3 Asian Stocks Estimated To Be Trading At Discounts Of Up To 45.3%

Reviewed by Simply Wall St

Amid ongoing global market volatility and economic uncertainties, Asian markets have been navigating a complex landscape marked by trade tensions and fluctuating investor sentiment. In this environment, identifying undervalued stocks can offer potential opportunities for investors seeking value; these stocks may be trading below their intrinsic worth due to broader market conditions rather than company-specific issues.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Tenchen Controls (SHSE:603085) | CN¥10.05 | CN¥19.36 | 48.1% |

| Tongguan Gold Group (SEHK:340) | HK$2.84 | HK$5.50 | 48.4% |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥39.16 | CN¥76.74 | 49% |

| Suzhou Hengmingda Electronic Technology (SZSE:002947) | CN¥44.72 | CN¥88.85 | 49.7% |

| Sheng Siong Group (SGX:OV8) | SGD2.18 | SGD4.29 | 49.2% |

| Lotes (TWSE:3533) | NT$1430.00 | NT$2842.98 | 49.7% |

| Insource (TSE:6200) | ¥928.00 | ¥1810.72 | 48.7% |

| Everest Medicines (SEHK:1952) | HK$53.10 | HK$103.64 | 48.8% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥48.79 | CN¥95.55 | 48.9% |

| Aecc Aero Science and TechnologyLtd (SHSE:600391) | CN¥27.19 | CN¥54.05 | 49.7% |

Underneath we present a selection of stocks filtered out by our screen.

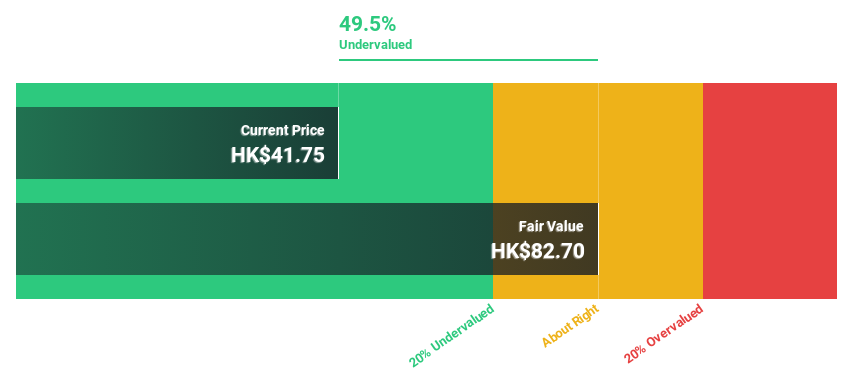

Zhejiang Leapmotor Technology (SEHK:9863)

Overview: Zhejiang Leapmotor Technology Co., Ltd. focuses on the research, development, production, and sale of new energy vehicles in Mainland China and internationally, with a market cap of HK$86.02 billion.

Operations: The company generates its revenue primarily through the production, research and development, and sales of new energy vehicles, amounting to CN¥47.57 billion.

Estimated Discount To Fair Value: 36.1%

Zhejiang Leapmotor Technology is trading at HK$60.5, significantly below its estimated fair value of HK$94.61, suggesting it may be undervalued based on cash flows. Analysts expect revenue to grow 29.8% annually, outpacing the Hong Kong market's growth rate of 8.6%. Recent sales announcements highlight a record-breaking month with over 57,066 vehicles sold in August 2025—an increase of over 88% year-on-year—indicating robust operational performance despite insider selling concerns.

- Our comprehensive growth report raises the possibility that Zhejiang Leapmotor Technology is poised for substantial financial growth.

- Navigate through the intricacies of Zhejiang Leapmotor Technology with our comprehensive financial health report here.

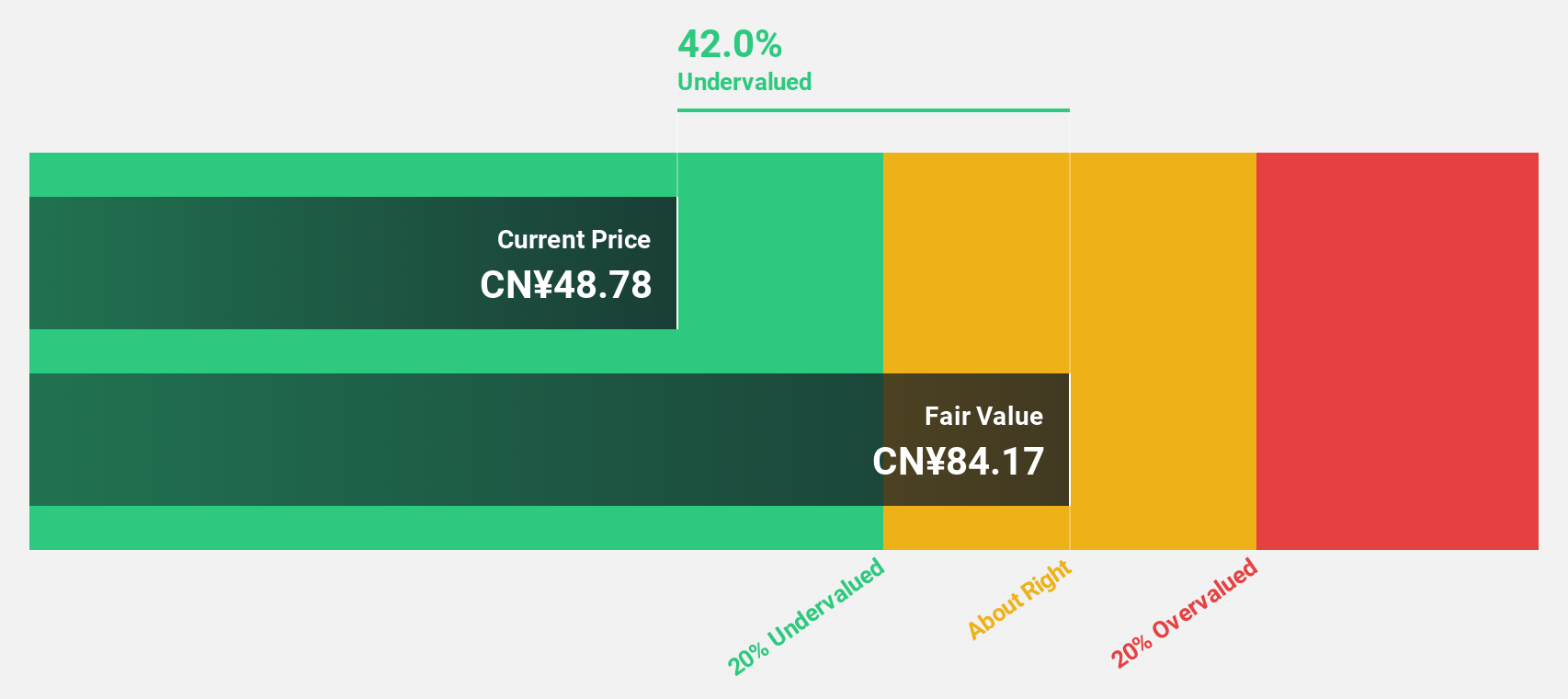

EverProX Technologies (SZSE:300548)

Overview: EverProX Technologies Co., Ltd. engages in the research, development, production, and sale of integrated optoelectronic devices for optical communications both in China and internationally, with a market cap of approximately CN¥29.65 billion.

Operations: The company's revenue primarily comes from Telecommunications Market at CN¥524.12 million and Data Communications, Consumer and Industrial Internet at approximately CN¥1.67 billion.

Estimated Discount To Fair Value: 45.3%

EverProX Technologies is trading at CN¥101.86, significantly below its estimated fair value of CN¥186.11, highlighting potential undervaluation based on cash flows. The company's earnings are forecast to grow 36.3% annually, surpassing the Chinese market's expected growth of 26%. Recent financial results show a substantial increase in net income to CNY 168.22 million from CNY 13.78 million a year ago, despite experiencing high share price volatility over the past three months.

- Our earnings growth report unveils the potential for significant increases in EverProX Technologies' future results.

- Take a closer look at EverProX Technologies' balance sheet health here in our report.

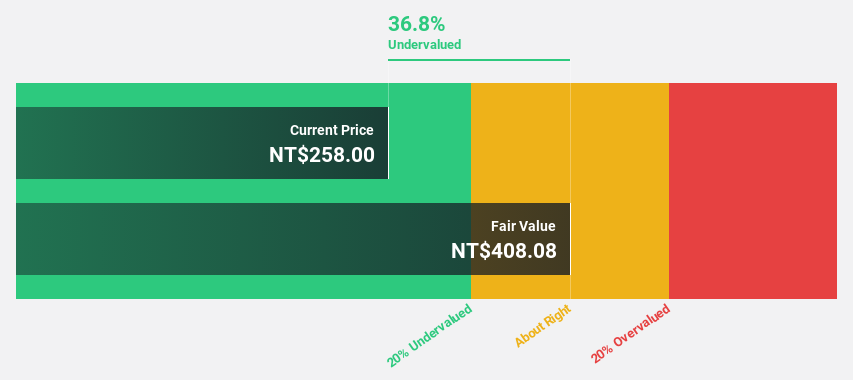

Giga-Byte Technology (TWSE:2376)

Overview: Giga-Byte Technology Co., Ltd. and its subsidiaries are involved in the manufacturing, processing, and trading of computer peripherals and component parts across Taiwan, Europe, the United States, Canada, China, and other international markets with a market cap of approximately NT$192.93 billion.

Operations: The Brand Business Division of Giga-Byte Technology Co., Ltd. generates NT$303.04 billion in revenue, focusing on computer peripherals and component parts across various international markets.

Estimated Discount To Fair Value: 14.3%

Giga-Byte Technology is trading at NT$288, below its estimated fair value of NT$335.92, presenting a potential undervaluation based on cash flows. The company's earnings are forecast to grow 20.2% annually, outpacing the Taiwanese market's growth rate of 18.7%. Recent product launches, including next-gen gaming laptops and gaming monitors, could bolster future revenue streams despite a slightly unstable dividend history and modest revenue growth forecasts compared to peers.

- Our growth report here indicates Giga-Byte Technology may be poised for an improving outlook.

- Click here to discover the nuances of Giga-Byte Technology with our detailed financial health report.

Taking Advantage

- Delve into our full catalog of 272 Undervalued Asian Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zhejiang Leapmotor Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9863

Zhejiang Leapmotor Technology

Engages in the research and development, production, and sale of new energy vehicles in Mainland China and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion