- China

- /

- Water Utilities

- /

- SHSE:601158

The Market Doesn't Like What It Sees From Chongqing Water Group Co.,Ltd.'s (SHSE:601158) Earnings Yet

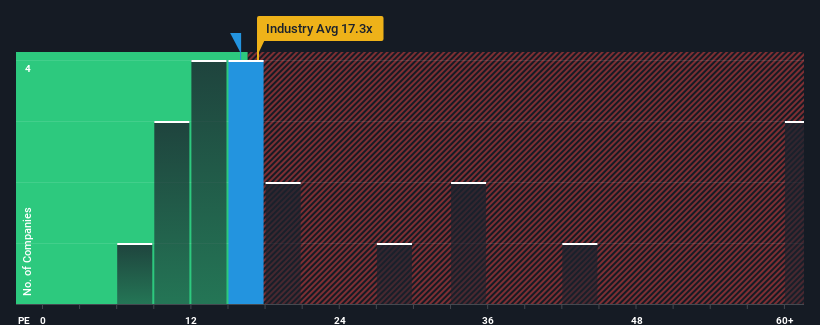

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 32x, you may consider Chongqing Water Group Co.,Ltd. (SHSE:601158) as a highly attractive investment with its 15.9x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

While the market has experienced earnings growth lately, Chongqing Water GroupLtd's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Chongqing Water GroupLtd

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Chongqing Water GroupLtd would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a frustrating 3.5% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 3.5% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 5.8% as estimated by the one analyst watching the company. With the market predicted to deliver 39% growth , the company is positioned for a weaker earnings result.

In light of this, it's understandable that Chongqing Water GroupLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Chongqing Water GroupLtd's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Chongqing Water GroupLtd's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 1 warning sign for Chongqing Water GroupLtd you should be aware of.

If you're unsure about the strength of Chongqing Water GroupLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601158

Chongqing Water GroupLtd

Engages in the water supply, wastewater treatment, sludge treatment and disposal, engineering construction, and other businesses in China.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.