Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Leptos Calypso Hotels Public Ltd. (CSE:LCH) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Leptos Calypso Hotels

What Is Leptos Calypso Hotels's Debt?

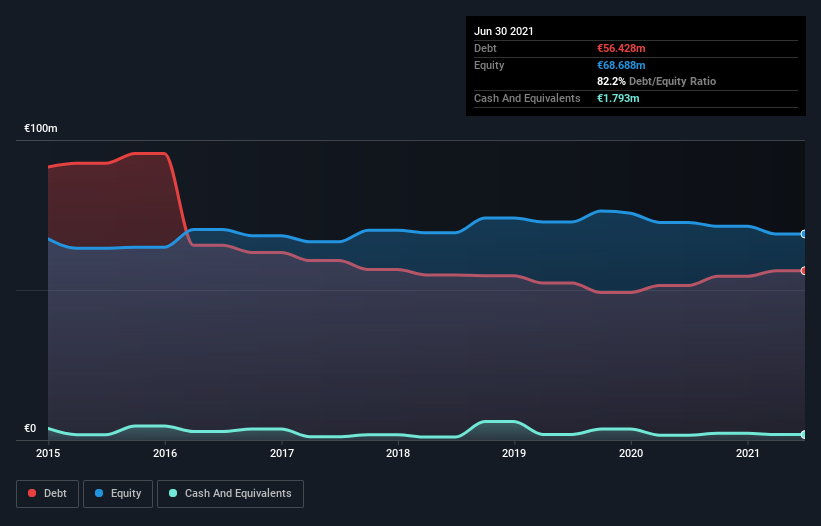

You can click the graphic below for the historical numbers, but it shows that as of June 2021 Leptos Calypso Hotels had €56.4m of debt, an increase on €51.5m, over one year. However, it does have €1.79m in cash offsetting this, leading to net debt of about €54.6m.

A Look At Leptos Calypso Hotels' Liabilities

According to the last reported balance sheet, Leptos Calypso Hotels had liabilities of €11.9m due within 12 months, and liabilities of €72.9m due beyond 12 months. Offsetting these obligations, it had cash of €1.79m as well as receivables valued at €2.52m due within 12 months. So its liabilities total €80.5m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the €6.64m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Leptos Calypso Hotels would likely require a major re-capitalisation if it had to pay its creditors today. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Leptos Calypso Hotels will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Leptos Calypso Hotels had a loss before interest and tax, and actually shrunk its revenue by 77%, to €4.5m. That makes us nervous, to say the least.

Caveat Emptor

Not only did Leptos Calypso Hotels's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Its EBIT loss was a whopping €1.5m. When you combine this with the very significant balance sheet liabilities mentioned above, we are so wary of it that we are basically at a loss for the right words. Like every long-shot we're sure it has a glossy presentation outlining its blue-sky potential. But the reality is that it is low on liquid assets relative to liabilities, and it burned through €2.3m in the last year. So we consider this a high risk stock, and we're worried its share price could sink faster than than a dingy with a great white shark attacking it. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Leptos Calypso Hotels is showing 3 warning signs in our investment analysis , you should know about...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CSE:LCH

Good value with acceptable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026