As global markets navigate a period of heightened inflation and interest rate expectations, U.S. stock indexes are climbing toward record highs, with growth stocks outpacing value shares. In this environment of economic uncertainty and market volatility, dividend stocks can offer investors a measure of stability through regular income streams while potentially benefiting from capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.12% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.35% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

Click here to see the full list of 1976 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

China Master Logistics (SHSE:603967)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Master Logistics Co., Ltd. is an integrated logistics company in China with a market cap of CN¥3.50 billion.

Operations: China Master Logistics Co., Ltd. generates revenue through its operations as an integrated logistics company in China.

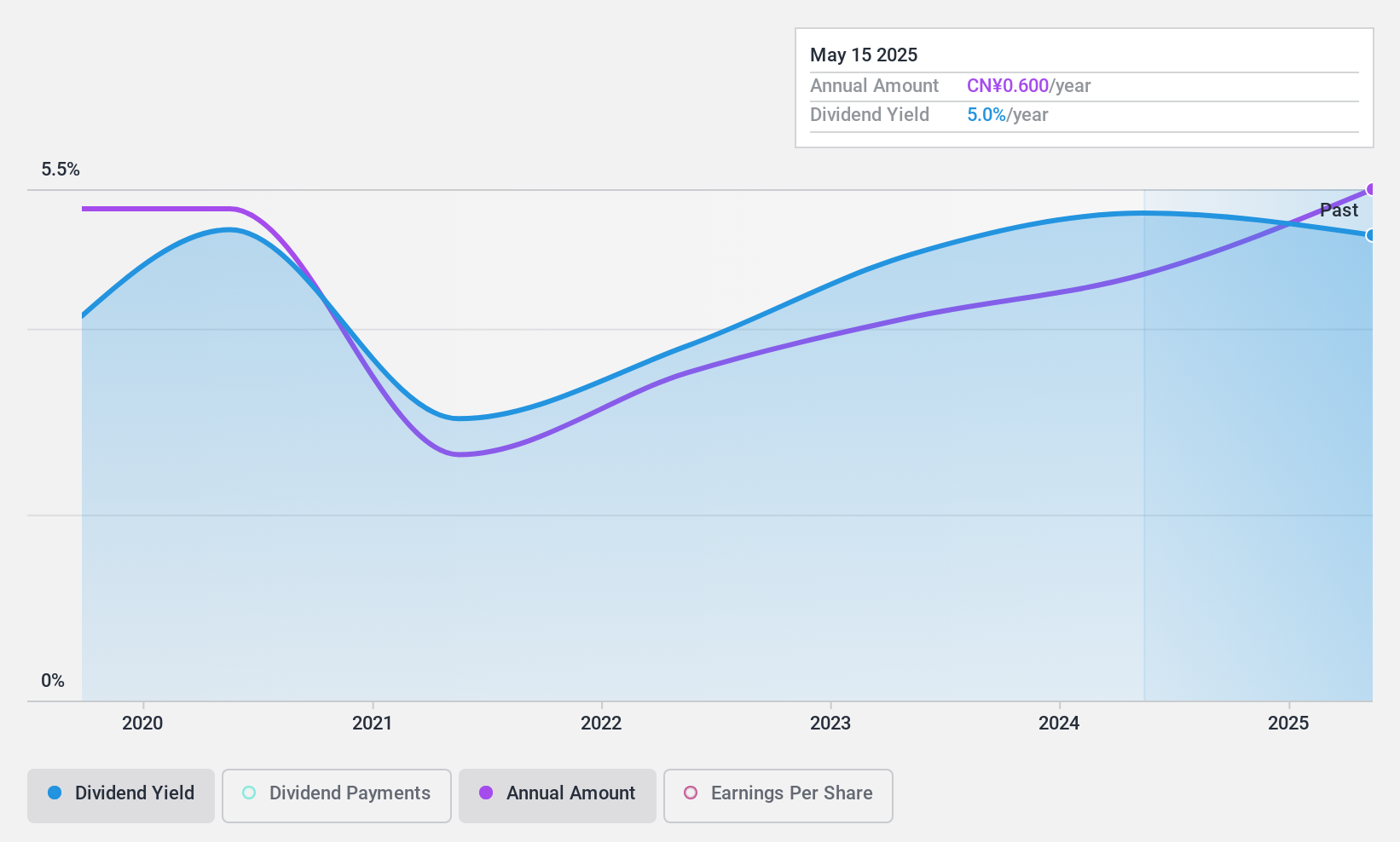

Dividend Yield: 5%

China Master Logistics, with a dividend yield of 4.95%, ranks in the top 25% of CN market payers. Its dividends are covered by earnings (68.5% payout ratio) and cash flows (72.7% cash payout ratio). However, its five-year dividend history shows volatility and declining payments, raising concerns about reliability. Despite trading at a significant discount to estimated fair value, the unstable dividend track record may deter some investors seeking consistent income streams.

- Delve into the full analysis dividend report here for a deeper understanding of China Master Logistics.

- Insights from our recent valuation report point to the potential undervaluation of China Master Logistics shares in the market.

