- China

- /

- Communications

- /

- SZSE:301600

Undiscovered Gems In Asia To Explore March 2025

Reviewed by Simply Wall St

Amidst global market fluctuations driven by tariff fears and inflation concerns, Asian markets present a unique landscape for investors seeking opportunities beyond the usual suspects. As we explore undiscovered gems in Asia, it's crucial to consider stocks that demonstrate resilience and growth potential despite broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Brillian Network & Automation Integrated System | 8.39% | 20.15% | 19.93% | ★★★★★★ |

| VICOM | NA | 3.60% | -2.15% | ★★★★★★ |

| PSC | 15.34% | 1.17% | 10.86% | ★★★★★★ |

| Chudenko | NA | 4.57% | 0.97% | ★★★★★★ |

| Namuga | 14.66% | -1.45% | 33.57% | ★★★★★★ |

| Nikko | 44.54% | 5.86% | -5.45% | ★★★★★☆ |

| Wuhan Guide Technology | 10.56% | 10.17% | 21.41% | ★★★★★☆ |

| Jiangsu Longda Superalloy | 17.07% | 19.16% | 11.40% | ★★★★★☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

| Zhejiang Jinghua Laser TechnologyLtd | 31.04% | 4.49% | -1.72% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kinetic Development Group Limited is an investment holding company focused on the extraction and sale of coal products in the People’s Republic of China, with a market capitalization of HK$10.28 billion.

Operations: The company generates revenue primarily from the extraction and sale of coal products in China. Its financial performance is influenced by its ability to manage costs associated with coal production. The net profit margin has shown variability, indicating fluctuations in profitability over different periods.

Kinetic Development Group stands out with its high-quality earnings and a notable reduction in its debt to equity ratio from 28.4% to 12.5% over five years. Its earnings growth of 39.2% in the past year surpasses the Oil and Gas industry average of -0.9%, highlighting robust performance despite sector challenges. The company trades at a significant discount, about 66.7% below estimated fair value, suggesting potential undervaluation in the market. Recent changes saw Mr. Chong Yuk Fai appointed as Company Secretary, bringing over 15 years of experience in finance and corporate governance to bolster management expertise.

- Click here and access our complete health analysis report to understand the dynamics of Kinetic Development Group.

Understand Kinetic Development Group's track record by examining our Past report.

Sanbo Hospital Management Group (SZSE:301293)

Simply Wall St Value Rating: ★★★★★★

Overview: Sanbo Hospital Management Group Limited operates a network of hospitals providing medical services with a market cap of CN¥10.98 billion.

Operations: The primary revenue stream for Sanbo Hospital Management Group is derived from its healthcare facilities and services, generating CN¥1.41 billion. The company's financial performance can be assessed through its net profit margin, which provides insight into profitability relative to total revenue.

Sanbo Hospital Management Group, a small player in the healthcare sector, has demonstrated impressive earnings growth of 36.9% over the past year, outpacing the industry average of -5.7%. Despite its modest size, it boasts high-quality non-cash earnings and remains debt-free compared to five years ago when its debt-to-equity ratio was 3%. The company recently completed a share buyback program worth CNY 104.19 million, acquiring nearly 1.46% of its shares. This move may reflect confidence in its financial stability and potential for future value creation within the competitive healthcare landscape.

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Value Rating: ★★★★★★

Overview: Flaircomm Microelectronics, Inc. develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China, with a market cap of CN¥14.33 billion.

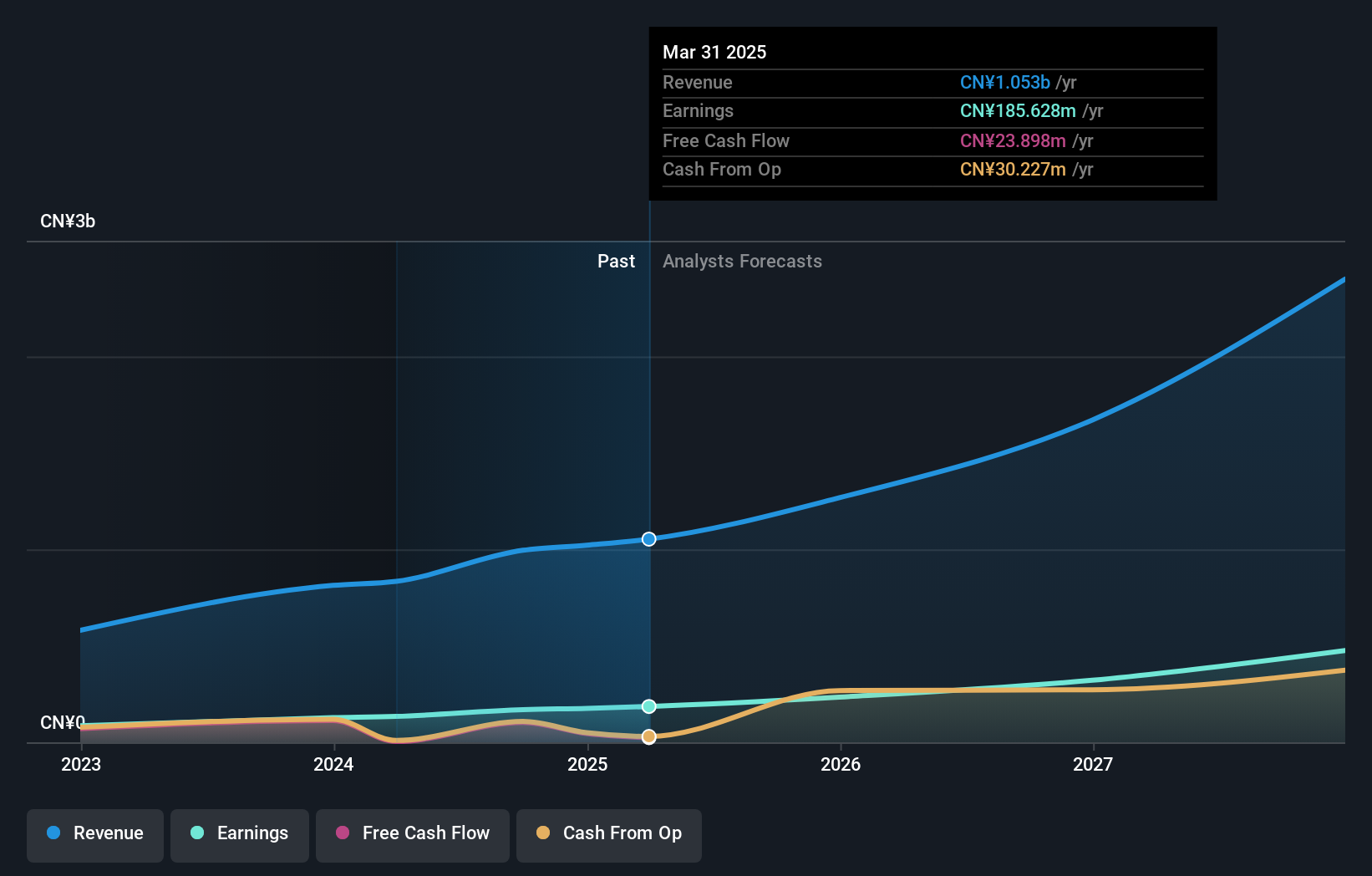

Operations: Flaircomm generates revenue primarily from its wireless communications equipment segment, which recorded CN¥995.17 million. The company's financial performance is highlighted by a net profit margin trend worth noting in recent periods.

