- China

- /

- Electronic Equipment and Components

- /

- SZSE:300502

Asian Growth Stocks With High Insider Ownership In June 2025

Reviewed by Simply Wall St

As of June 2025, Asian markets are navigating a complex landscape marked by trade tensions and economic stimulus expectations, particularly in China where recent economic indicators have prompted hopes for further government intervention. In this environment, growth companies with high insider ownership can be appealing to investors as they often indicate strong confidence from those who know the business best, potentially providing stability amid market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 59.9% |

| Vuno (KOSDAQ:A338220) | 15.6% | 109.8% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 24.3% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 94.4% |

| NEXTIN (KOSDAQ:A348210) | 12.4% | 33.8% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11% | 63.3% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.2% |

| Fulin Precision (SZSE:300432) | 13.6% | 43% |

We're going to check out a few of the best picks from our screener tool.

Samyang Foods (KOSE:A003230)

Simply Wall St Growth Rating: ★★★★★★

Overview: Samyang Foods Co., Ltd. operates in the food industry both domestically in South Korea and internationally, with a market capitalization of ₩8.93 trillion.

Operations: Samyang Foods Co., Ltd. generates revenue through its food business operations in South Korea and international markets.

Insider Ownership: 11.7%

Revenue Growth Forecast: 21.1% p.a.

Samyang Foods is experiencing significant growth, with earnings projected to increase over 24% annually, outpacing the Korean market. Revenue is also expected to grow over 21% per year. The company trades at a notable discount to its estimated fair value. Recent product developments include the reintroduction of Tangle instant pasta in the U.S., which could enhance revenue streams. While insider trading activity is minimal, high-quality earnings support its growth trajectory.

- Get an in-depth perspective on Samyang Foods' performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Samyang Foods' share price might be on the expensive side.

Xiaomi (SEHK:1810)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xiaomi Corporation is an investment holding company that develops and sells smartphones both in Mainland China and internationally, with a market cap of HK$1.41 trillion.

Operations: The company's revenue is primarily derived from its segments, which include Smartphones at CN¥195.89 billion, Internet Services at CN¥35.14 billion, IoT and Lifestyle Products at CN¥116.07 billion, and Smart EV and Other New Initiatives at CN¥51.31 billion.

Insider Ownership: 32.8%

Revenue Growth Forecast: 16.5% p.a.

Xiaomi's earnings are forecast to grow significantly, surpassing the Hong Kong market average. Recent strategic partnerships, such as with Moloco and Liftoff, enhance Xiaomi's advertising reach and monetization capabilities across global markets. The company's Q1 2025 earnings showed robust growth, with sales reaching CNY 111.29 billion and net income rising sharply year-over-year. Insider activity shows more buying than selling recently, indicating confidence in its growth potential despite trading slightly below fair value estimates.

- Unlock comprehensive insights into our analysis of Xiaomi stock in this growth report.

- The analysis detailed in our Xiaomi valuation report hints at an inflated share price compared to its estimated value.

Eoptolink Technology (SZSE:300502)

Simply Wall St Growth Rating: ★★★★★★

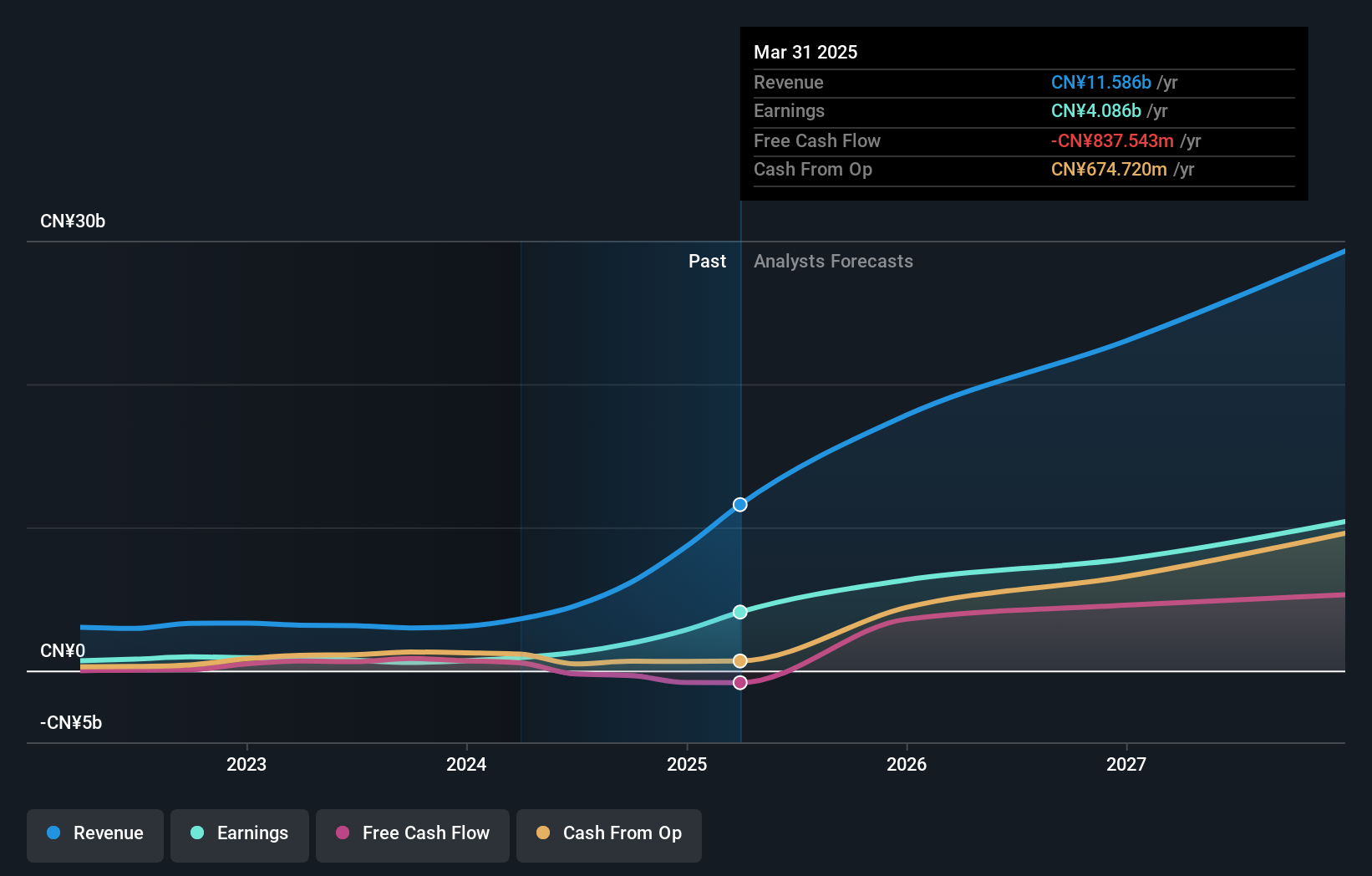

Overview: Eoptolink Technology Inc., Ltd. is involved in the research, development, production, and sales of optical modules both in China and internationally, with a market cap of CN¥97.61 billion.

Operations: Eoptolink Technology generates revenue primarily from its Optical Communication Equipment segment, amounting to CN¥11.59 billion.

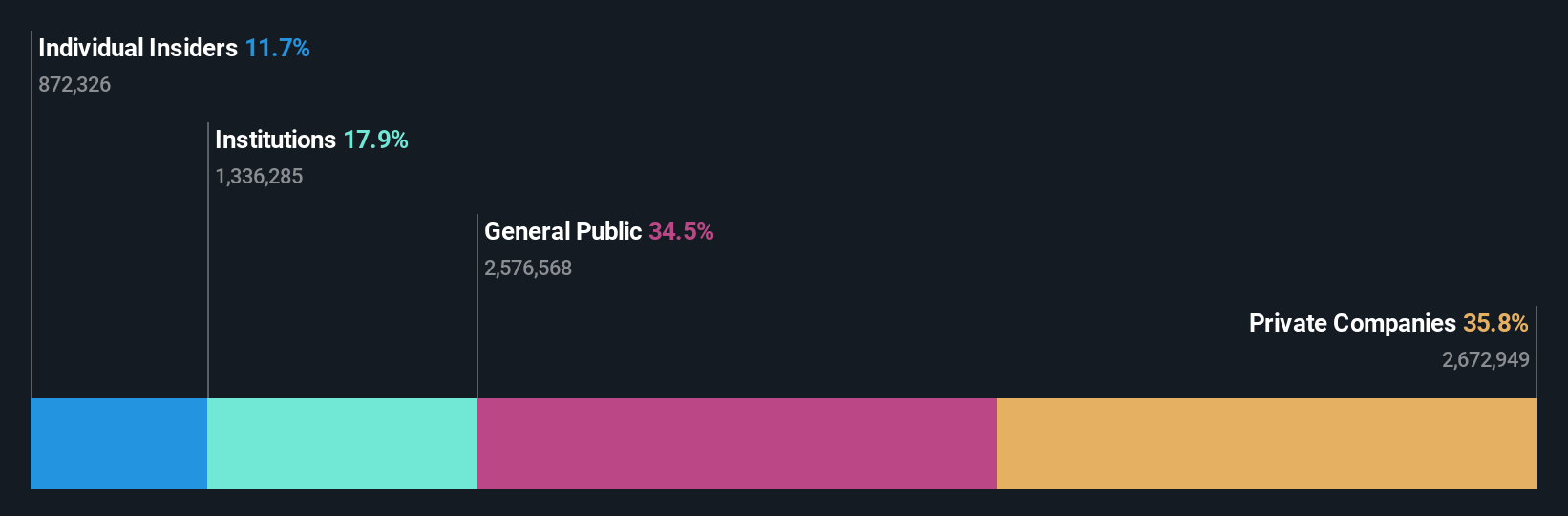

Insider Ownership: 23%

Revenue Growth Forecast: 31.2% p.a.

Eoptolink Technology's revenue and earnings are expected to grow significantly, outpacing the Chinese market. Recent innovations, like their 800G optical transceiver, position them well in the data center sector. Despite a highly volatile share price recently, the company trades below its fair value estimate and offers good relative value compared to peers. Insider ownership remains stable with no significant buying or selling activities in recent months.

- Click here to discover the nuances of Eoptolink Technology with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Eoptolink Technology is trading behind its estimated value.

Turning Ideas Into Actions

- Click here to access our complete index of 610 Fast Growing Asian Companies With High Insider Ownership.

- Ready For A Different Approach? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eoptolink Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300502

Eoptolink Technology

Engages in the research and development, production, and sale of optical modules for optical communication applications in China and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)