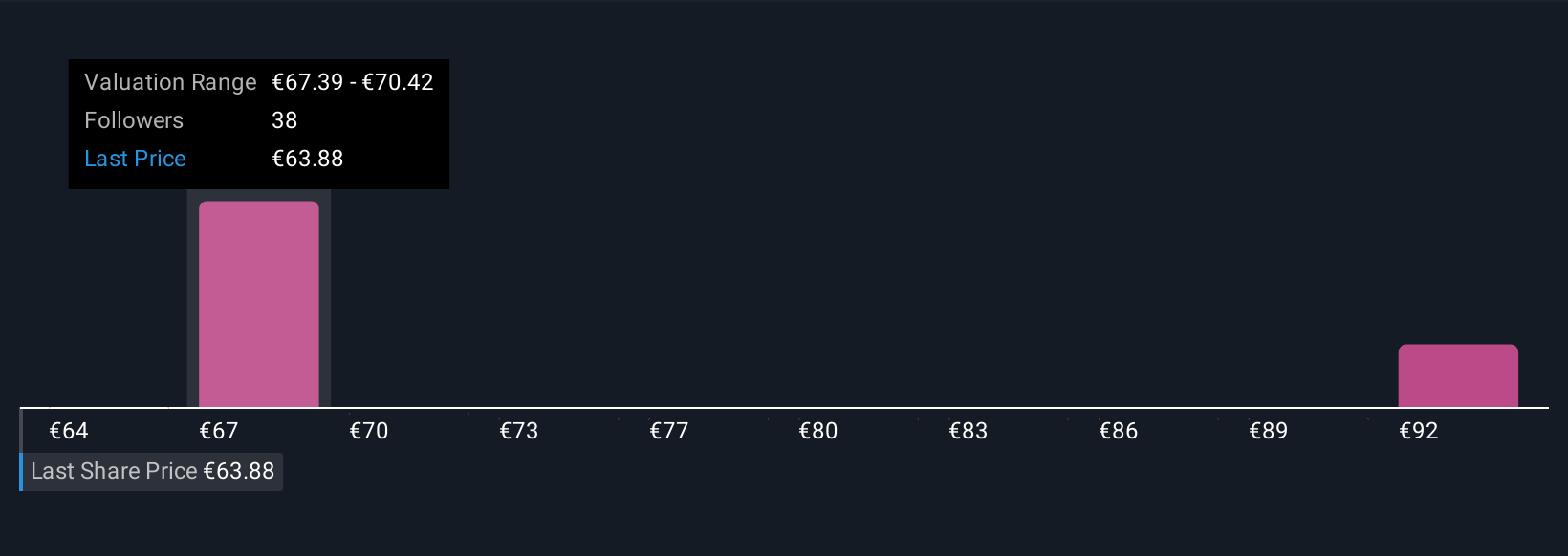

Five investor fair value estimates from the Simply Wall St Community range from €64.35 to €114.11 per share. With revenue forecasts sharply downgraded, these opposing views highlight how opinions can diverge widely about Continental’s prospects, inviting you to weigh multiple outlooks.

Explore 5 other fair value estimates on Continental - why the stock might be worth over 2x more than the current price!

Build Your Own Continental Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Continental research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Continental research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Continental's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:CON

Continental

Manufactures tire and develops and produces solutions for automotive manufacturers, industrial, and end customers worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026