- China

- /

- Semiconductors

- /

- SHSE:688147

Global Growth Stocks With 21% Revenue Growth

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by potential rate cuts and fluctuating indices, investors are closely watching for opportunities in sectors with robust growth potential. In this environment, companies that demonstrate strong revenue growth and high insider ownership can be particularly appealing, as they often signal confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.8% | 56.5% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| Laopu Gold (SEHK:6181) | 35.5% | 34.3% |

| KebNi (OM:KEBNI B) | 38.4% | 63.7% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 43.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 80.6% |

| CD Projekt (WSE:CDR) | 29.7% | 39.5% |

| Ascentage Pharma Group International (SEHK:6855) | 12.7% | 91.9% |

Let's take a closer look at a couple of our picks from the screened companies.

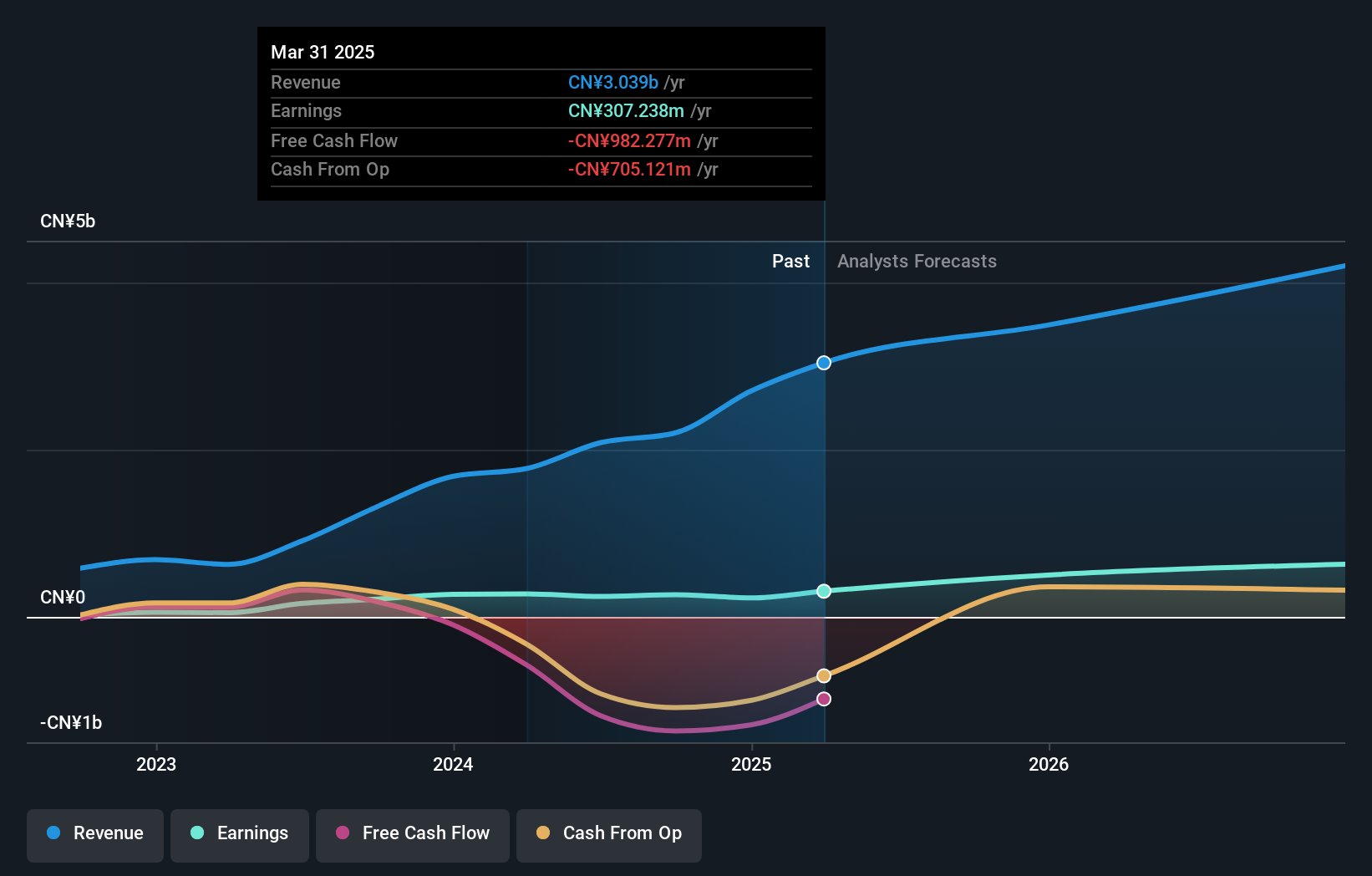

Jiangsu Leadmicro Nano-Equipment Technology (SHSE:688147)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jiangsu Leadmicro Nano-Equipment Technology Ltd specializes in manufacturing high-end micro-nano equipment for the semiconductor and pan-semiconductor industries, with a market cap of CN¥18.22 billion.

Operations: The company's revenue primarily comes from its equipment manufacturing segment, which generated CN¥3.04 billion.

Insider Ownership: 18.7%

Revenue Growth Forecast: 18.6% p.a.

Jiangsu Leadmicro Nano-Equipment Technology shows promising growth potential, with earnings expected to rise 37.8% annually, outpacing the CN market's 25.5%. The company's price-to-earnings ratio of 66x is attractive compared to the semiconductor industry average of 73.8x, suggesting good value. However, profit margins have declined from last year's 15.5% to 10.1%, and insider trading data over the past three months is unavailable, which could impact investor confidence in management alignment with shareholder interests.

- Click here and access our complete growth analysis report to understand the dynamics of Jiangsu Leadmicro Nano-Equipment Technology.

- Our expertly prepared valuation report Jiangsu Leadmicro Nano-Equipment Technology implies its share price may be too high.

