- China

- /

- Electronic Equipment and Components

- /

- SHSE:688003

High Growth Tech Stocks In Asia For March 2025

Reviewed by Simply Wall St

As global markets grapple with tariff fears, inflationary pressures, and trade policy uncertainties, Asian tech stocks are capturing attention with their potential for high growth amidst these challenges. In this environment, a strong stock is often characterized by its resilience to external economic pressures and its ability to leverage technological advancements to drive innovation and expansion.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Xi'an NovaStar Tech | 30.18% | 35.32% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Arizon RFID Technology (Cayman) | 27.55% | 28.53% | ★★★★★★ |

| giftee | 20.20% | 68.98% | ★★★★★★ |

| Ascentage Pharma Group International | 23.29% | 60.86% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

We'll examine a selection from our screener results.

Suzhou TZTEK Technology (SHSE:688003)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou TZTEK Technology Co., Ltd specializes in the design, development, assembly, and debugging of industrial vision equipment in China and has a market capitalization of CN¥12.01 billion.

Operations: TZTEK focuses on industrial vision equipment, emphasizing design and development processes. The company operates within China, leveraging its expertise to cater to various industrial applications.

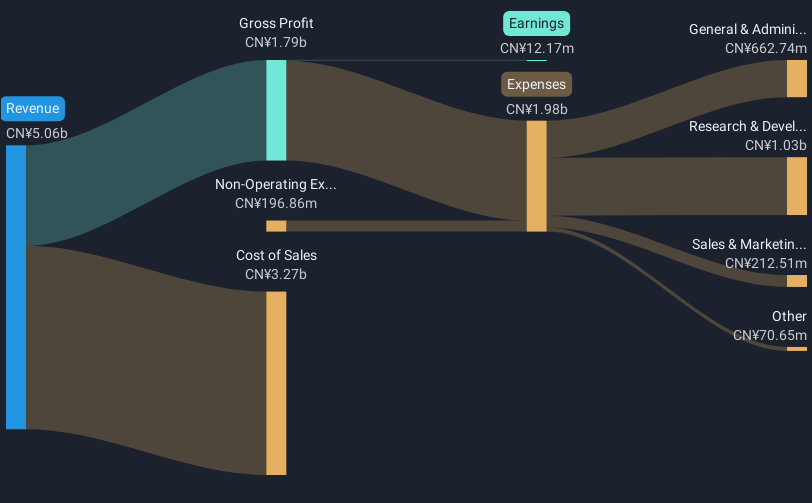

Suzhou TZTEK Technology, amidst a challenging fiscal year with a revenue dip to CNY 1.61 billion from CNY 1.65 billion and net income falling to CNY 124.8 million from CNY 215.17 million, still shows promise with its strategic buybacks and robust projected earnings growth of 49.7% annually. Despite the recent volatility in share price and lower profit margins at 7.8%, the company's aggressive R&D spending aligns with its ambitious revenue growth forecast of 24.1% per year, outpacing the Chinese market's average of 13.3%. This focus on innovation could bolster long-term competitiveness in the high-tech sector of Asia.

Thunder Software TechnologyLtd (SZSE:300496)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Thunder Software Technology Co., Ltd. develops and offers operating-system products across China, Europe, the United States, Japan, and other international markets with a market cap of approximately CN¥30.05 billion.

Operations: Thunder Software Technology Co., Ltd. specializes in developing operating-system products for a global market, including China, Europe, the United States, and Japan.

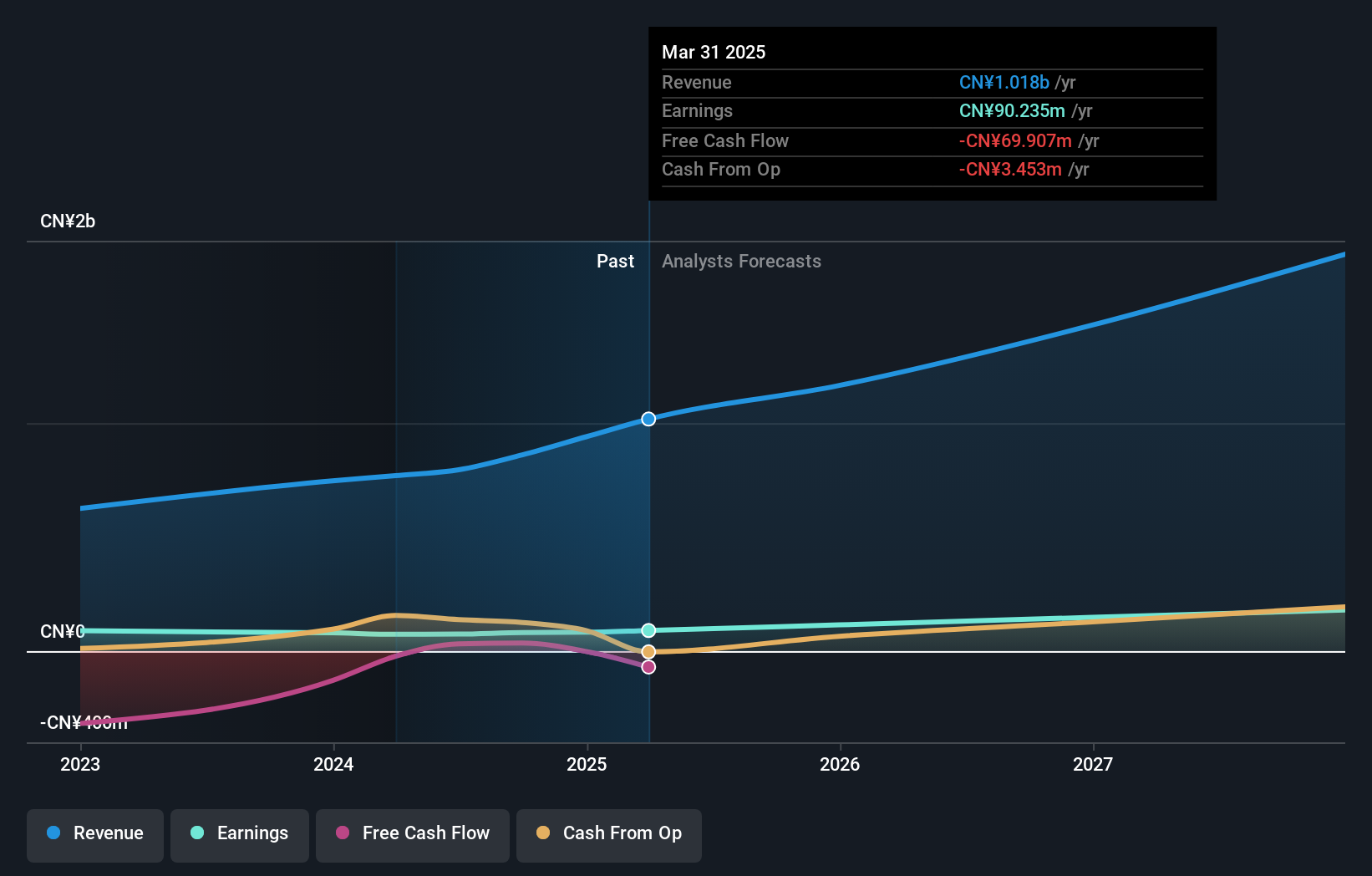

Thunder Software Technology Co., Ltd. faces challenges with a significant drop in net profit margins to 0.2% from last year's 13.5%, largely due to one-off gains of CN¥142.5M skewing recent financials. Despite this, the company's revenue growth projection remains robust at 16.5% annually, outperforming the Chinese market average of 13.3%. With earnings expected to surge by approximately 70% per year, Thunder Software is aggressively investing in R&D and innovation, positioning itself as a resilient contender in Asia’s competitive tech landscape despite current volatility and profitability pressures.

Shenzhen Ampron Technology (SZSE:301413)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Ampron Technology Co., Ltd. focuses on the research and development, manufacture, sale, and service of sensors in China, with a market capitalization of approximately CN¥10.65 billion.

Operations: Ampron Technology derives its revenue primarily from the sale of electronic components and parts, amounting to approximately CN¥860.91 million. The company's operations are centered on sensor technology within China.

Shenzhen Ampron Technology, despite a challenging past with a 1.1% contraction in earnings, is poised for substantial growth with projected annual revenue and earnings increases of 24.1% and 35.6%, respectively—both figures notably surpassing the Chinese market averages of 13.3% and 25.5%. This aggressive growth trajectory is supported by robust R&D investments, aligning with industry trends towards enhanced technological innovation. The company's recent strategic moves, including amendments to corporate governance and financial management strategies discussed in their latest shareholders' meeting, underscore a proactive approach to sustaining this growth momentum amidst volatile market conditions.

Seize The Opportunity

- Navigate through the entire inventory of 520 Asian High Growth Tech and AI Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688003

Suzhou TZTEK Technology

Engages in the design, development, assembly, and debugging of the industrial vision equipment in China.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives