As global markets navigate a landscape marked by dovish central bank signals and shifting economic data, Asian indices have shown resilience, with technology and AI sectors gaining traction despite broader economic concerns. In this context, dividend stocks in Asia present an intriguing opportunity for investors seeking steady income streams amidst market volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.89% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.44% | ★★★★★★ |

| NCD (TSE:4783) | 4.60% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.71% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.07% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.09% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.81% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.81% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.50% | ★★★★★★ |

Click here to see the full list of 1043 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

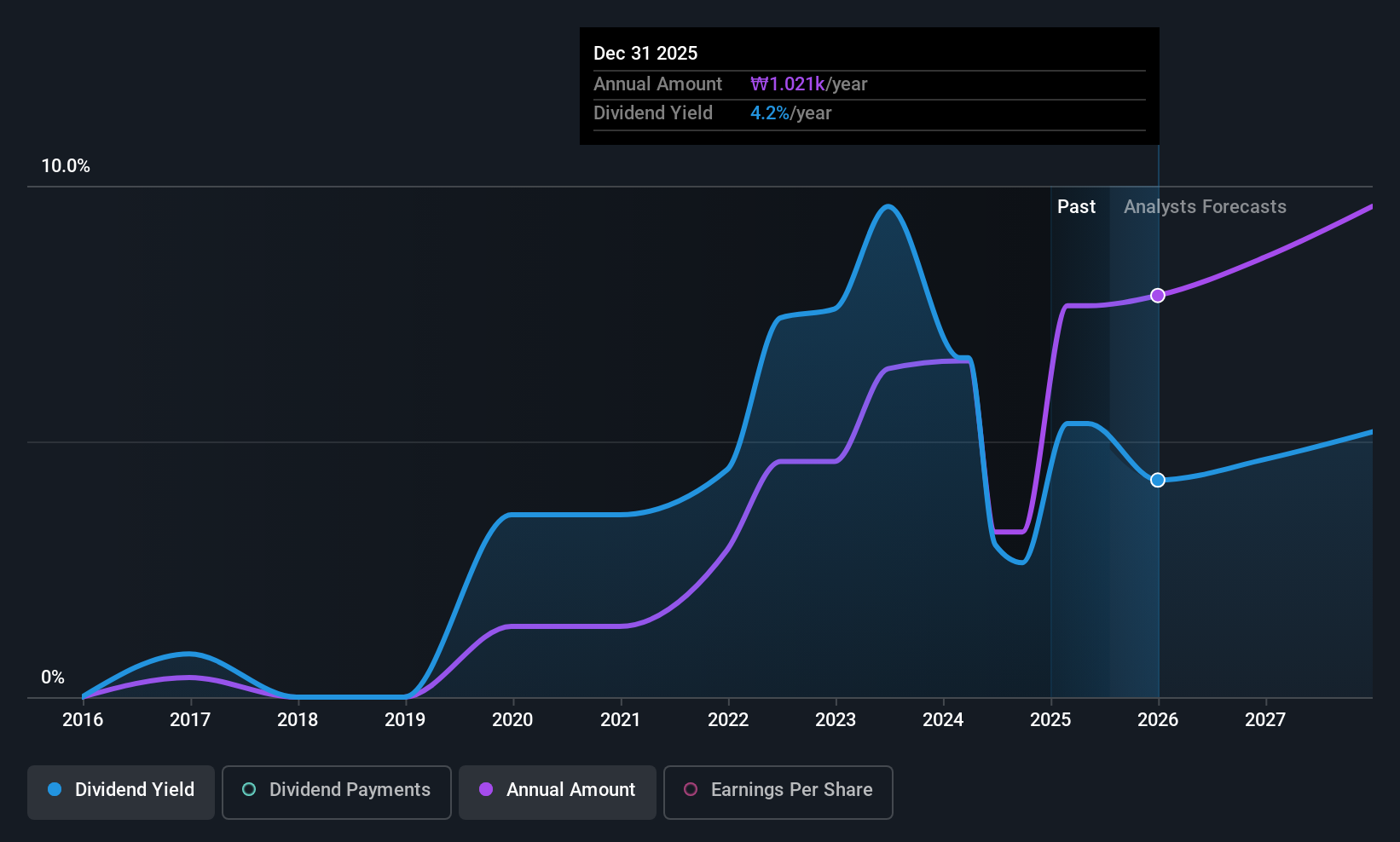

JB Financial Group (KOSE:A175330)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: JB Financial Group Co., Ltd. operates through its subsidiaries to provide financial services both in South Korea and internationally, with a market cap of ₩4.79 trillion.

Operations: JB Financial Group Co., Ltd. generates revenue through its subsidiaries by offering a range of financial services across domestic and international markets.

Dividend Yield: 3.9%

JB Financial Group's dividend yield is in the top 25% of the Korean market, though its payments have been volatile over the past decade. Despite this instability, dividends are well covered by earnings with a low payout ratio of 28.2%, suggesting sustainability. The company recently announced a KRW 40 billion share buyback program to enhance shareholder returns, indicating a commitment to improving corporate value amidst trading at a significant discount to estimated fair value.

