Asian Market Insights Highlighting 3 Stocks Priced Below Estimated Value

Reviewed by Simply Wall St

As global markets navigate through a period of volatility, the Asian stock markets have been particularly influenced by ongoing trade tensions and economic policy shifts. In this environment, identifying stocks that are priced below their estimated value can present opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Yangtze Optical Fibre And Cable Limited (SEHK:6869) | HK$36.72 | HK$72.80 | 49.6% |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥38.40 | CN¥76.73 | 50% |

| Shanghai Conant Optical (SEHK:2276) | HK$38.60 | HK$75.76 | 49.1% |

| LITALICO (TSE:7366) | ¥1250.00 | ¥2421.94 | 48.4% |

| Insource (TSE:6200) | ¥913.00 | ¥1811.37 | 49.6% |

| Hainan Jinpan Smart Technology (SHSE:688676) | CN¥64.14 | CN¥125.87 | 49% |

| Guangdong Lyric Robot AutomationLtd (SHSE:688499) | CN¥59.95 | CN¥119.47 | 49.8% |

| Dajin Heavy IndustryLtd (SZSE:002487) | CN¥45.30 | CN¥89.09 | 49.2% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥47.89 | CN¥95.67 | 49.9% |

| Aecc Aero Science and TechnologyLtd (SHSE:600391) | CN¥27.12 | CN¥54.06 | 49.8% |

Underneath we present a selection of stocks filtered out by our screen.

J&T Global Express (SEHK:1519)

Overview: J&T Global Express Limited is an investment holding company providing integrated express delivery services across several countries including China, Indonesia, and Brazil, with a market cap of HK$88.15 billion.

Operations: The company generates revenue from its transportation segment, specifically air freight services, amounting to $10.90 billion.

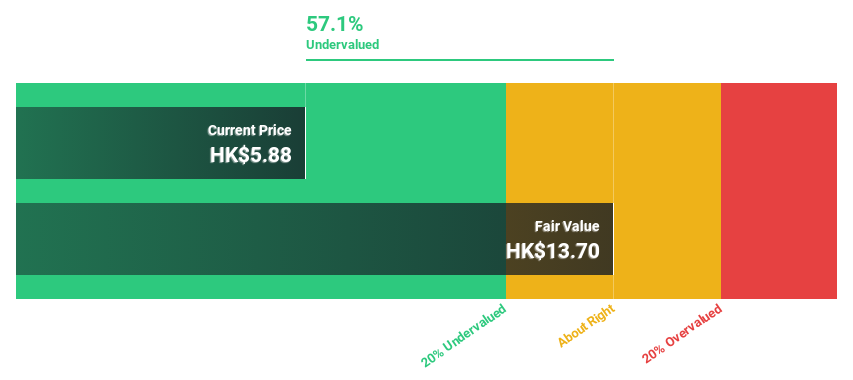

Estimated Discount To Fair Value: 41.3%

J&T Global Express is trading significantly below its estimated fair value, presenting a potential opportunity for investors focused on cash flow valuation. Recent earnings show a substantial increase in net income to US$86.37 million, driven by strong parcel volume growth, particularly in Southeast Asia. The company has initiated a share buyback program that could enhance earnings per share and net asset value per share, despite being removed from the Hang Seng China Enterprises Index.

- Insights from our recent growth report point to a promising forecast for J&T Global Express' business outlook.

- Dive into the specifics of J&T Global Express here with our thorough financial health report.

Hanshow Technology (SZSE:301275)

Overview: Hanshow Technology Co. Ltd, with a market cap of CN¥22.67 billion, specializes in providing electronic shelf labeling solutions.

Operations: The company's revenue from electric equipment amounts to CN¥4.34 billion.

