CMST DevelopmentLtd's (SHSE:600787) Shareholders May Want To Dig Deeper Than Statutory Profit

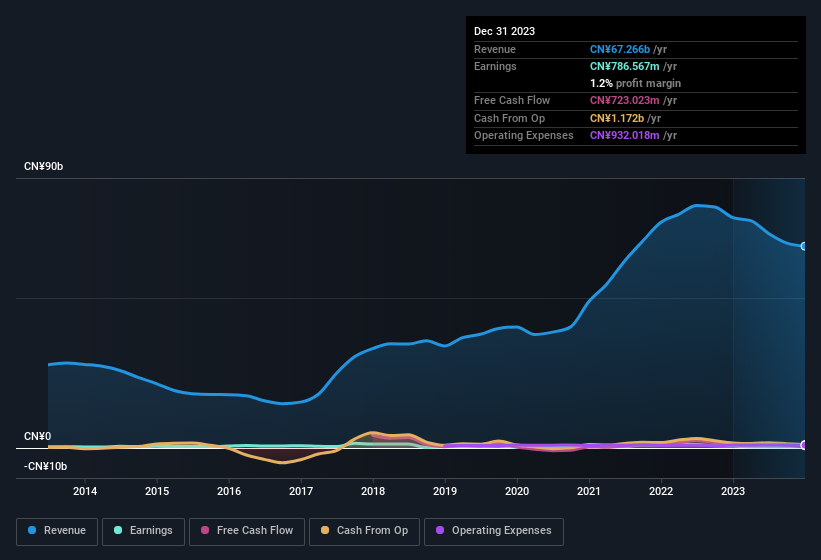

CMST Development Co.,Ltd. (SHSE:600787) just released a solid earnings report, and the stock displayed some strength. While the profit numbers were good, our analysis has found some concerning factors that shareholders should be aware of.

See our latest analysis for CMST DevelopmentLtd

How Do Unusual Items Influence Profit?

For anyone who wants to understand CMST DevelopmentLtd's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from CN¥539m worth of unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. CMST DevelopmentLtd had a rather significant contribution from unusual items relative to its profit to December 2023. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of CMST DevelopmentLtd.

Our Take On CMST DevelopmentLtd's Profit Performance

As we discussed above, we think the significant positive unusual item makes CMST DevelopmentLtd's earnings a poor guide to its underlying profitability. As a result, we think it may well be the case that CMST DevelopmentLtd's underlying earnings power is lower than its statutory profit. Nonetheless, it's still worth noting that its earnings per share have grown at 35% over the last three years. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you want to do dive deeper into CMST DevelopmentLtd, you'd also look into what risks it is currently facing. Every company has risks, and we've spotted 2 warning signs for CMST DevelopmentLtd you should know about.

This note has only looked at a single factor that sheds light on the nature of CMST DevelopmentLtd's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600787

CMST DevelopmentLtd

Provides warehouse logistics services in China, Hong Kong, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026