As global markets face economic uncertainties, the Chinese market has shown mixed signals with both challenges and opportunities. Despite recent declines in key indices like the Shanghai Composite and CSI 300, there are still promising prospects for investors willing to explore lesser-known stocks. In this environment, a good stock often exhibits resilience through strong fundamentals, innovative business models, or unique market positioning. Here are three undiscovered gems in China that demonstrate these qualities and hold strong potential for growth.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| HangZhou Everfine Photo-e-info | NA | 1.86% | 38.27% | ★★★★★★ |

| Sublime China Information | NA | 6.24% | 1.49% | ★★★★★★ |

| Jinghua Pharmaceutical Group | 0.95% | 5.39% | 47.06% | ★★★★★★ |

| Ningbo Sinyuan Zm Technology | NA | 15.67% | 9.90% | ★★★★★★ |

| Guoguang ElectricLtd.Chengdu | 0.05% | 8.51% | 1.60% | ★★★★★★ |

| ZHEJIANG DIBAY ELECTRICLtd | 28.50% | 8.58% | -0.18% | ★★★★★☆ |

| Shenzhen Easttop Supply Chain Management | 89.23% | -43.08% | 5.73% | ★★★★★☆ |

| Hubei Sanxia New Building Materials | 27.38% | -9.28% | 22.96% | ★★★★★☆ |

| Silvery Dragon Prestressed MaterialsLTD Tianjin | 22.53% | 0.77% | -3.26% | ★★★★☆☆ |

| Sunny Loan TopLtd | 55.45% | -11.58% | 9.47% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Poly Plastic Masterbatch (SuZhou)Ltd (SZSE:300905)

Simply Wall St Value Rating: ★★★★★☆

Overview: Poly Plastic Masterbatch (SuZhou) Co., Ltd engages in the research and development, production, and sale of fiber masterbatches in China and internationally, with a market cap of CN¥4.73 billion.

Operations: The company generates revenue primarily from its industrial segment, which reported CN¥1.39 billion. The net profit margin is not provided in the available data.

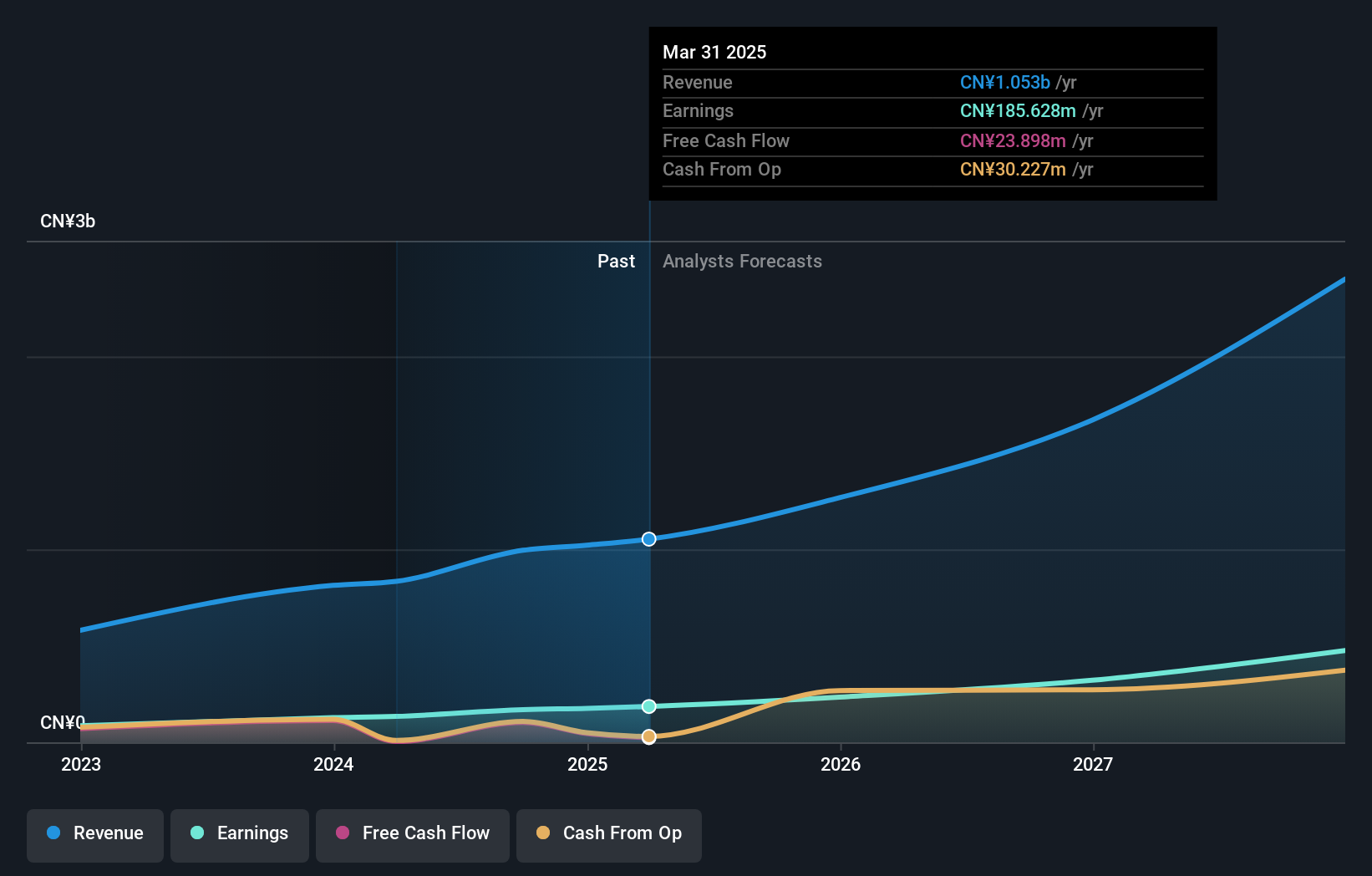

Poly Plastic Masterbatch (SuZhou) Ltd. has shown impressive growth, with earnings surging by 99.5% over the past year, significantly outpacing the Chemicals industry average of -6.2%. The company reported a net income of CN¥55.4M for H1 2024, compared to CN¥40.78M a year ago, and basic earnings per share increased from CN¥0.28 to CN¥0.31 during the same period. Despite high volatility in its share price recently, it remains profitable with more cash than total debt and no concerns over interest coverage.