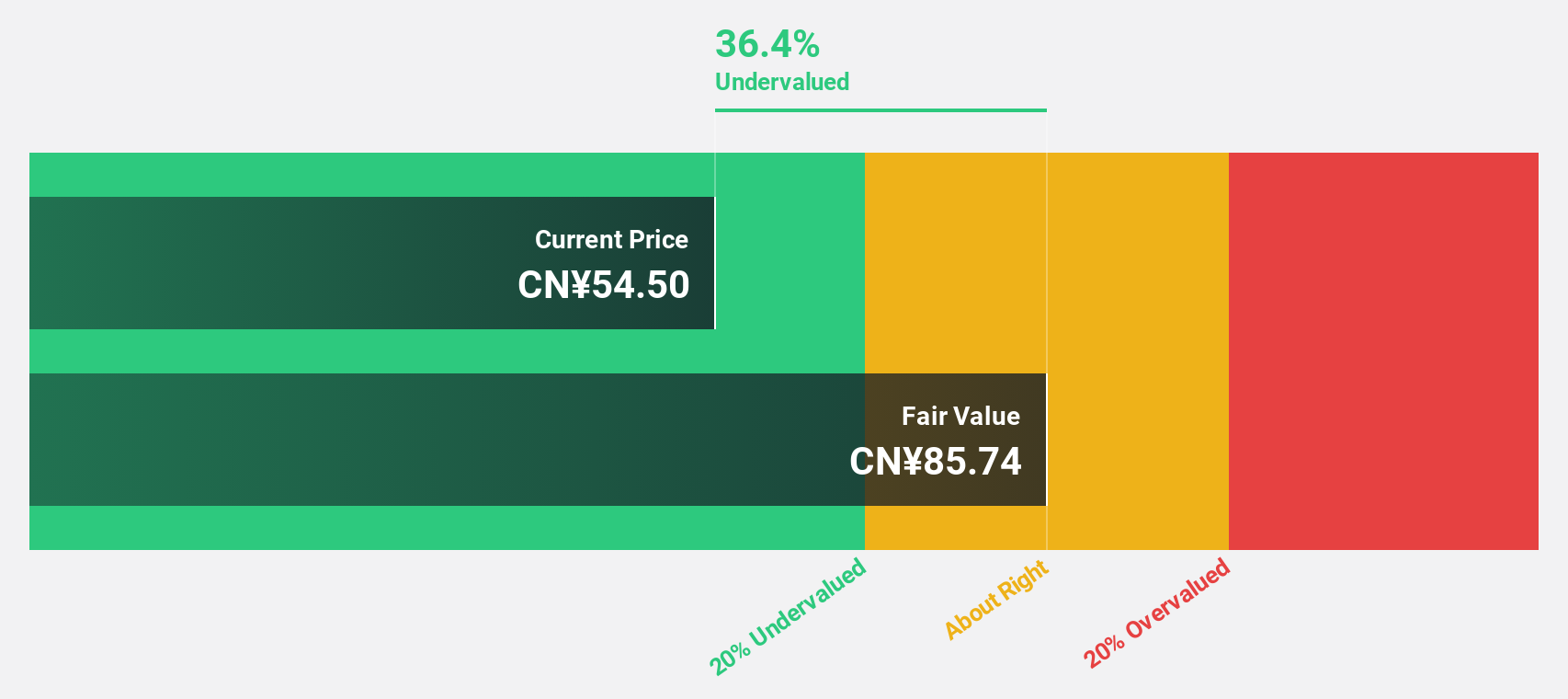

Estimated Discount To Fair Value: 37%

Hanshow Technology is trading 37% below its estimated fair value of CN¥86.02, suggesting potential undervaluation based on cash flows. Despite a recent dip in revenue and net income, earnings are expected to grow significantly at 26.66% annually, outpacing the Chinese market. The company has announced a CN¥300 million share buyback program and is expanding globally through strategic partnerships, enhancing its digital retail ecosystem and positioning itself for future growth opportunities.

- Upon reviewing our latest growth report, Hanshow Technology's projected financial performance appears quite optimistic.

- Take a closer look at Hanshow Technology's balance sheet health here in our report.

Global Security Experts (TSE:4417)

Overview: Global Security Experts Inc. is a cybersecurity education company based in Japan with a market cap of ¥53.02 billion.

Operations: Global Security Experts Inc. generates its revenue from providing cybersecurity education services in Japan.

