- China

- /

- Household Products

- /

- SZSE:301327

January 2025's Top Insider-Owned Growth Stocks

Reviewed by Simply Wall St

As we enter 2025, global markets have shown resilience with U.S. indices closing out a strong year despite mixed performances in the final week, while European and Asian markets faced varied economic signals. In this environment of cautious optimism and economic recalibration, growth companies with high insider ownership can offer unique insights into market confidence and potential stability, as insiders often have a deep understanding of their company's prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| EHang Holdings (NasdaqGM:EH) | 31.4% | 79.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

Let's uncover some gems from our specialized screener.

Changzhou Fusion New Material (SHSE:688503)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Changzhou Fusion New Material Co., Ltd. specializes in the R&D, production, and sale of conductive silver paste, electronic component paste, conductive adhesive, and semiconductor materials for the photovoltaic industry both in China and globally, with a market cap of CN¥9.99 billion.

Operations: The company's revenue primarily comes from its Electronic Components & Parts segment, generating CN¥12.72 billion.

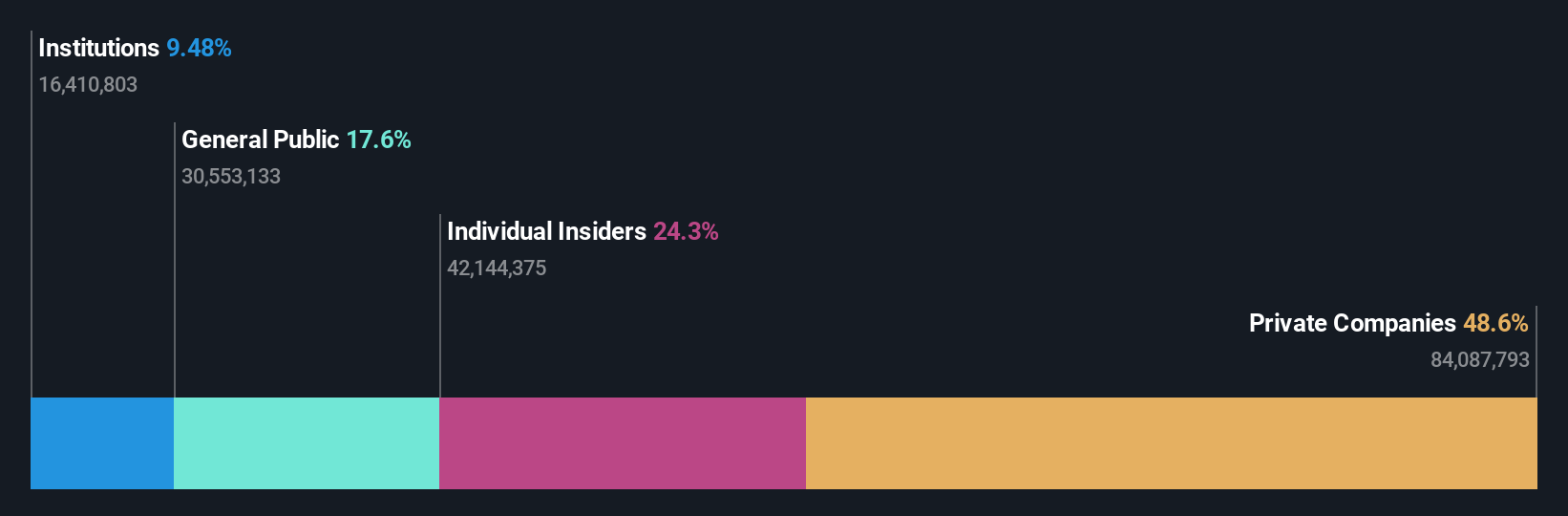

Insider Ownership: 24.8%

Earnings Growth Forecast: 29.3% p.a.

Changzhou Fusion New Material is trading at a favorable price-to-earnings ratio of 24.2x compared to the CN market average of 32.7x, indicating good relative value. Despite high volatility in its share price recently, the company shows significant earnings growth potential at 29.3% annually, outpacing the CN market's expected growth rate. However, its profit margins have decreased from last year and its dividend yield of 1.65% is not well covered by free cash flows.

- Navigate through the intricacies of Changzhou Fusion New Material with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Changzhou Fusion New Material is trading behind its estimated value.

Puya Semiconductor (Shanghai) (SHSE:688766)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Puya Semiconductor (Shanghai) Co., Ltd. specializes in the design and sale of non-volatile memory chips and derivative chips both in China and internationally, with a market cap of CN¥9.85 billion.

Operations: The company generates revenue of CN¥1.73 billion from its Integrated Circuit segment.

Insider Ownership: 23.8%

Earnings Growth Forecast: 24.4% p.a.

Puya Semiconductor (Shanghai) demonstrates strong growth potential, having transitioned to profitability with CNY 224.75 million net income for the first nine months of 2024, up from a loss last year. The company is expected to see significant revenue growth at 24.1% annually, surpassing the CN market average. Despite high share price volatility and a relatively low forecasted return on equity, its price-to-earnings ratio of 38.4x suggests good value compared to industry peers.

- Unlock comprehensive insights into our analysis of Puya Semiconductor (Shanghai) stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Puya Semiconductor (Shanghai) shares in the market.

Shenzhen Hello Tech Energy (SZSE:301327)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Hello Tech Energy Co., Ltd. focuses on the research, development, manufacture, and sale of portable power products in China, with a market cap of CN¥9.26 billion.

Operations: Shenzhen Hello Tech Energy Co., Ltd. generates revenue through its research, development, manufacture, and sale of portable power products in China.

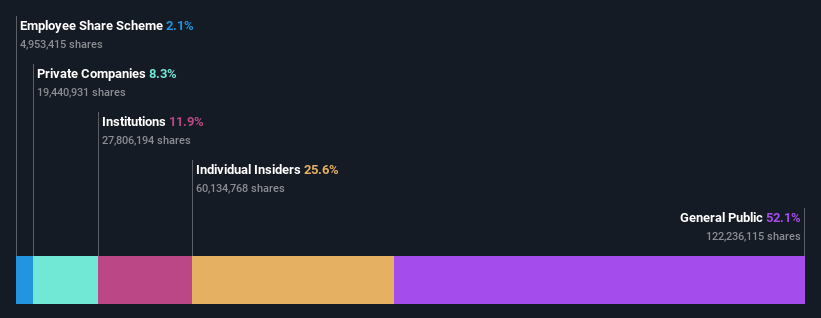

Insider Ownership: 24.3%

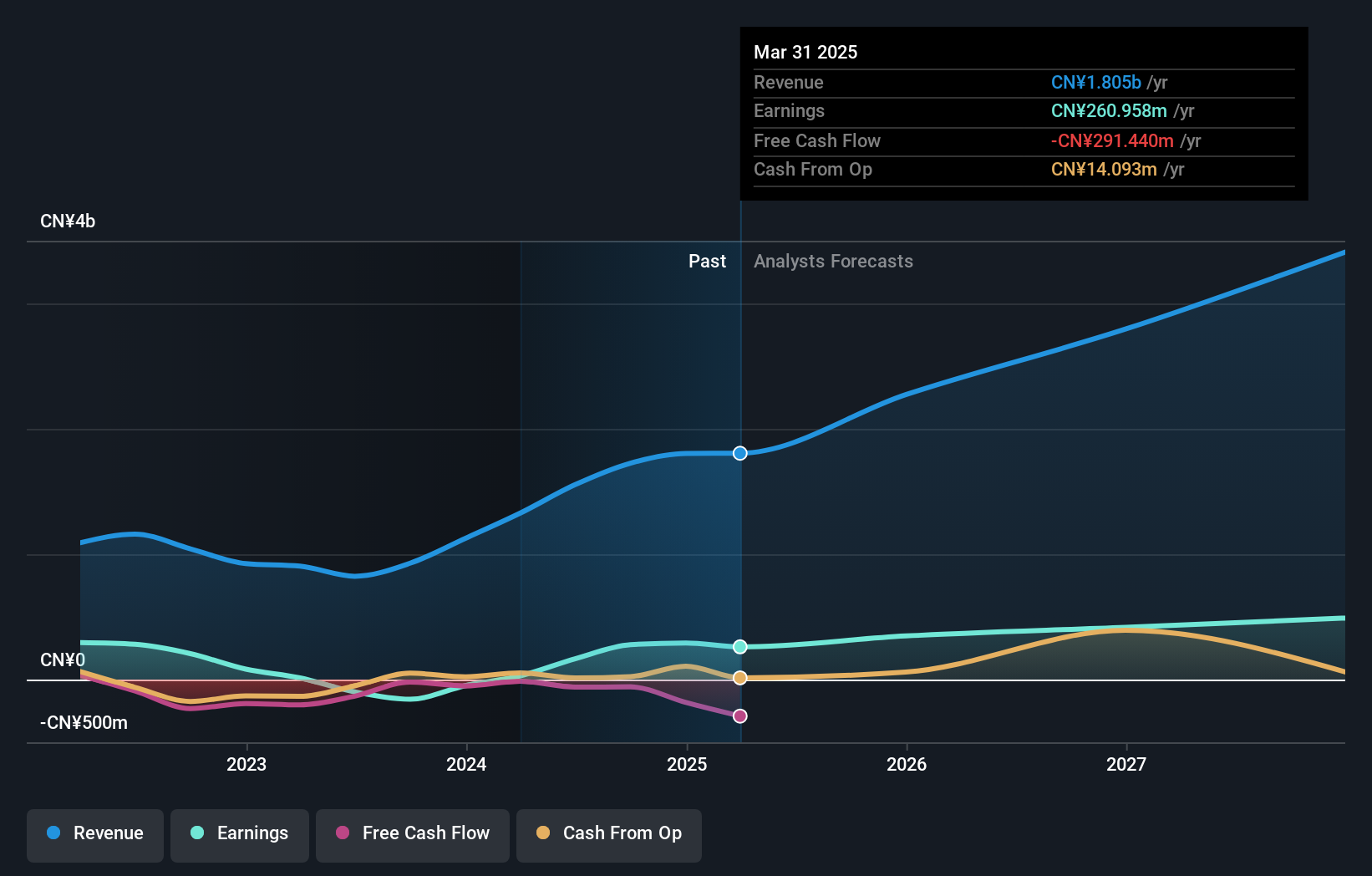

Earnings Growth Forecast: 58.6% p.a.

Shenzhen Hello Tech Energy has shown a significant turnaround, reporting CNY 159.43 million net income for the first nine months of 2024, compared to a loss last year. The company is trading well below its estimated fair value and is expected to see robust earnings growth at 58.62% annually, outpacing the CN market. Despite an unstable dividend track record and low forecasted return on equity of 5.8%, revenue growth remains strong at 25.2% per year.

- Dive into the specifics of Shenzhen Hello Tech Energy here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Shenzhen Hello Tech Energy's current price could be quite moderate.

Key Takeaways

- Dive into all 1491 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301327

Shenzhen Hello Tech Energy

Engages in the research and development, manufacture, and sale of portable power products in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives