- China

- /

- Communications

- /

- SZSE:300559

Exploring High Growth Tech Stocks In October 2024

Reviewed by Simply Wall St

As global markets grapple with rising U.S. Treasury yields, impacting equities and leading to a mixed performance across major indices, the tech-heavy Nasdaq Composite Index has shown resilience with slight gains amidst this challenging environment. In such volatile times, high-growth tech stocks that demonstrate strong fundamentals and adaptability to evolving economic conditions can present intriguing opportunities for investors seeking potential growth in their portfolios.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Travere Therapeutics | 29.19% | 70.82% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1279 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Inmyshow Digital Technology(Group)Co.Ltd (SHSE:600556)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Inmyshow Digital Technology (Group) Co., Ltd. operates within the digital marketing and advertising industry, with a market capitalization of approximately CN¥8.19 billion.

Operations: The company generates its revenue primarily through digital marketing services, leveraging technology to deliver targeted advertising solutions. It focuses on enhancing client engagement and brand visibility, aiming to optimize advertising effectiveness. The company's operational costs are significantly influenced by technological investments and personnel expenses. Gross profit margin trends indicate a focus on cost management strategies within the competitive digital landscape.

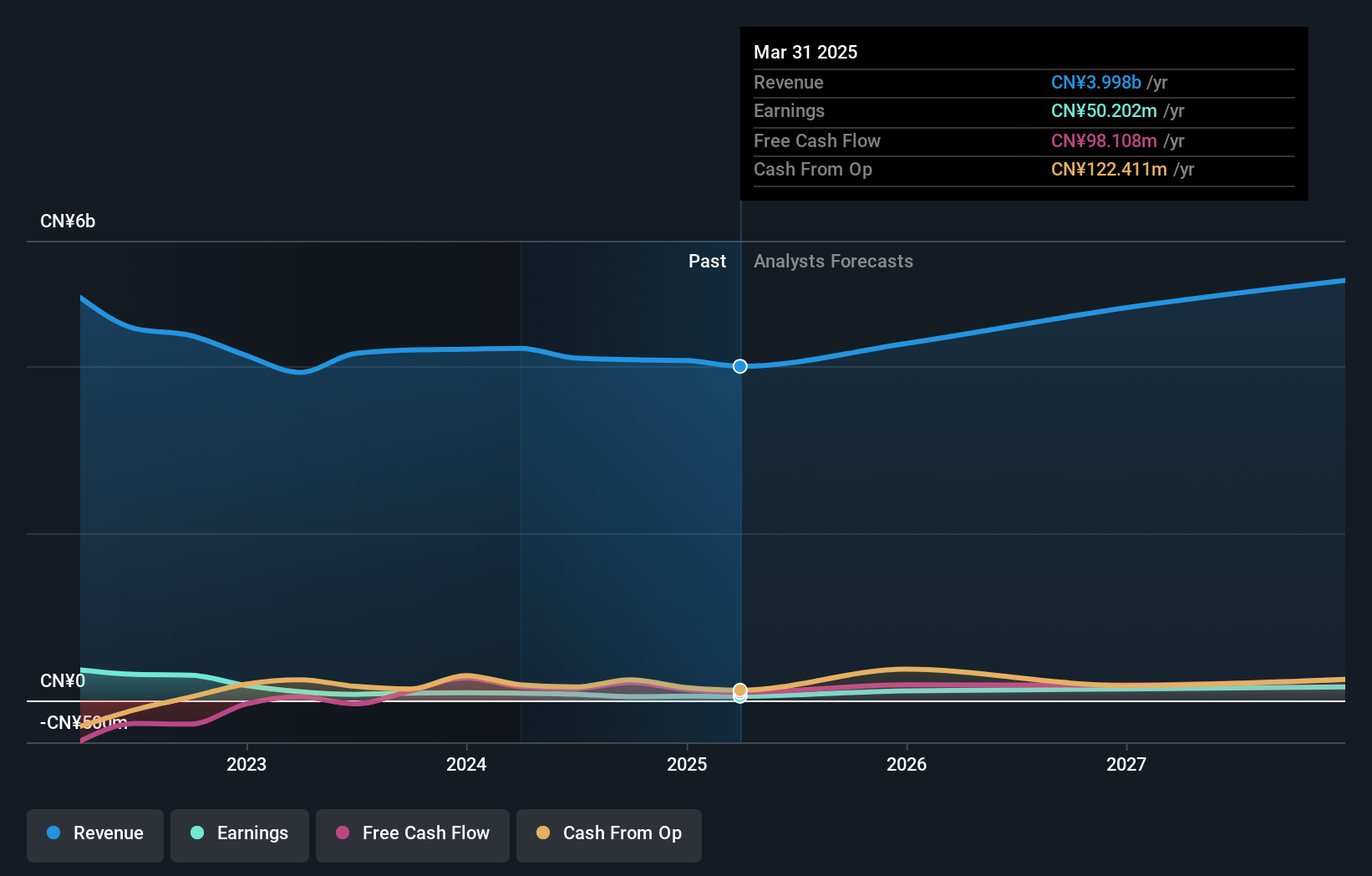

Inmyshow Digital Technology(Group)Co., Ltd. is navigating a challenging landscape with its recent earnings revealing a dip in revenue to CNY 3.05 billion from the previous year's CNY 3.17 billion and net income falling to CNY 65.42 million from CNY 112.63 million. Despite these hurdles, the company's projected earnings growth stands at an impressive 62.4% annually, significantly outpacing the broader Chinese market forecast of 24.6%. This robust growth expectation is coupled with an R&D commitment that remains strong, underpinning potential future innovations and market competitiveness in a rapidly evolving tech landscape where R&D vigor often translates into sustainable growth trajectories.

Beijing Vastdata Technology (SHSE:603138)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Vastdata Technology Co., Ltd. is a company that offers data technology services in China and has a market capitalization of approximately CN¥4.82 billion.

Operations: Vastdata Technology focuses on software and information technology services, generating revenue of CN¥365.24 million from this segment. The company's operations are centered in China, contributing to its market presence and financial performance.

Beijing Vastdata Technology has demonstrated a remarkable ability to outpace its industry, with projected revenue growth of 41.8% annually, significantly higher than the broader market's 13.9%. This surge is supported by an impressive forecast for earnings growth at 119.7% per year, positioning the company well for future profitability. Despite current unprofitability, substantial investments in R&D are paving the way for innovative solutions and enhanced market competitiveness; in fact, recent financial reports indicate a reduction in net loss from CNY 85.35 million to CNY 43.59 million year-over-year, showcasing effective cost management and operational improvements amidst aggressive expansion efforts.

- Delve into the full analysis health report here for a deeper understanding of Beijing Vastdata Technology.

Understand Beijing Vastdata Technology's track record by examining our Past report.

Chengdu Jiafaantai Education TechnologyLtd (SZSE:300559)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chengdu Jiafaantai Education Technology Co., Ltd. focuses on providing educational technology solutions and services, with a market capitalization of CN¥4.34 billion.

Operations: The company generates revenue primarily from its Information Services - Computer Applications segment, amounting to CN¥506.40 million.

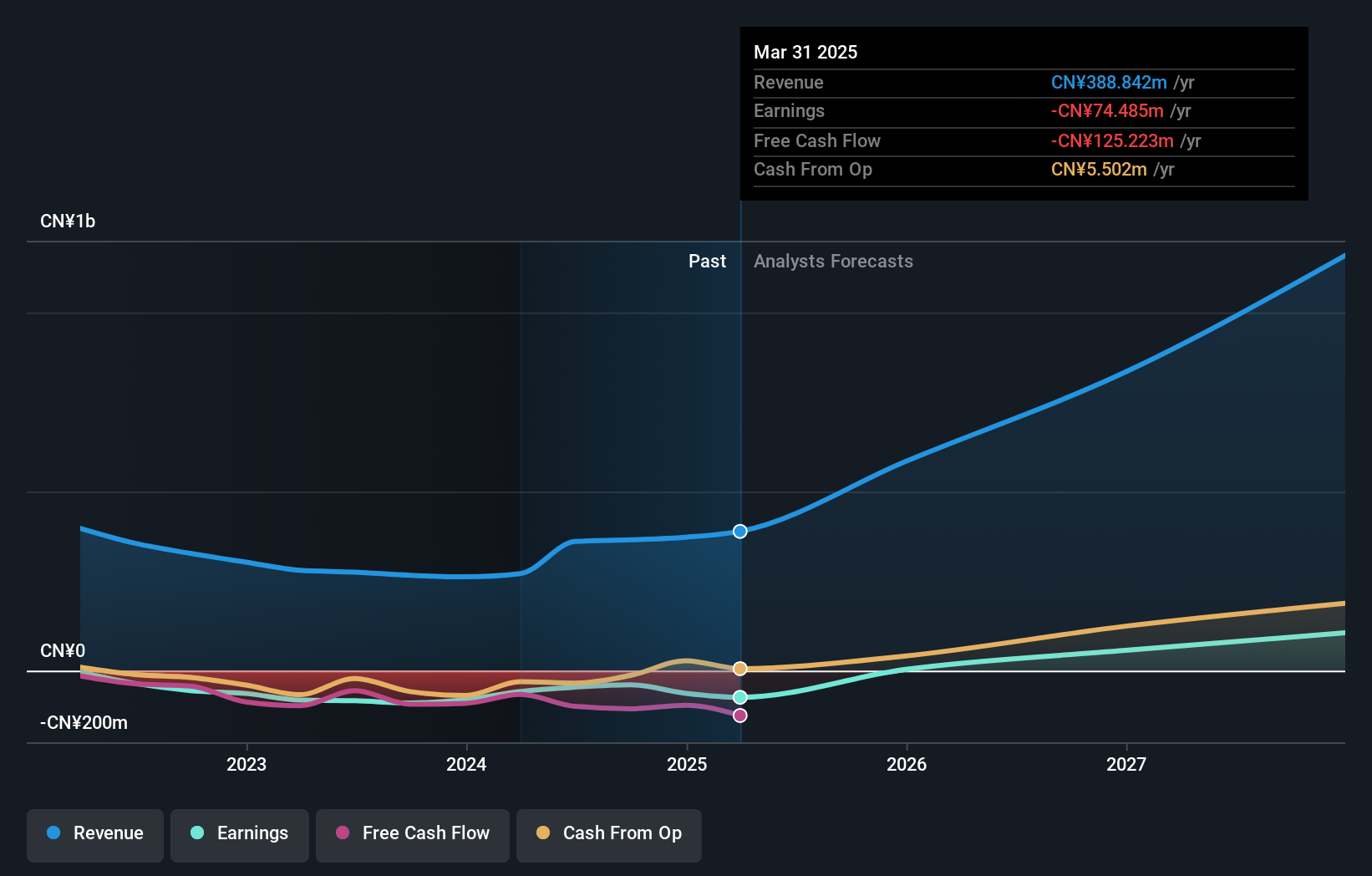

Chengdu Jiafaantai Education Technology Ltd., amidst a challenging fiscal period, reported a significant revenue drop to CNY 338.03 million from CNY 436.01 million year-over-year as of September 2024, reflecting broader market challenges. Despite this downturn, the company's strategic maneuvers, including a notable equity acquisition by Qianyi Private Equity Fund, underscore its resilience and potential for recovery. Impressively, forecasts suggest an ambitious annual earnings growth of 43.2%, outpacing the Chinese market's expectation of 25%. This projection is bolstered by R&D investments aimed at innovating within the educational tech sector, which remains critical in maintaining competitiveness and driving future revenue growth projected at an impressive rate of 30.9% annually.

Where To Now?

- Delve into our full catalog of 1279 High Growth Tech and AI Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300559

Chengdu Jiafaantai Education TechnologyLtd

Chengdu Jiafaantai Education Technology Co.,Ltd.

High growth potential with excellent balance sheet.