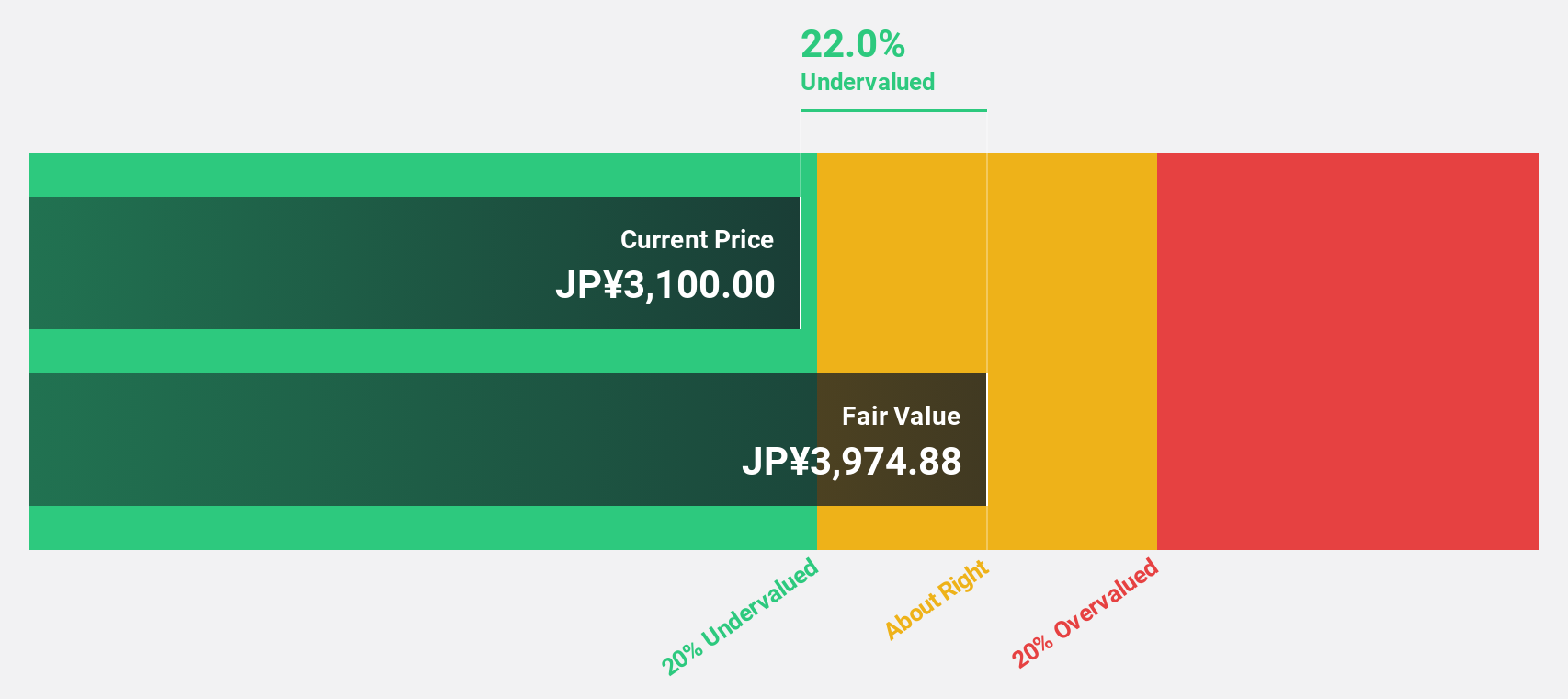

Estimated Discount To Fair Value: 28.4%

Global Security Experts is trading at ¥4,135, significantly below its estimated fair value of ¥5,772.53. The company is poised for substantial growth with earnings projected to increase by 34.06% annually over the next three years, outpacing the Japanese market's 8% growth rate. Revenue growth is also expected to be robust at 24.3% per year. However, investors should note the stock's high volatility and limited financial data availability over the past three years.

- According our earnings growth report, there's an indication that Global Security Experts might be ready to expand.

- Get an in-depth perspective on Global Security Experts' balance sheet by reading our health report here.

Where To Now?

- Navigate through the entire inventory of 272 Undervalued Asian Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4417

Global Security Experts

Operates as a cybersecurity education company in Japan.

Exceptional growth potential with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)