- China

- /

- Electronic Equipment and Components

- /

- SZSE:300567

3 Global Stocks Estimated To Be Undervalued By Up To 49.8%

Reviewed by Simply Wall St

As global markets navigate the anticipation of interest rate cuts and mixed economic signals, investors are keenly observing how these developments influence stock valuations. Amidst this fluctuating landscape, identifying undervalued stocks can offer potential opportunities for those looking to capitalize on discrepancies between market prices and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wuhan Guide Infrared (SZSE:002414) | CN¥12.59 | CN¥25.15 | 49.9% |

| Ottobock SE KGaA (XTRA:OBCK) | €69.25 | €138.11 | 49.9% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.465 | €4.88 | 49.4% |

| KB Components (OM:KBC) | SEK41.75 | SEK83.21 | 49.8% |

| HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540) | ₩447500.00 | ₩891906.31 | 49.8% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.39 | €0.77 | 49.7% |

| Esautomotion (BIT:ESAU) | €3.10 | €6.14 | 49.5% |

| China Ruyi Holdings (SEHK:136) | HK$2.41 | HK$4.80 | 49.8% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥27.94 | CN¥55.75 | 49.9% |

| Allcore (BIT:CORE) | €1.345 | €2.68 | 49.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

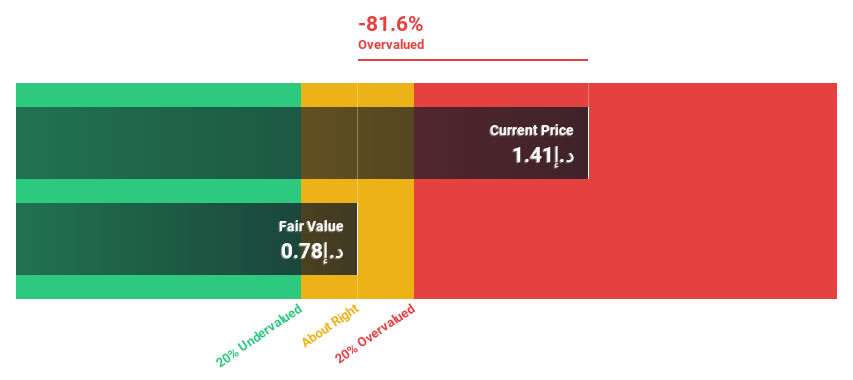

Burjeel Holdings (ADX:BURJEEL)

Overview: Burjeel Holdings PLC, along with its subsidiaries, operates multi-specialty hospitals and medical centers in the United Arab Emirates, Oman, and Saudi Arabia, with a market cap of AED7.29 billion.

Operations: The company's revenue segments include hospitals generating AED4.96 billion, pharmacies contributing AED65.10 million, and medical centers adding AED442.61 million.

Estimated Discount To Fair Value: 23.5%

Burjeel Holdings is trading at AED 1.4, significantly below its estimated fair value of AED 1.83, suggesting it may be undervalued based on cash flows. Despite a high level of debt, the company shows strong earnings growth potential with forecasts predicting a 17% annual increase, outpacing the AE market's 5.5%. Recent earnings reports reveal steady revenue and income growth, supporting its position as potentially undervalued in terms of cash flow metrics.

- Our expertly prepared growth report on Burjeel Holdings implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Burjeel Holdings here with our thorough financial health report.

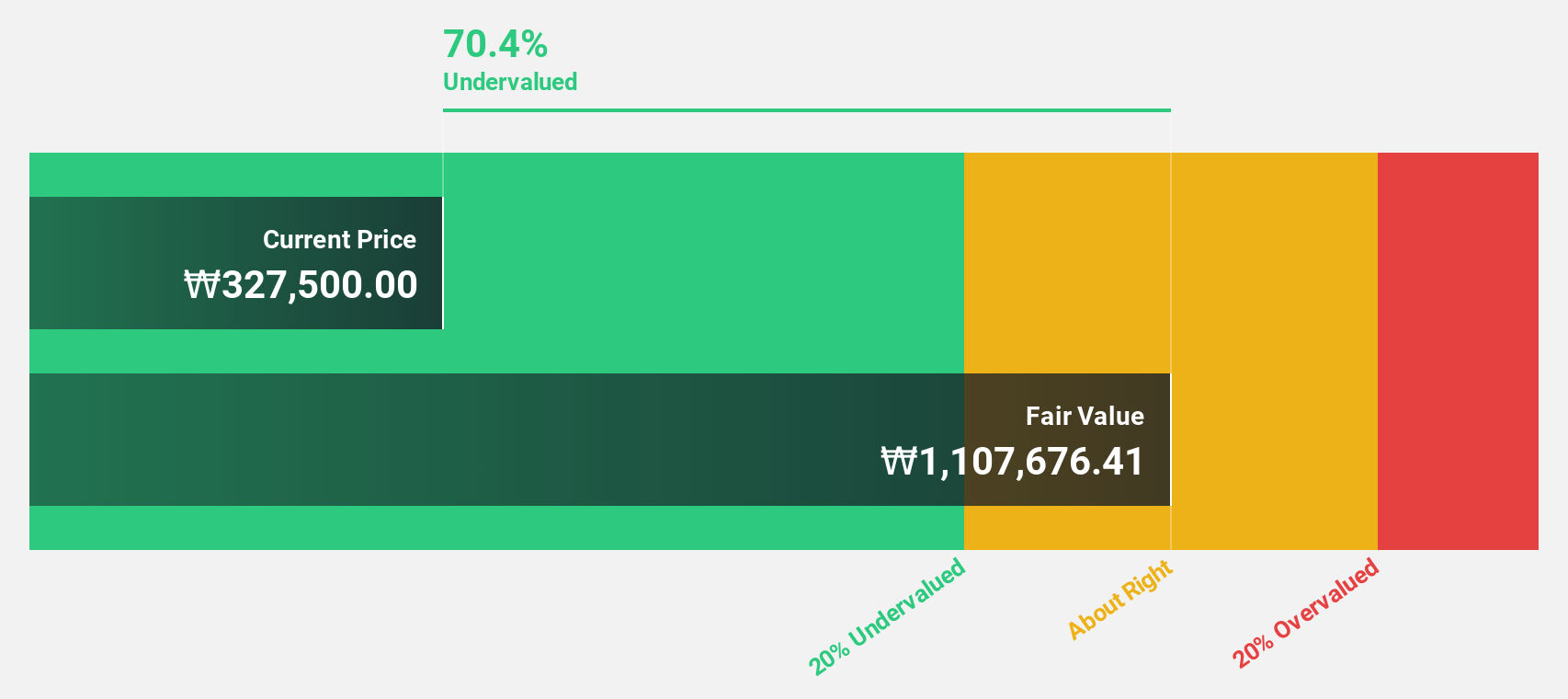

HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540)

Overview: HD Korea Shipbuilding & Offshore Engineering Co., Ltd. is a leading company in the shipbuilding and offshore engineering industry with a market cap of ₩31.04 trillion.

Operations: The company's revenue is primarily derived from its Shipbuilding segment at ₩25.79 trillion, followed by the Engine segment at ₩4.20 trillion, with additional contributions from Green Energy and Marine Plant segments at ₩508.78 million and ₩895.89 million respectively.

Estimated Discount To Fair Value: 49.8%

HD Korea Shipbuilding & Offshore Engineering is trading at ₩447,500, well below its estimated fair value of ₩891,906.31, highlighting potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 30.12% annually over the next three years, surpassing the KR market's growth rate. Recent earnings reports show substantial improvements with Q3 net income rising to KRW 633 billion from KRW 151 billion a year ago, reinforcing its strong cash flow position despite slower revenue growth compared to the market.

- Upon reviewing our latest growth report, HD Korea Shipbuilding & Offshore Engineering's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of HD Korea Shipbuilding & Offshore Engineering stock in this financial health report.

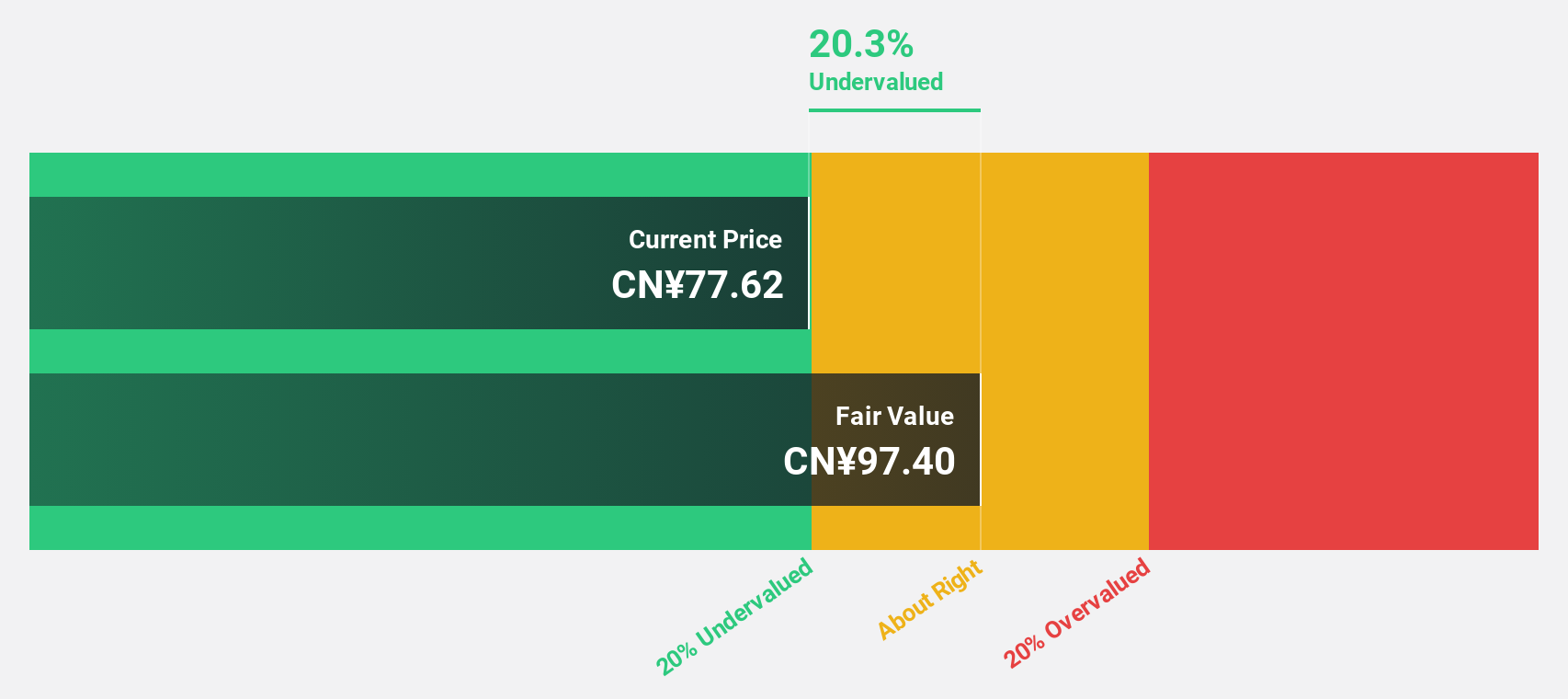

Wuhan Jingce Electronic GroupLtd (SZSE:300567)

Overview: Wuhan Jingce Electronic Group Co., Ltd engages in the research, development, production, and sale of display, semiconductor, and new energy equipment with a market capitalization of approximately CN¥18.86 billion.

Operations: The company generates revenue primarily from its Electron Product segment, totaling CN¥3.01 billion.

Estimated Discount To Fair Value: 23.7%

Wuhan Jingce Electronic Group is trading at CN¥67.43, significantly below its estimated fair value of CN¥95.43, indicating potential undervaluation based on cash flows. The company's revenue for the first nine months of 2025 increased to CN¥2.27 billion from CN¥1.83 billion the previous year, with net income rising to CN¥100.09 million from CN¥82.24 million, supporting its strong financial position despite debt concerns and a modest return on equity forecast of 10.5%.

- The growth report we've compiled suggests that Wuhan Jingce Electronic GroupLtd's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Wuhan Jingce Electronic GroupLtd's balance sheet health report.

Key Takeaways

- Explore the 504 names from our Undervalued Global Stocks Based On Cash Flows screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wuhan Jingce Electronic GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300567

Wuhan Jingce Electronic GroupLtd

Researches, develops, produces, and sells display, semiconductor, and new energy equipment.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026