- Click to explore a detailed breakdown of our findings in JB Financial Group's dividend report.

- The analysis detailed in our JB Financial Group valuation report hints at an deflated share price compared to its estimated value.

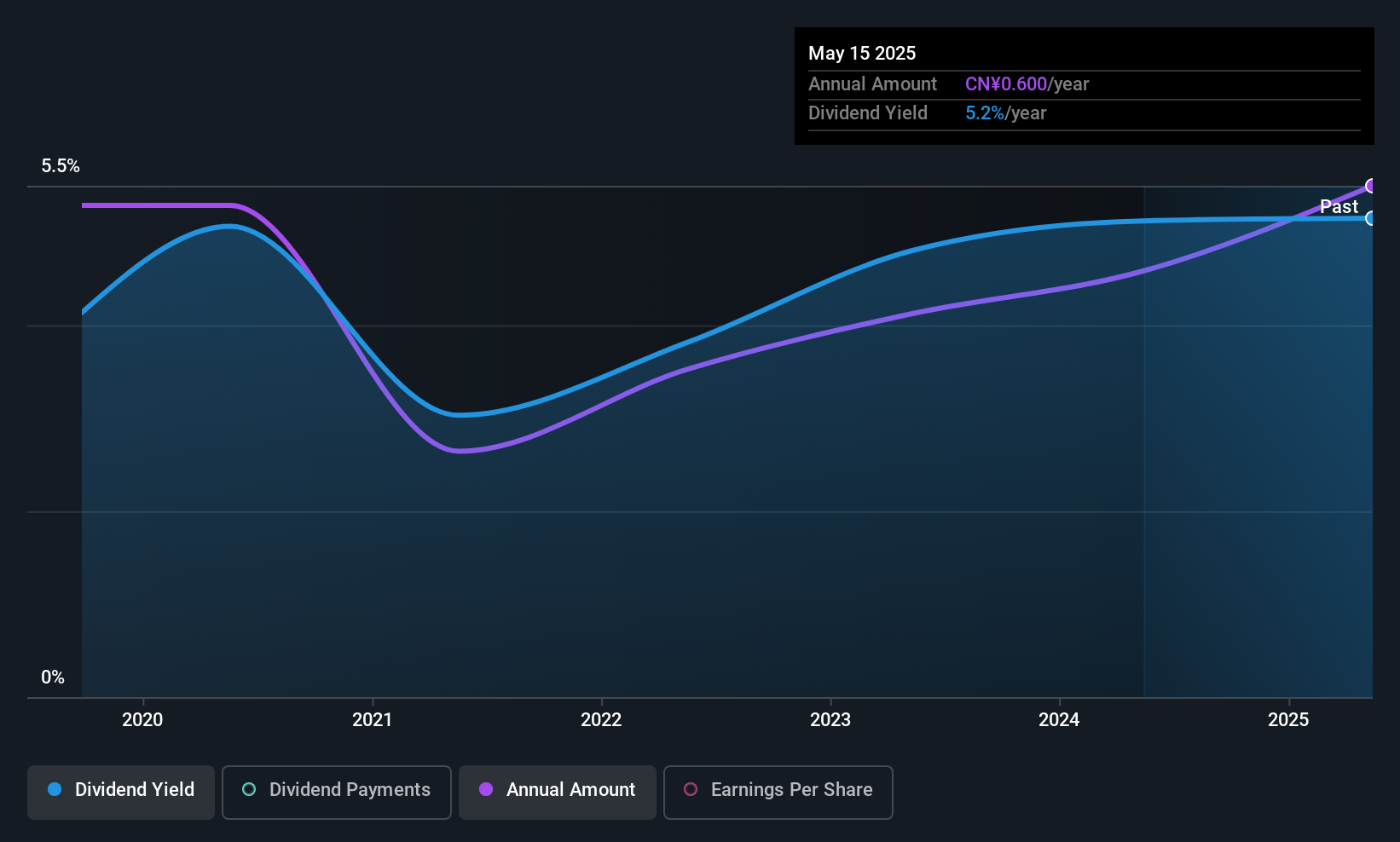

China Master Logistics (SHSE:603967)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Master Logistics Co., Ltd. operates as an integrated logistics company in China with a market cap of CN¥4.26 billion.

Operations: China Master Logistics Co., Ltd. generates its revenue through various logistics services across China.

Dividend Yield: 4.9%

China Master Logistics offers a compelling dividend yield in the top 25% of the Chinese market, though its short six-year history of payments has been marked by volatility. Despite this, dividends are covered by both earnings and cash flows with payout ratios of 80% and 38.9%, respectively. Recent earnings showed slight growth in net income despite a drop in sales, indicating potential resilience. The upcoming shareholder meeting may provide further insights into future dividend policies.

- Unlock comprehensive insights into our analysis of China Master Logistics stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of China Master Logistics shares in the market.

