- China

- /

- Electric Utilities

- /

- SHSE:600644

Leshan Electric Power Co.,Ltd (SHSE:600644) Looks Just Right With A 26% Price Jump

Despite an already strong run, Leshan Electric Power Co.,Ltd (SHSE:600644) shares have been powering on, with a gain of 26% in the last thirty days. Notwithstanding the latest gain, the annual share price return of 6.8% isn't as impressive.

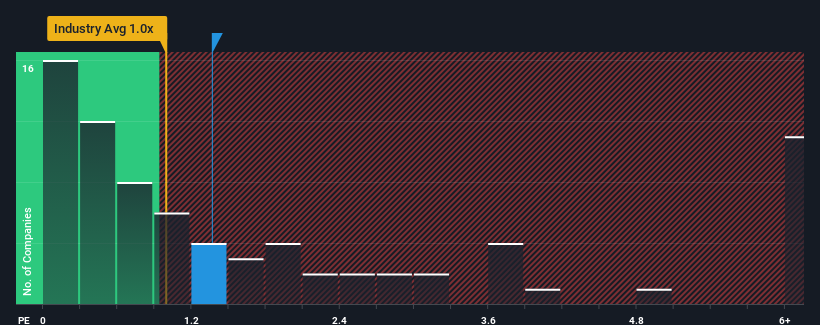

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Leshan Electric PowerLtd's P/S ratio of 1.4x, since the median price-to-sales (or "P/S") ratio for the Electric Utilities industry in China is also close to 1.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Leshan Electric PowerLtd

How Leshan Electric PowerLtd Has Been Performing

Leshan Electric PowerLtd has been doing a decent job lately as it's been growing revenue at a reasonable pace. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Leshan Electric PowerLtd will help you shine a light on its historical performance.How Is Leshan Electric PowerLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Leshan Electric PowerLtd would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 5.9% gain to the company's revenues. The latest three year period has also seen a 27% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 6.4% shows it's about the same on an annualised basis.

With this information, we can see why Leshan Electric PowerLtd is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

What We Can Learn From Leshan Electric PowerLtd's P/S?

Leshan Electric PowerLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It appears to us that Leshan Electric PowerLtd maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Leshan Electric PowerLtd with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600644

Adequate balance sheet very low.

Market Insights

Community Narratives