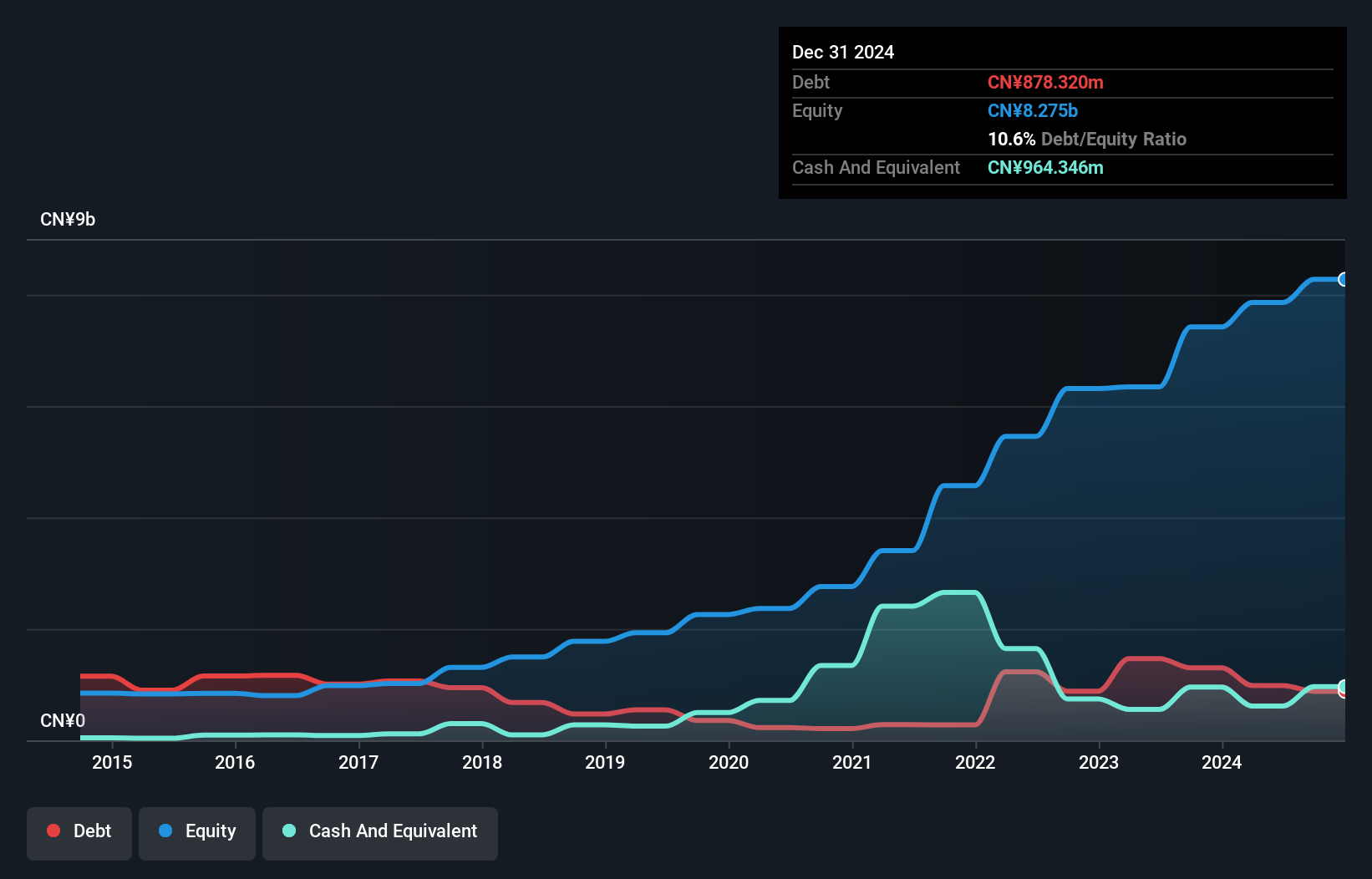

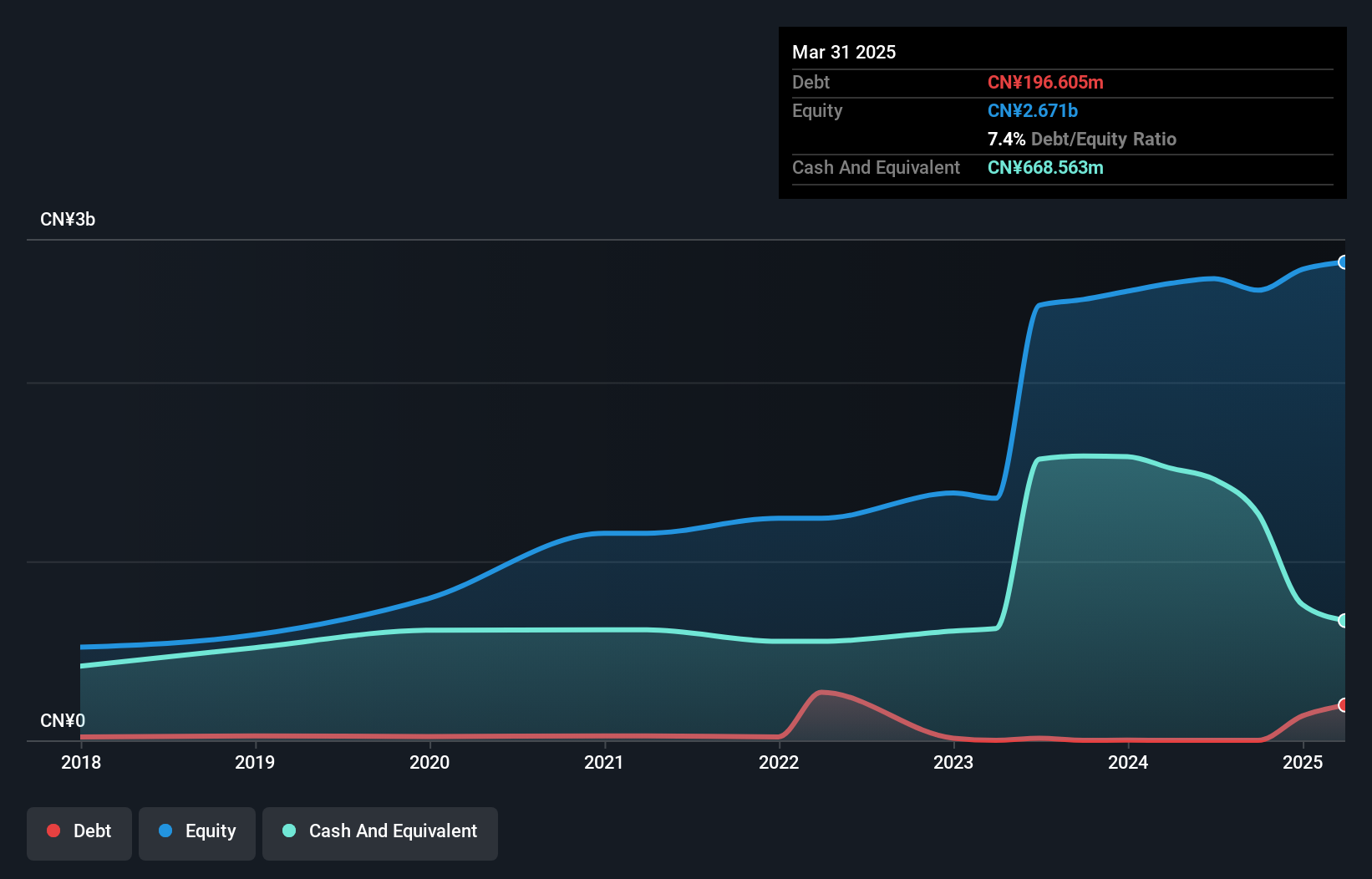

Flaircomm Microelectronics, a nimble player in the tech space, has shown impressive earnings growth of 44.7% over the past year, outpacing the broader Communications industry which saw a -6% change. With no debt on its books now compared to a 4.2% debt-to-equity ratio five years ago, it seems financially robust and free from interest payment concerns. The company's price-to-earnings ratio sits at 84.7x, slightly more attractive than the industry's average of 88.2x, suggesting potential value for investors seeking opportunities in this sector with promising prospects for continued growth at an estimated rate of 30.78% per year.

- Click to explore a detailed breakdown of our findings in Flaircomm Microelectronics' health report.

Gain insights into Flaircomm Microelectronics' past trends and performance with our Past report.

Make It Happen

- Embark on your investment journey to our 2582 Asian Undiscovered Gems With Strong Fundamentals selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301600

Flaircomm Microelectronics

Develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives