- China

- /

- Electronic Equipment and Components

- /

- SZSE:300747

High Growth Tech Stocks to Watch in January 2025

Reviewed by Simply Wall St

As global markets continue to react to President Trump's policy changes and AI-related developments, major indices like the S&P 500 have reached record highs, driven by optimism around potential trade deals and increased investment in artificial intelligence infrastructure. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that are well-positioned to benefit from technological advancements and favorable economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1226 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Triumph Science & TechnologyLtd (SHSE:600552)

Simply Wall St Growth Rating: ★★★★☆☆

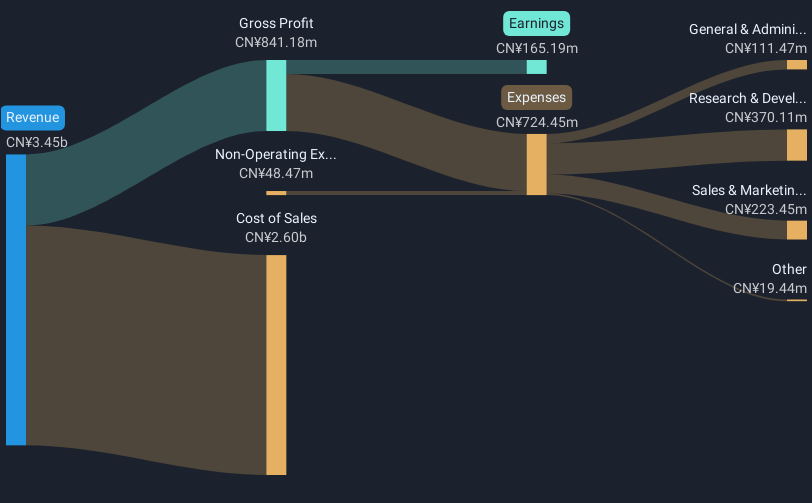

Overview: Triumph Science & Technology Co., Ltd specializes in the development, production, and sale of electronic information displays and new materials both in China and internationally, with a market capitalization of CN¥10.66 billion.

Operations: Triumph Science & Technology Co., Ltd generates revenue through the production and sale of electronic information displays and new materials, catering to both domestic and international markets. The company focuses on leveraging its expertise in these sectors to drive its business operations.

Triumph Science & TechnologyLtd has demonstrated robust growth, with revenue increasing by 16.9% annually, outpacing the Chinese market's 13.4%. This growth is supported by significant R&D investments, which are crucial for maintaining technological leadership and fueling future innovations. In the past year alone, earnings surged by 19.9%, eclipsing the electronic industry's average of 2.3%. The company also hosted multiple shareholder meetings recently, indicating active engagement and potential strategic shifts that could further influence its market position and operational focus. Despite challenges in covering interest payments with earnings, Triumph’s aggressive R&D spending and strong revenue growth trajectory suggest a proactive approach to innovation and market expansion. With earnings expected to grow at an annual rate of 36.9%, significantly above the national average of 25.1%, the firm is well-positioned to leverage its technological advancements for sustained competitive advantage in a rapidly evolving industry landscape.

WG TECH (Jiang Xi) (SHSE:603773)

Simply Wall St Growth Rating: ★★★★★☆

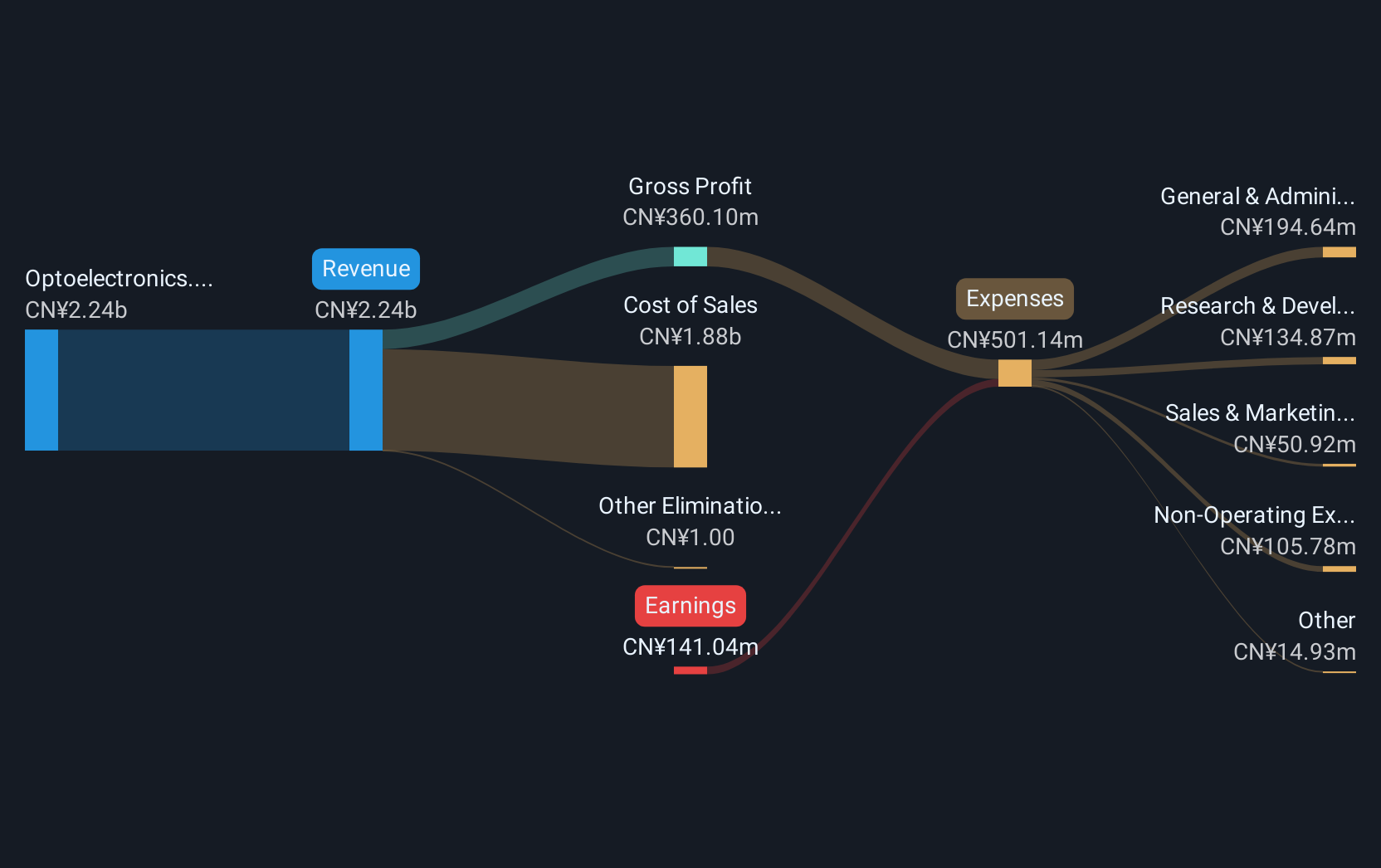

Overview: WG TECH (Jiang Xi) Co., Ltd. is involved in the photoelectric glass finishing industry in China with a market capitalization of CN¥5.57 billion.

Operations: WG TECH (Jiang Xi) focuses on the photoelectric glass finishing sector in China, generating revenue primarily from its optoelectronics segment, which contributed CN¥2.21 billion.

WG TECH (Jiang Xi) is navigating a transformative phase, marked by recent strategic equity transactions and a challenging financial performance. The company's revenue trajectory, growing at an annual rate of 26.5%, outstrips the broader Chinese market's growth of 13.4%. Despite current unprofitability, with a net loss expanding to CNY 49.42 million from CNY 20.49 million year-over-year, WG TECH is poised for recovery with projected earnings growth of 126.9% annually over the next three years. This optimism is underpinned by aggressive R&D investments which are essential for fostering innovation and securing competitive advantages in the tech landscape.

- Dive into the specifics of WG TECH (Jiang Xi) here with our thorough health report.

Examine WG TECH (Jiang Xi)'s past performance report to understand how it has performed in the past.

Wuhan Raycus Fiber Laser TechnologiesLtd (SZSE:300747)

Simply Wall St Growth Rating: ★★★★☆☆

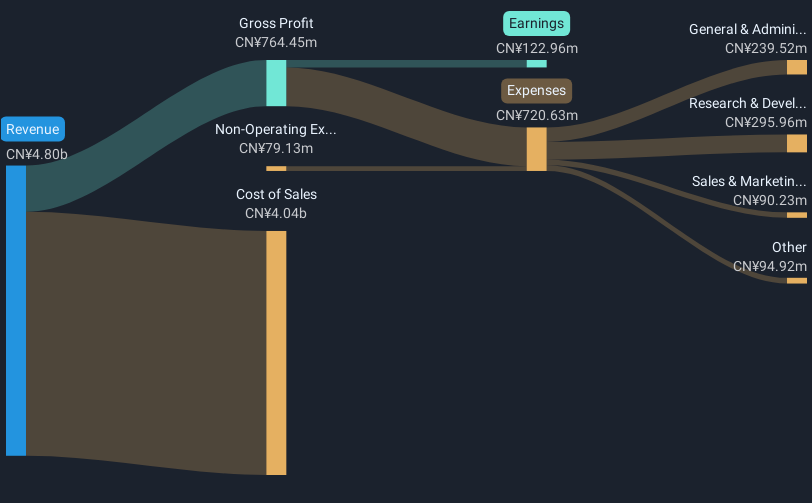

Overview: Wuhan Raycus Fiber Laser Technologies Co., Ltd. specializes in the development and manufacturing of fiber laser technologies, with a market capitalization of CN¥10.60 billion.

Operations: Raycus Fiber Laser focuses on producing fiber laser technologies, generating revenue primarily through the sale of these products. The company operates within the laser technology sector, contributing to its market capitalization of CN¥10.60 billion.

Wuhan Raycus Fiber Laser Technologies has demonstrated robust growth with a forecasted annual revenue increase of 19.5%, outpacing the broader Chinese market's 13.4% expansion. This growth is complemented by an impressive projected annual earnings surge of 50%, signaling strong operational efficiency and market demand for its laser technologies. The company's commitment to innovation is reflected in substantial R&D investments, crucial for maintaining its competitive edge in the fast-evolving tech landscape. Recent corporate activities, including strategic shareholder meetings and dividend affirmations, underscore a proactive approach to governance and shareholder engagement, enhancing its industry standing amidst challenging economic conditions.

- Click here and access our complete health analysis report to understand the dynamics of Wuhan Raycus Fiber Laser TechnologiesLtd.

Learn about Wuhan Raycus Fiber Laser TechnologiesLtd's historical performance.

Make It Happen

- Dive into all 1226 of the High Growth Tech and AI Stocks we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Raycus Fiber Laser TechnologiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300747

Wuhan Raycus Fiber Laser TechnologiesLtd

Wuhan Raycus Fiber Laser Technologies Co.,Ltd.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives