As global markets navigate a mixed start to the year, with major indices like the S&P 500 and Nasdaq Composite reflecting strong annual gains despite recent volatility, investors are keenly observing economic indicators such as manufacturing data and GDP forecasts. Amidst this backdrop of cautious optimism and strategic repositioning, growth companies with high insider ownership stand out as potentially robust investments due to their alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Shanghai Milkground Food Tech (SHSE:600882)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shanghai Milkground Food Tech Co., Ltd manufactures and sells cheese and liquid milk products to consumers and industrial clients in China, with a market cap of CN¥8.66 billion.

Operations: The company's revenue primarily comes from the manufacture and sale of cheese and liquid milk products to both consumer and industrial markets in China.

Insider Ownership: 16.5%

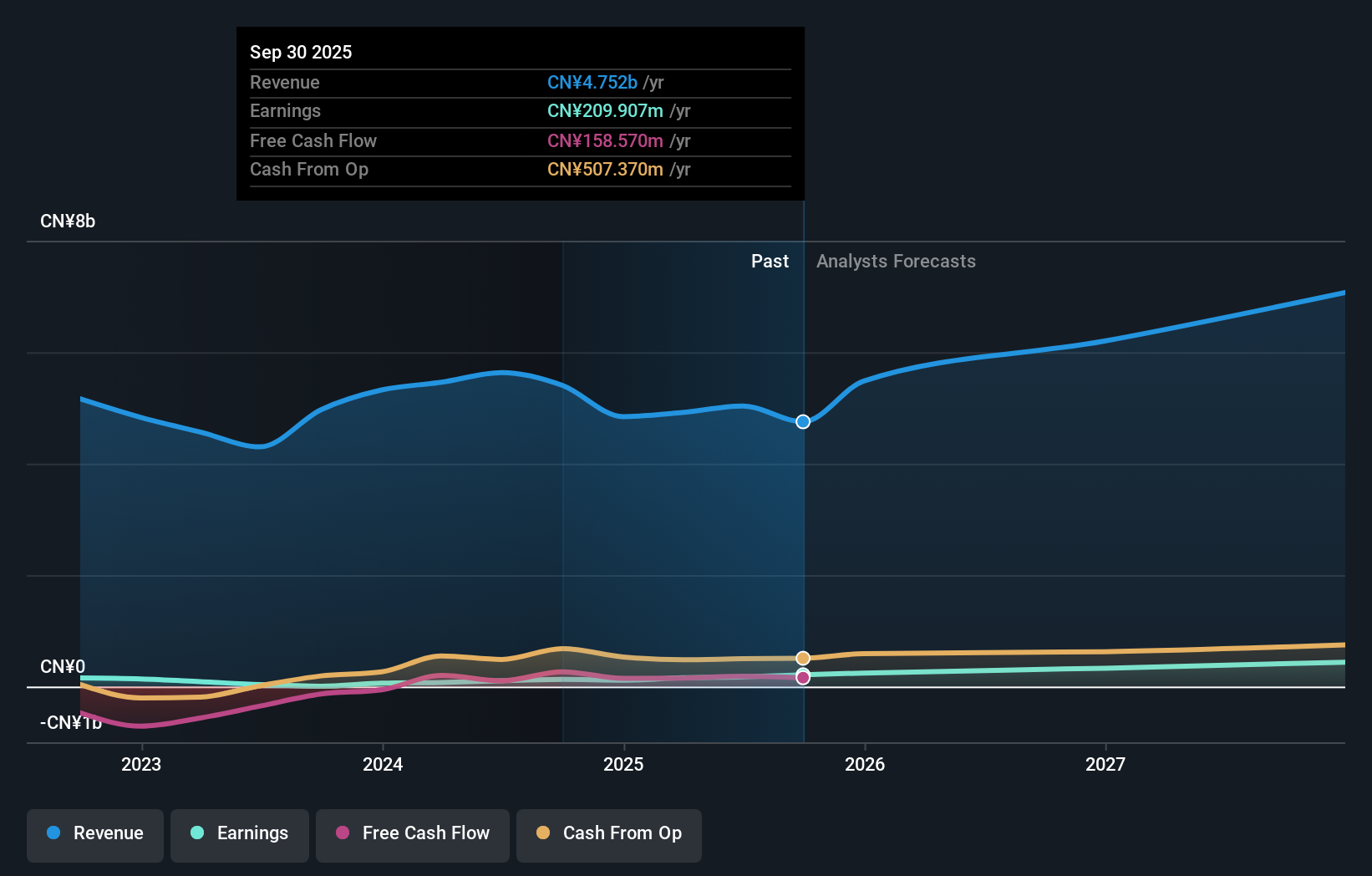

Shanghai Milkground Food Tech has demonstrated substantial earnings growth, with a very large increase over the past year. Despite a revenue decline to CNY 3.59 billion in the latest nine-month period, net income rose significantly to CNY 85.04 million. The stock trades well below its estimated fair value and is expected to continue growing earnings faster than the Chinese market average at 26.44% annually, although insider trading activity remains limited recently.

- Navigate through the intricacies of Shanghai Milkground Food Tech with our comprehensive analyst estimates report here.

- Our valuation report here indicates Shanghai Milkground Food Tech may be overvalued.

Tianyang New Materials (Shanghai) Technology (SHSE:603330)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tianyang New Materials (Shanghai) Technology Co., Ltd. operates in the materials technology sector and has a market cap of approximately CN¥2.48 billion.

Operations: Revenue segments for Tianyang New Materials (Shanghai) Technology Co., Ltd. are currently unavailable.

Insider Ownership: 36.5%

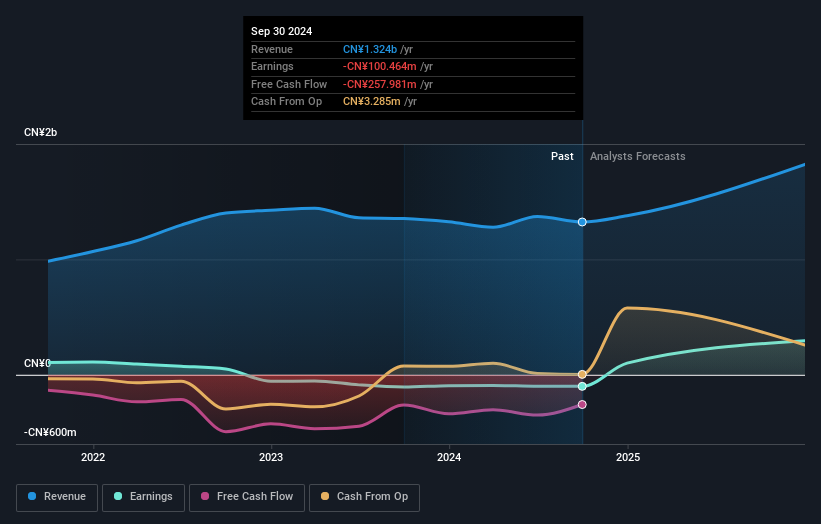

Tianyang New Materials (Shanghai) Technology shows promising growth potential with revenue forecasted to increase by 27.4% annually, outpacing the Chinese market average. While the company reported a slight revenue decline to CNY 1 billion and a net loss of CNY 28.94 million for the recent nine-month period, earnings are expected to grow significantly by 170.04% per year and become profitable within three years, despite limited recent insider trading activity.

- Delve into the full analysis future growth report here for a deeper understanding of Tianyang New Materials (Shanghai) Technology.

- Our valuation report unveils the possibility Tianyang New Materials (Shanghai) Technology's shares may be trading at a premium.

Tianrun Industry Technology (SZSE:002283)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tianrun Industry Technology Co., Ltd. manufactures and sells internal combustion engine crankshafts both in China and internationally, with a market cap of CN¥5.89 billion.

Operations: The company generates revenue primarily from the manufacturing and sale of internal combustion engine crankshafts for both domestic and international markets.

Insider Ownership: 23.7%

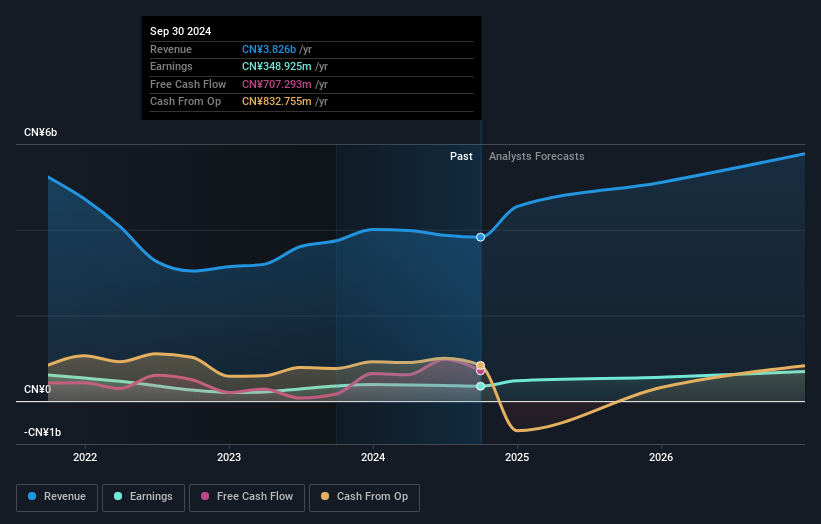

Tianrun Industry Technology's earnings are expected to grow significantly at 26.2% annually, surpassing the Chinese market average. Trading at a Price-To-Earnings ratio of 17.3x, it is valued attractively compared to the CN market's 32.7x. Despite a recent revenue decline to CNY 2.77 billion and net income drop to CNY 268.96 million for nine months ending September 2024, the company completed a share buyback worth CNY 70.91 million, reflecting strategic financial management amidst low insider trading activity recently.

- Click here and access our complete growth analysis report to understand the dynamics of Tianrun Industry Technology.

- Upon reviewing our latest valuation report, Tianrun Industry Technology's share price might be too pessimistic.

Summing It All Up

- Explore the 1491 names from our Fast Growing Companies With High Insider Ownership screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Tianrun Industry Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002283

Tianrun Industry Technology

Manufactures and sells internal combustion engine crankshafts in China and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives