- China

- /

- Electronic Equipment and Components

- /

- SZSE:300552

Exploring High Growth Tech Stocks Including Unionman TechnologyLtd And Two Others

Reviewed by Simply Wall St

As global markets navigate mixed signals, with the S&P 500 and Nasdaq Composite closing another strong year despite recent economic headwinds like a plummeting Chicago PMI and revised GDP forecasts, investors are keenly observing high-growth sectors for opportunities. In this context, identifying promising tech stocks involves considering companies that not only demonstrate robust innovation but also resilience amid fluctuating market dynamics, such as those seen in Unionman Technology Ltd and others within the high-growth tech arena.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.06% | 44.32% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1263 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Unionman TechnologyLtd (SHSE:688609)

Simply Wall St Growth Rating: ★★★★★★

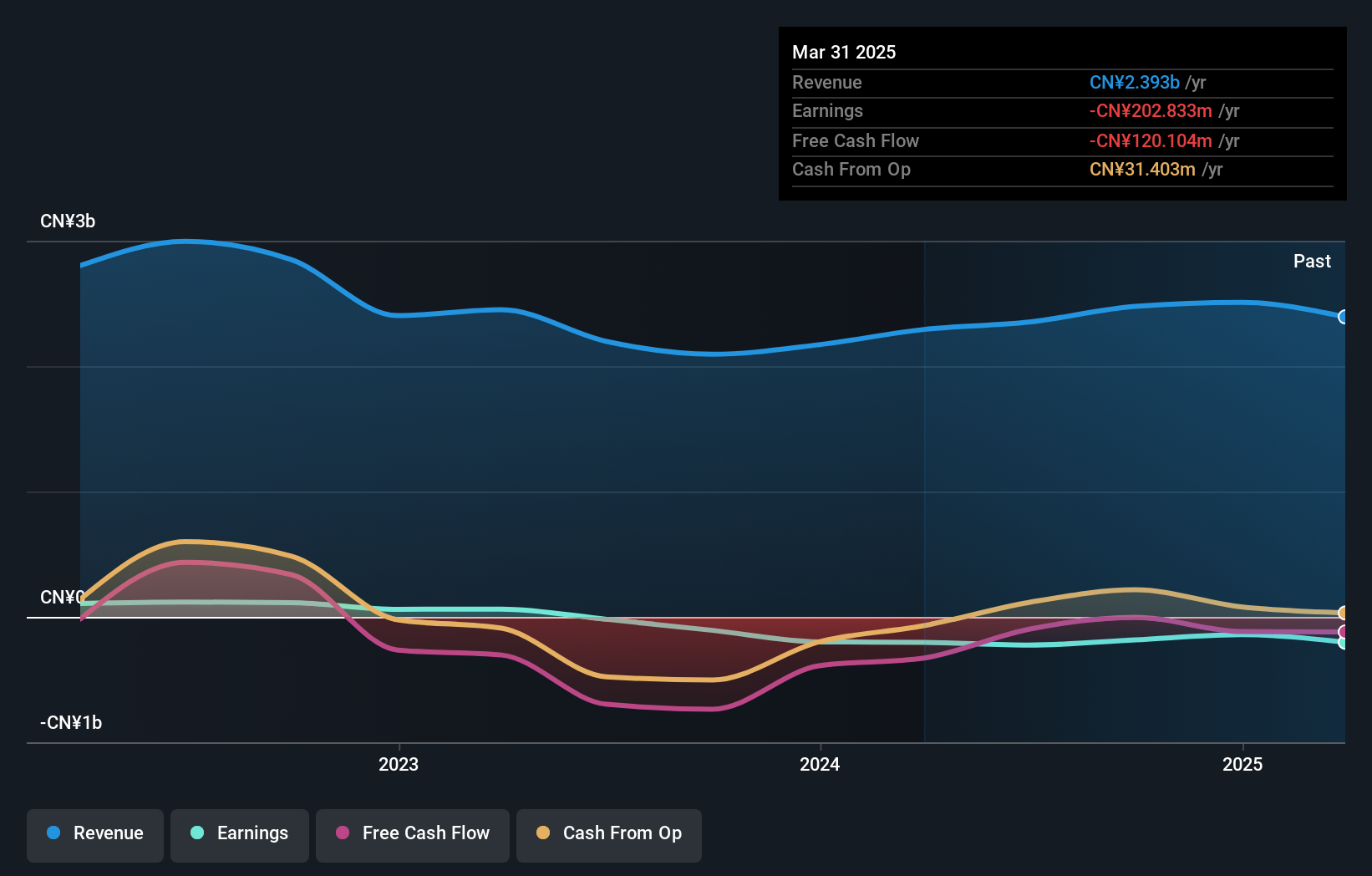

Overview: Unionman Technology Co., Ltd. engages in the production, sale, and servicing of multimedia information terminals, smart home network communication equipment, IoT communication modules, optical communication modules, smart security equipment, and related software systems and platforms with a market capitalization of CN¥4.55 billion.

Operations: The company's primary revenue stream is derived from its operations in the computer, communications, and other electronic intelligent equipment manufacturing industry, generating CN¥2.48 billion.

Unionman TechnologyLtd, amidst a volatile market, is setting a brisk pace with an expected annual revenue growth of 34.4%, outstripping the Chinese market's average of 13.5%. This growth is bolstered by significant investments in R&D, which have risen to CNY 150 million this year, accounting for nearly 8% of their total revenue—a clear indicator of their commitment to innovation and staying ahead in tech advancements. Despite current unprofitability, forecasts suggest an impressive turnaround with earnings potentially growing by 88.3% annually over the next three years. The firm recently highlighted these projections in their Q3 earnings call while addressing operational strategies aimed at reducing net losses which decreased from CNY 120.65 million last year to CNY 105.15 million this year, showcasing effective cost management and operational improvements.

Dongguan Aohai Technology (SZSE:002993)

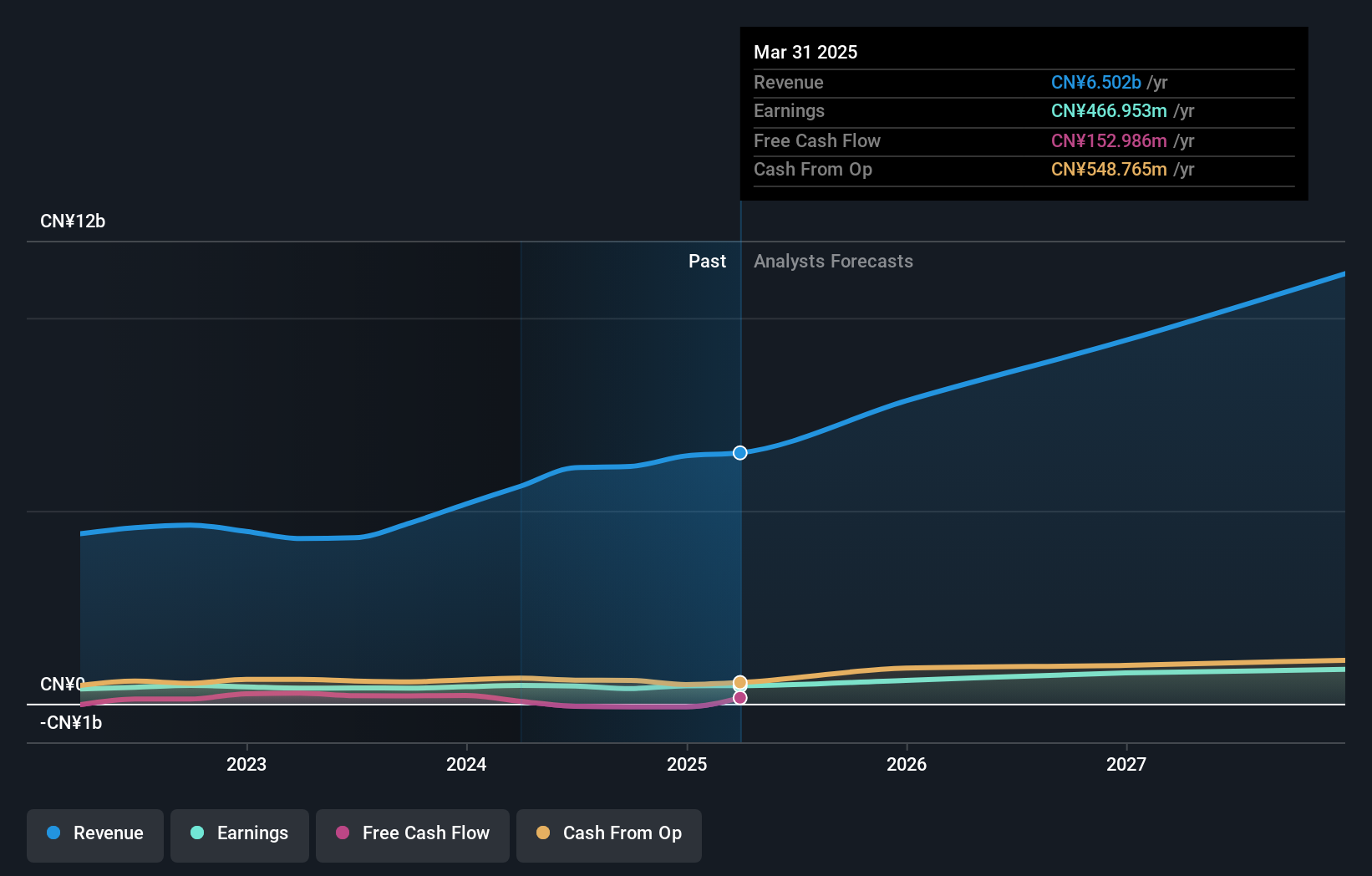

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dongguan Aohai Technology Co., Ltd. engages in the research, development, production, and sale of consumer electronics products both in China and internationally, with a market cap of approximately CN¥10.09 billion.

Operations: Aohai Technology generates revenue primarily from the manufacturing of computer, communications, and other electronic equipment, totaling approximately CN¥6.15 billion. The company's operations span both domestic and international markets within the consumer electronics sector.

Dongguan Aohai Technology has demonstrated robust financial health, with revenue growth reaching 20.5% annually, outpacing the Chinese market's average of 13.5%. This surge is supported by a strategic focus on R&D, where expenses have been carefully managed to align with broader business goals, contributing significantly to their innovative edge in technology sectors. Additionally, the company's earnings are expected to climb by 29.1% per year, reflecting strong operational efficiencies and market positioning. Recent activities including a share buyback of CNY 48.7 million and consistent dividend payments underscore their commitment to shareholder value and financial stability amidst dynamic market conditions.

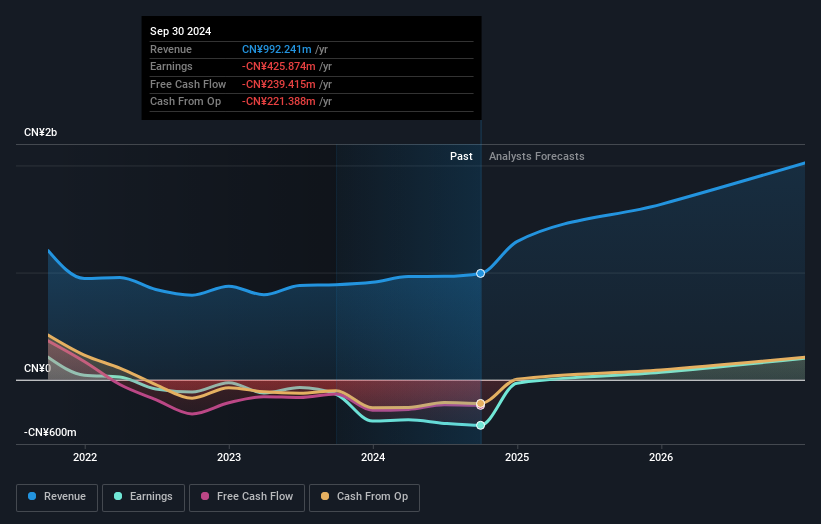

Vanjee Technology (SZSE:300552)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vanjee Technology Co., Ltd. specializes in providing intelligent transportation systems in China with a market capitalization of CN¥6.26 billion.

Operations: Vanjee Technology Co., Ltd. generates revenue primarily from the intelligent transportation industry, amounting to CN¥992.24 million.

Vanjee Technology, amidst a challenging financial landscape marked by a net loss of CNY 237.39 million for the nine months ending September 2024, continues to invest heavily in innovation with R&D expenses significantly shaping its strategic direction. Despite these losses, the company's revenue has surged by 28.7% annually, outstripping the broader Chinese market growth of 13.5%. This growth trajectory is supported by their recent shareholder meeting decisions aimed at enhancing operational frameworks and governance structures for future scalability and market responsiveness.

Summing It All Up

- Click here to access our complete index of 1263 High Growth Tech and AI Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300552

High growth potential with adequate balance sheet.