- China

- /

- Water Utilities

- /

- SHSE:601158

Chongqing Water GroupLtd's (SHSE:601158) Sluggish Earnings Might Be Just The Beginning Of Its Problems

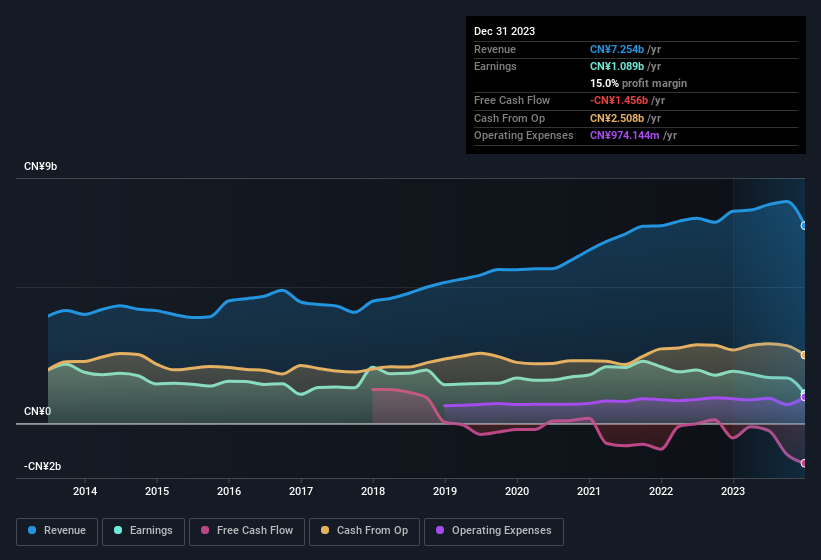

Investors were disappointed by Chongqing Water Group Co.,Ltd.'s (SHSE:601158 ) latest earnings release. We did some analysis, and found that there are some reasons to be cautious about the headline numbers.

View our latest analysis for Chongqing Water GroupLtd

How Do Unusual Items Influence Profit?

To properly understand Chongqing Water GroupLtd's profit results, we need to consider the CN¥171m gain attributed to unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly surprising, given the name. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Chongqing Water GroupLtd's Profit Performance

Arguably, Chongqing Water GroupLtd's statutory earnings have been distorted by unusual items boosting profit. Therefore, it seems possible to us that Chongqing Water GroupLtd's true underlying earnings power is actually less than its statutory profit. Sadly, its EPS was down over the last twelve months. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So while earnings quality is important, it's equally important to consider the risks facing Chongqing Water GroupLtd at this point in time. For example - Chongqing Water GroupLtd has 3 warning signs we think you should be aware of.

Today we've zoomed in on a single data point to better understand the nature of Chongqing Water GroupLtd's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601158

Chongqing Water GroupLtd

Engages in the water supply, wastewater treatment, sludge treatment and disposal, engineering construction, and other businesses in China.

Acceptable track record with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.