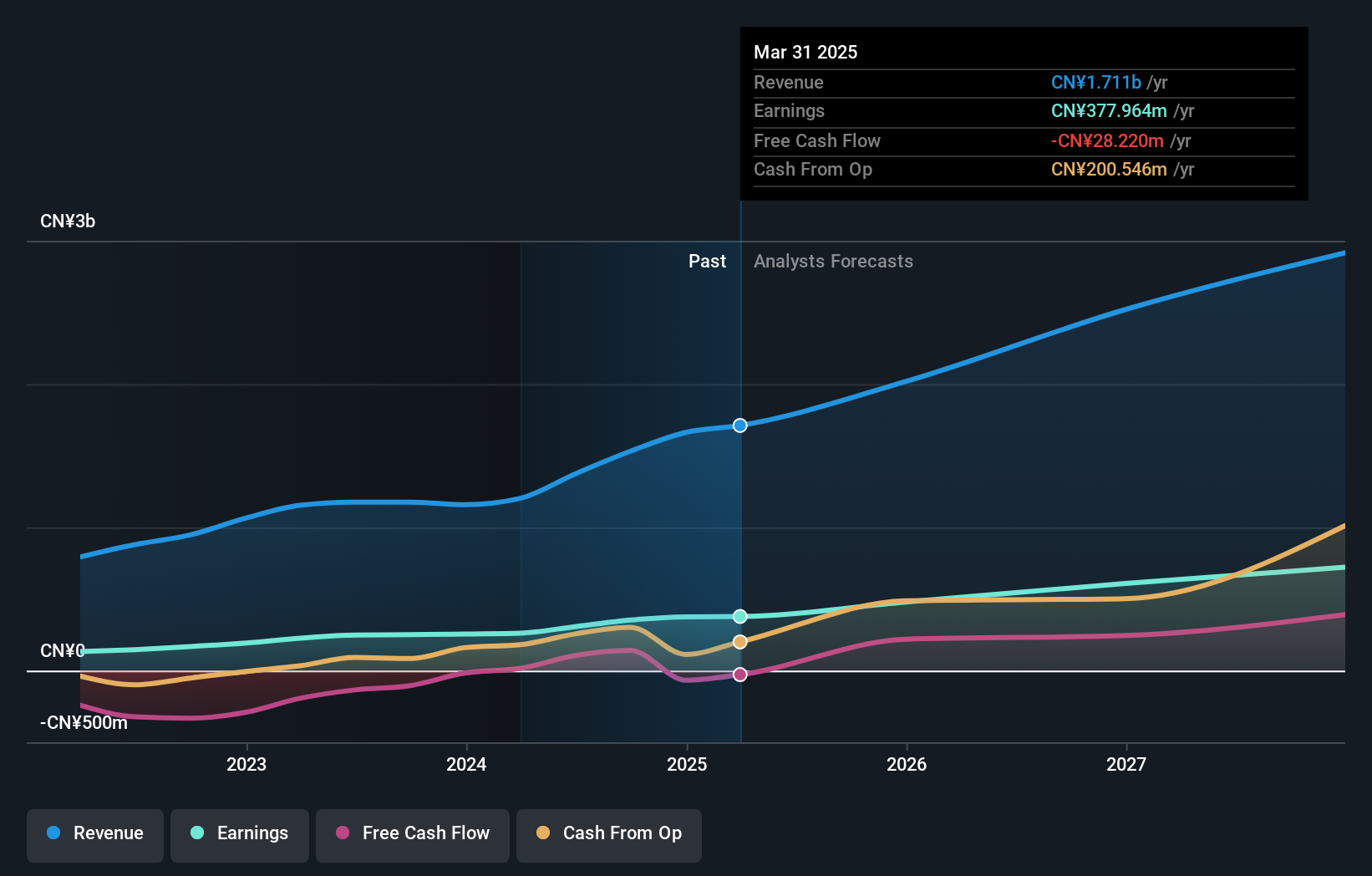

POCO Holding (SZSE:300811)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: POCO Holding Co., Ltd. engages in the development, production, and sale of alloy soft magnetic powder and components for electronic equipment, with a market cap of CN¥20.85 billion.

Operations: POCO Holding Co., Ltd. generates revenue from developing, producing, and selling alloy soft magnetic powder and cores, along with related inductance components for electronic equipment.

Insider Ownership: 24%

Revenue Growth Forecast: 21.8% p.a.

POCO Holding's growth outlook is robust, with earnings forecasted to grow significantly at 24.44% annually, though slightly below the CN market's 25.5%. Its price-to-earnings ratio of 59.1x is competitive within the electronic industry average of 61.6x, indicating reasonable valuation. Despite volatile share prices recently and no recent insider trading data, revenue growth projections remain strong at 21.8% per year, surpassing market averages. Recent earnings reports show steady financial performance improvements year-over-year.

- Click to explore a detailed breakdown of our findings in POCO Holding's earnings growth report.

- Our comprehensive valuation report raises the possibility that POCO Holding is priced higher than what may be justified by its financials.

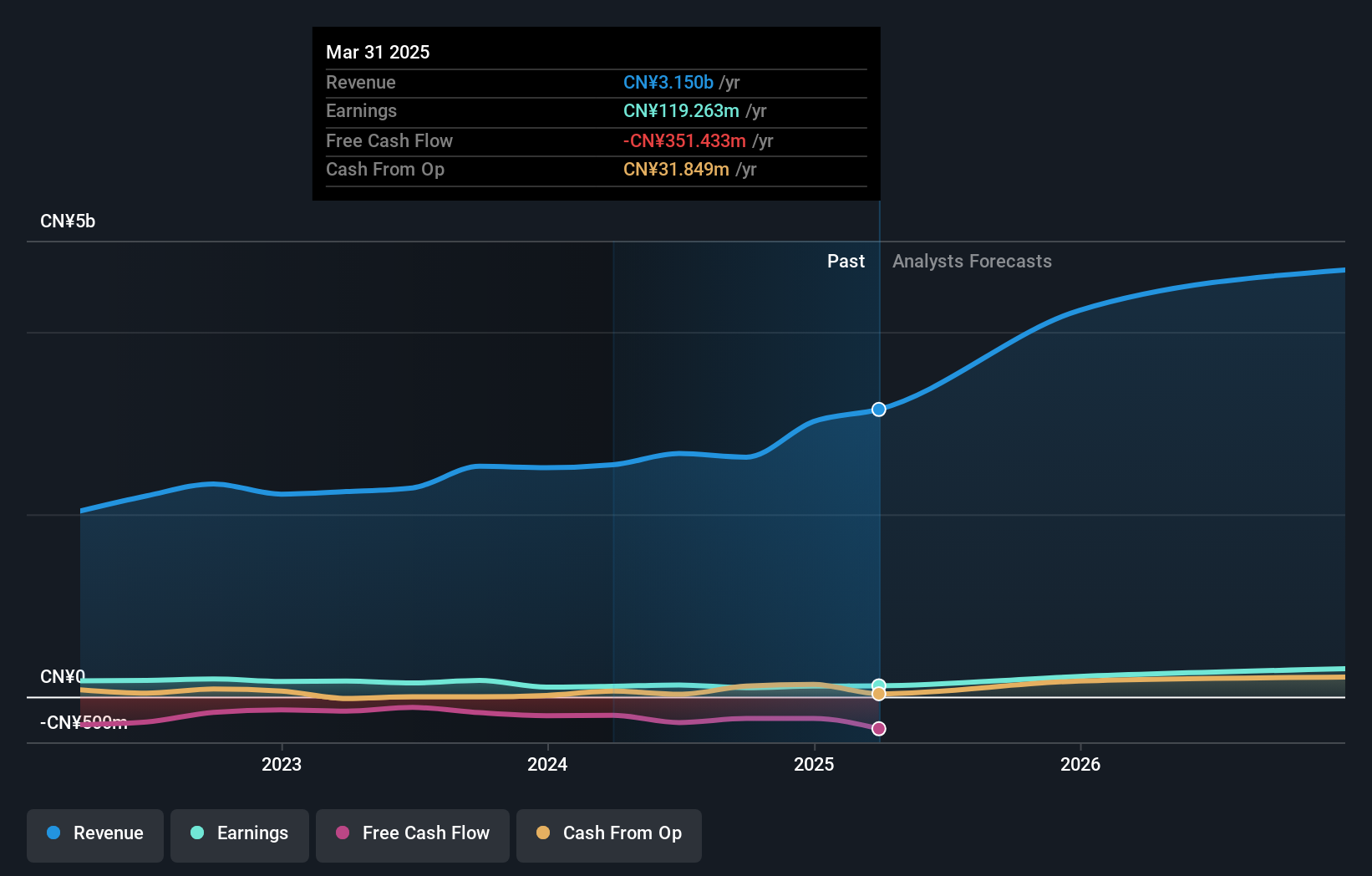

Guangdong Shenling Environmental Systems (SZSE:301018)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Shenling Environmental Systems Co., Ltd., with a market cap of CN¥18.45 billion, specializes in the development and production of environmental control systems.

Operations: The company generates revenue through its specialized development and production of environmental control systems.

Insider Ownership: 38.7%

Revenue Growth Forecast: 21.7% p.a.

Guangdong Shenling Environmental Systems is poised for robust growth, with earnings expected to increase significantly at 46.3% annually, outpacing the CN market's 25.5%. Revenue is also set to grow rapidly at 21.7% per year, exceeding the market average of 13.5%. Despite a highly volatile share price and no recent insider trading activity, these projections highlight strong growth potential in both revenue and earnings for the company.

- Navigate through the intricacies of Guangdong Shenling Environmental Systems with our comprehensive analyst estimates report here.

- Our valuation report here indicates Guangdong Shenling Environmental Systems may be overvalued.

Where To Now?

- Get an in-depth perspective on all 823 Fast Growing Global Companies With High Insider Ownership by using our screener here.

- Seeking Other Investments? AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688147

Jiangsu Leadmicro Nano-Equipment Technology

Engages in manufacturing high-end micro-nano equipment for semiconductor and pan-semiconductor.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)