- China

- /

- Electronic Equipment and Components

- /

- SZSE:300567

Wuhan Jingce Electronic Group Co.,Ltd (SZSE:300567) Analysts Are Reducing Their Forecasts For This Year

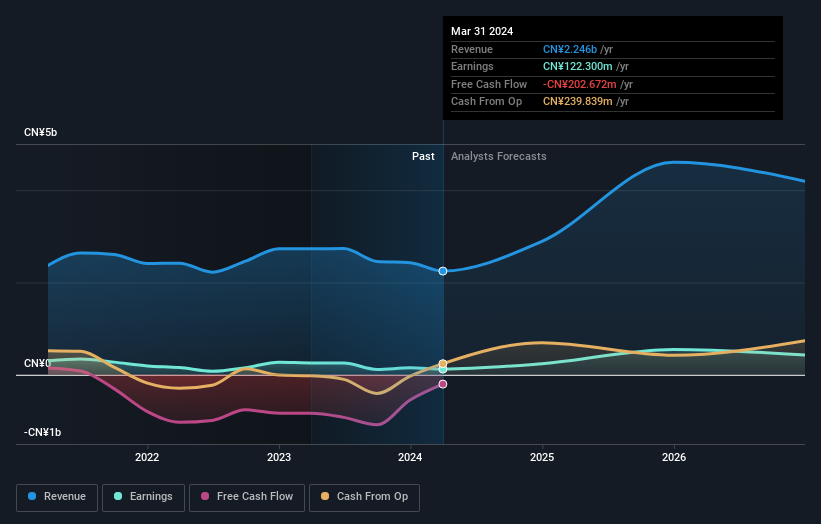

One thing we could say about the analysts on Wuhan Jingce Electronic Group Co.,Ltd (SZSE:300567) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting analysts have soured majorly on the business. The stock price has risen 7.6% to CN¥61.36 over the past week. Investors could be forgiven for changing their mind on the business following the downgrade; but it's not clear if the revised forecasts will lead to selling activity.

Following the downgrade, the most recent consensus for Wuhan Jingce Electronic GroupLtd from its ten analysts is for revenues of CN¥2.9b in 2024 which, if met, would be a substantial 29% increase on its sales over the past 12 months. Statutory earnings per share are presumed to jump 93% to CN¥0.86. Previously, the analysts had been modelling revenues of CN¥3.9b and earnings per share (EPS) of CN¥1.59 in 2024. It looks like analyst sentiment has declined substantially, with a pretty serious reduction to revenue estimates and a pretty serious decline to earnings per share numbers as well.

See our latest analysis for Wuhan Jingce Electronic GroupLtd

Analysts made no major changes to their price target of CN¥95.55, suggesting the downgrades are not expected to have a long-term impact on Wuhan Jingce Electronic GroupLtd's valuation.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Wuhan Jingce Electronic GroupLtd's past performance and to peers in the same industry. The analysts are definitely expecting Wuhan Jingce Electronic GroupLtd's growth to accelerate, with the forecast 40% annualised growth to the end of 2024 ranking favourably alongside historical growth of 8.1% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 17% annually. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Wuhan Jingce Electronic GroupLtd to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Unfortunately, analysts also downgraded their revenue estimates, although our data indicates revenues are expected to perform better than the wider market. We're also surprised to see that the price target went unchanged. Still, deteriorating business conditions (assuming accurate forecasts!) can be a leading indicator for the stock price, so we wouldn't blame investors for being more cautious on Wuhan Jingce Electronic GroupLtd after the downgrade.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Wuhan Jingce Electronic GroupLtd analysts - going out to 2026, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wuhan Jingce Electronic GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300567

Wuhan Jingce Electronic GroupLtd

Researches, develops, produces, and sells display, semiconductor, and new energy equipment.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>