- Click to explore a detailed breakdown of our findings in Poly Plastic Masterbatch (SuZhou)Ltd's health report.

Learn about Poly Plastic Masterbatch (SuZhou)Ltd's historical performance.

Shenzhen Farben Information TechnologyLtd (SZSE:300925)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Farben Information Technology Co., Ltd. (SZSE:300925) specializes in providing information technology solutions and services, with a market cap of CN¥5.27 billion.

Operations: Shenzhen Farben Information Technology Co., Ltd. (SZSE:300925) generates revenue primarily through its information technology solutions and services. The company reported a market cap of CN¥5.27 billion.

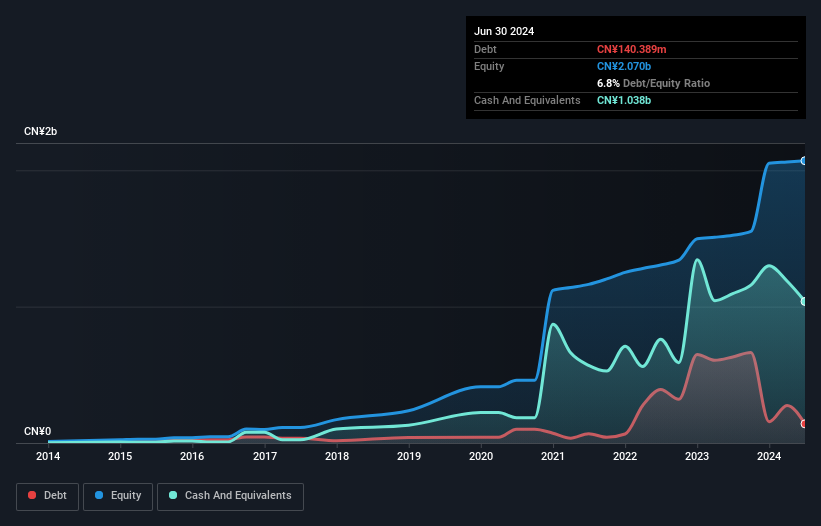

Shenzhen Farben Information Technology Ltd. has shown promising growth, with earnings rising 4.9% over the past year, outpacing the IT industry’s -11.6%. The debt-to-equity ratio improved from 12.7% to 7.8% in five years, indicating better financial health. Recently, Jinan Huiying Investment acquired a 5.99% stake for CNY 210 million (US$28M). For H1 2024, sales were CNY 2B (US$286M) and net income reached CNY 73M (US$10M), reflecting steady performance improvements.

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Value Rating: ★★★★★★

Overview: Flaircomm Microelectronics, Inc. develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China with a market cap of CN¥4.20 billion.

Operations: Flaircomm Microelectronics generates revenue primarily from the sale of wireless communication modules, embedded software, and turnkey system solutions. The company has a market cap of CN¥4.20 billion.

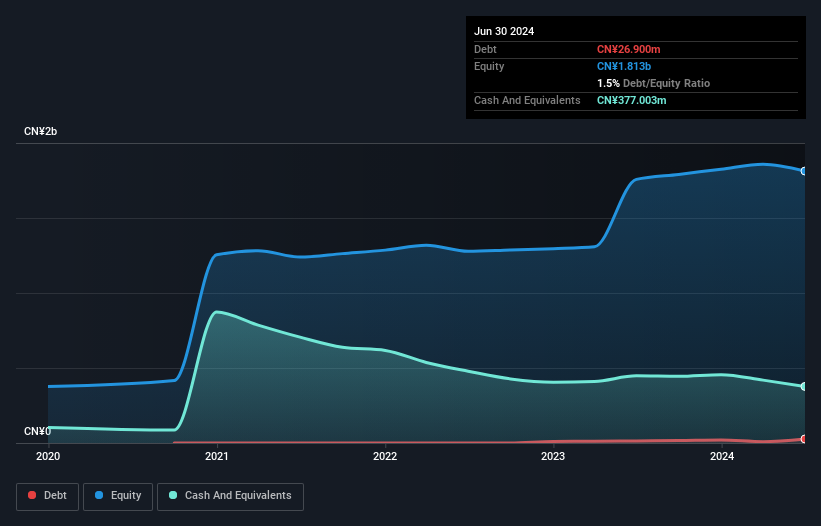

Flaircomm Microelectronics, a promising player in the Chinese market, recently completed an IPO raising CNY 699.19 million at CNY 39.84 per share. For the half year ended June 2024, sales reached CNY 429.85 million, up from CNY 327.8 million a year ago, while net income climbed to CNY 74.27 million from CNY 53.04 million previously. The company’s debt-to-equity ratio has impressively dropped from 8.7% to just 0.6% over five years, highlighting robust financial health and efficient management practices.

Key Takeaways

- Dive into all 946 of the Chinese Undiscovered Gems With Strong Fundamentals we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300905

Poly Plastic Masterbatch (SuZhou)Ltd

Engages in the research and development, production, and sale of chemical fiber solution coloring and advanced functional modified materials in China and internationally.

Excellent balance sheet with acceptable track record.