- China

- /

- Water Utilities

- /

- SZSE:000598

Chengdu Xingrong Environment Co., Ltd.'s (SZSE:000598) Price Is Right But Growth Is Lacking

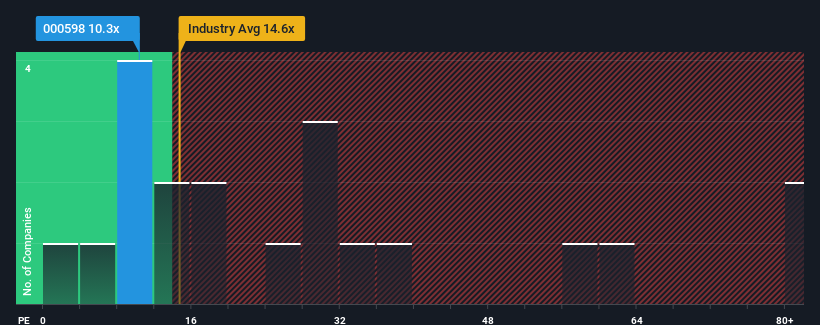

Chengdu Xingrong Environment Co., Ltd.'s (SZSE:000598) price-to-earnings (or "P/E") ratio of 10.3x might make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 37x and even P/E's above 72x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been pleasing for Chengdu Xingrong Environment as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Chengdu Xingrong Environment

How Is Chengdu Xingrong Environment's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Chengdu Xingrong Environment's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 14% last year. This was backed up an excellent period prior to see EPS up by 33% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 13% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the market is forecast to expand by 37%, which is noticeably more attractive.

In light of this, it's understandable that Chengdu Xingrong Environment's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Chengdu Xingrong Environment maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Chengdu Xingrong Environment is showing 2 warning signs in our investment analysis, and 1 of those is a bit concerning.

Of course, you might also be able to find a better stock than Chengdu Xingrong Environment. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000598

Chengdu Xingrong Environment

Primarily engages in the tap water business in China.

Established dividend payer and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026