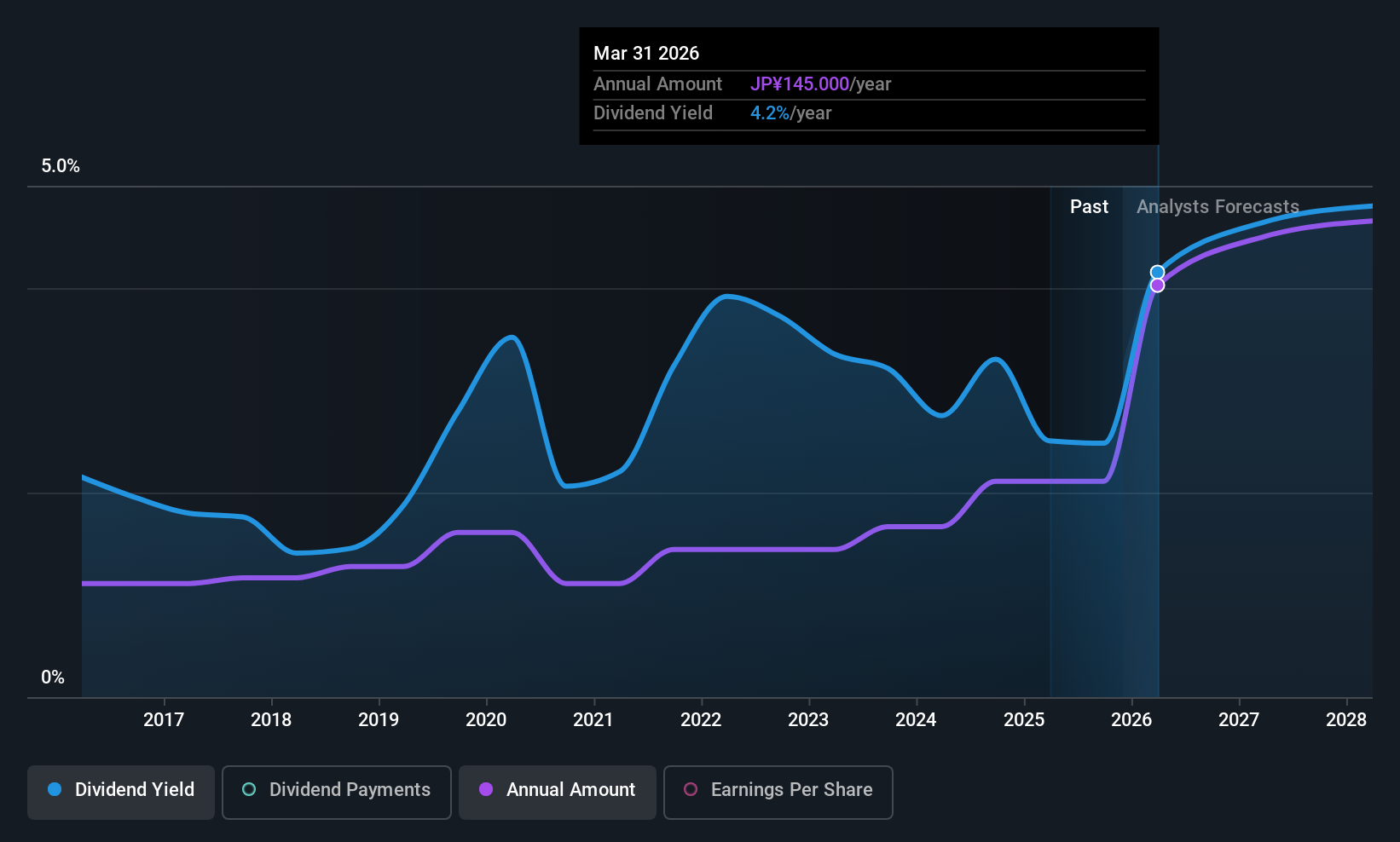

F.C.C (TSE:7296)

Simply Wall St Dividend Rating: ★★★★★★

Overview: F.C.C. Co., Ltd. is a manufacturer and seller of clutches for automobiles, motorcycles, and general-purpose machinery in Japan and internationally, with a market cap of ¥170.25 billion.

Operations: F.C.C. Co., Ltd.'s revenue is primarily derived from its Automobile Business segment at ¥135.21 billion and Motorcycle Business segment at ¥120.33 billion, with a smaller contribution from its Non-Mobility Business segment at ¥123 million.

Dividend Yield: 3.8%

F.C.C. Co., Ltd. maintains a stable and growing dividend history, with payments reliably increasing over the past decade. The company's low payout ratio of 10.8% ensures dividends are well covered by earnings, although the cash payout ratio is higher at 86.6%. Trading below its estimated fair value, F.C.C.'s current dividend yield of 3.81% ranks among the top quarter in Japan's market, with interim dividends recently considered during a board meeting on November 5, 2025.

- Delve into the full analysis dividend report here for a deeper understanding of F.C.C.

- The analysis detailed in our F.C.C valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Investigate our full lineup of 1043 Top Asian Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603967

China Master Logistics

Operates as an integrated logistics company in China.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026