- China

- /

- Transportation

- /

- SHSE:601816

Subdued Growth No Barrier To Beijing-Shanghai High-Speed Railway Co., Ltd.'s (SHSE:601816) Price

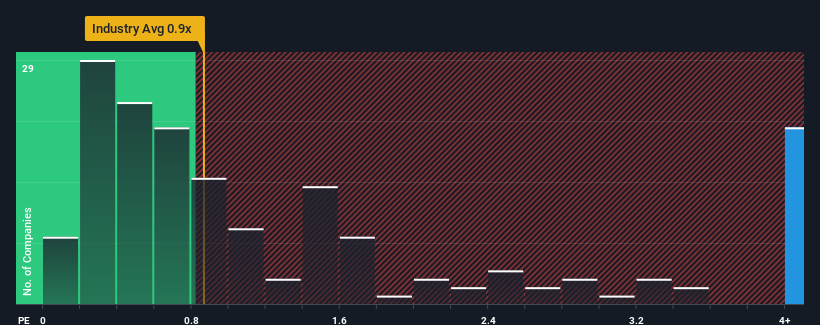

Beijing-Shanghai High-Speed Railway Co., Ltd.'s (SHSE:601816) price-to-sales (or "P/S") ratio of 6.2x may look like a poor investment opportunity when you consider close to half the companies in the Transportation industry in China have P/S ratios below 2.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Beijing-Shanghai High-Speed Railway

How Beijing-Shanghai High-Speed Railway Has Been Performing

With revenue growth that's superior to most other companies of late, Beijing-Shanghai High-Speed Railway has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Beijing-Shanghai High-Speed Railway will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Beijing-Shanghai High-Speed Railway?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Beijing-Shanghai High-Speed Railway's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 85% last year. The strong recent performance means it was also able to grow revenue by 62% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 8.2% as estimated by the analysts watching the company. With the industry predicted to deliver 7.3% growth , the company is positioned for a comparable revenue result.

With this information, we find it interesting that Beijing-Shanghai High-Speed Railway is trading at a high P/S compared to the industry. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Beijing-Shanghai High-Speed Railway's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given Beijing-Shanghai High-Speed Railway's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

Before you take the next step, you should know about the 1 warning sign for Beijing-Shanghai High-Speed Railway that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Beijing-Shanghai High-Speed Railway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601816

Beijing-Shanghai High-Speed Railway

Beijing-Shanghai High-Speed Railway Co., Ltd.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)