Goldcard Smart Group (SZSE:300349)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Goldcard Smart Group Co., Ltd. is a utility digitalization solution provider specializing in smart gas, smart water, and hydrogen metering in China, with a market cap of CN¥5.71 billion.

Operations: Goldcard Smart Group Co., Ltd. generates revenue through its operations in smart gas, smart water, and hydrogen metering solutions within China.

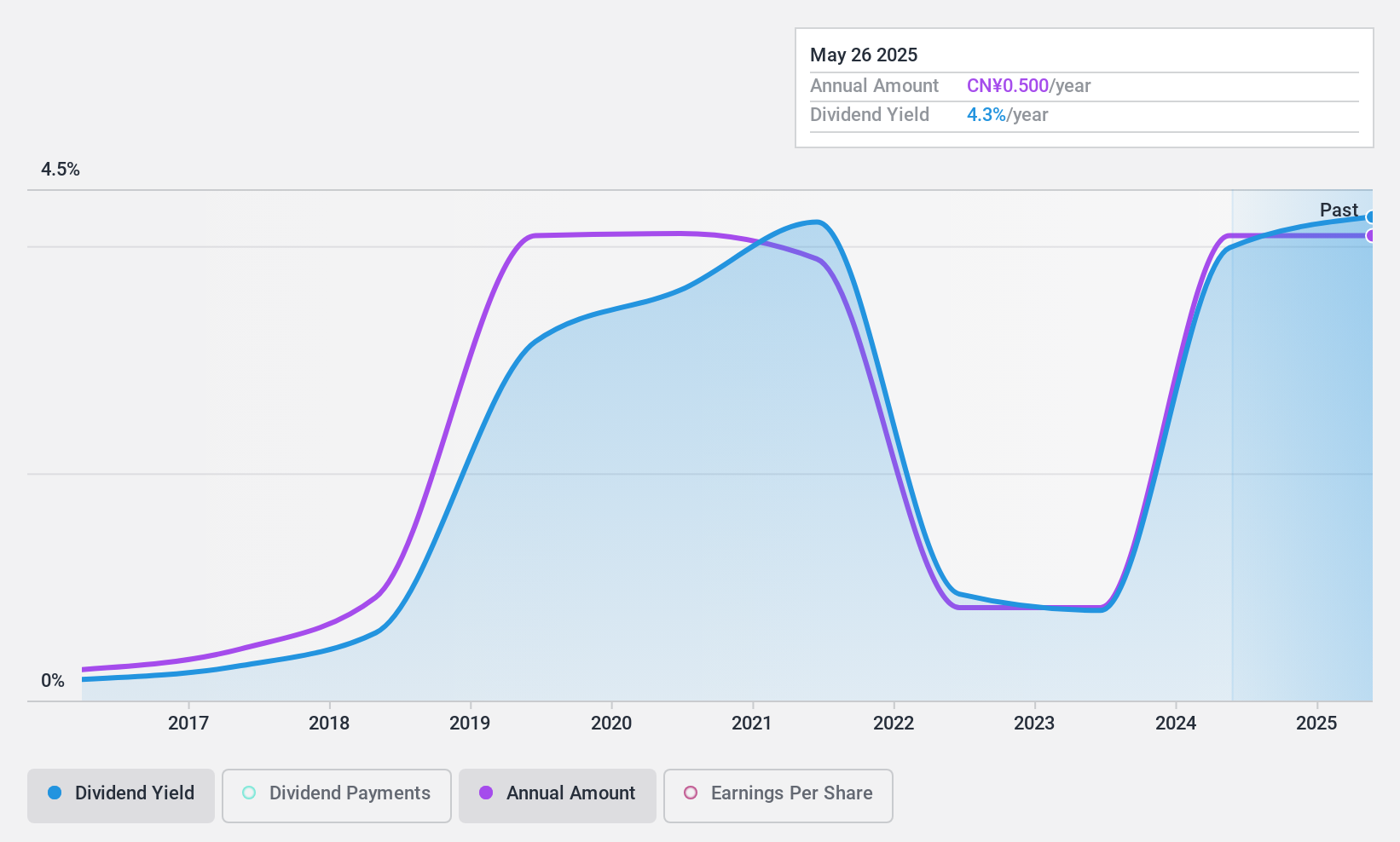

Dividend Yield: 3.6%

Goldcard Smart Group offers a dividend yield of 3.64%, placing it among the top 25% in the CN market. Despite a low payout ratio of 50%, dividends are not covered by free cash flows, indicating potential sustainability issues. The company's dividend history shows volatility over the past decade, though payments have increased overall. Trading at a favorable P/E ratio of 14x compared to the market, recent board changes may influence future strategies and stability.

- Get an in-depth perspective on Goldcard Smart Group's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Goldcard Smart Group is trading behind its estimated value.

MVV Energie (XTRA:MVV1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MVV Energie AG, with a market cap of €2.10 billion, operates primarily in Germany offering electricity, heat, gas, water, and waste treatment and disposal services through its subsidiaries.

Operations: MVV Energie AG generates its revenue through the provision of electricity, heat, gas, water services, and waste treatment and disposal products mainly in Germany.

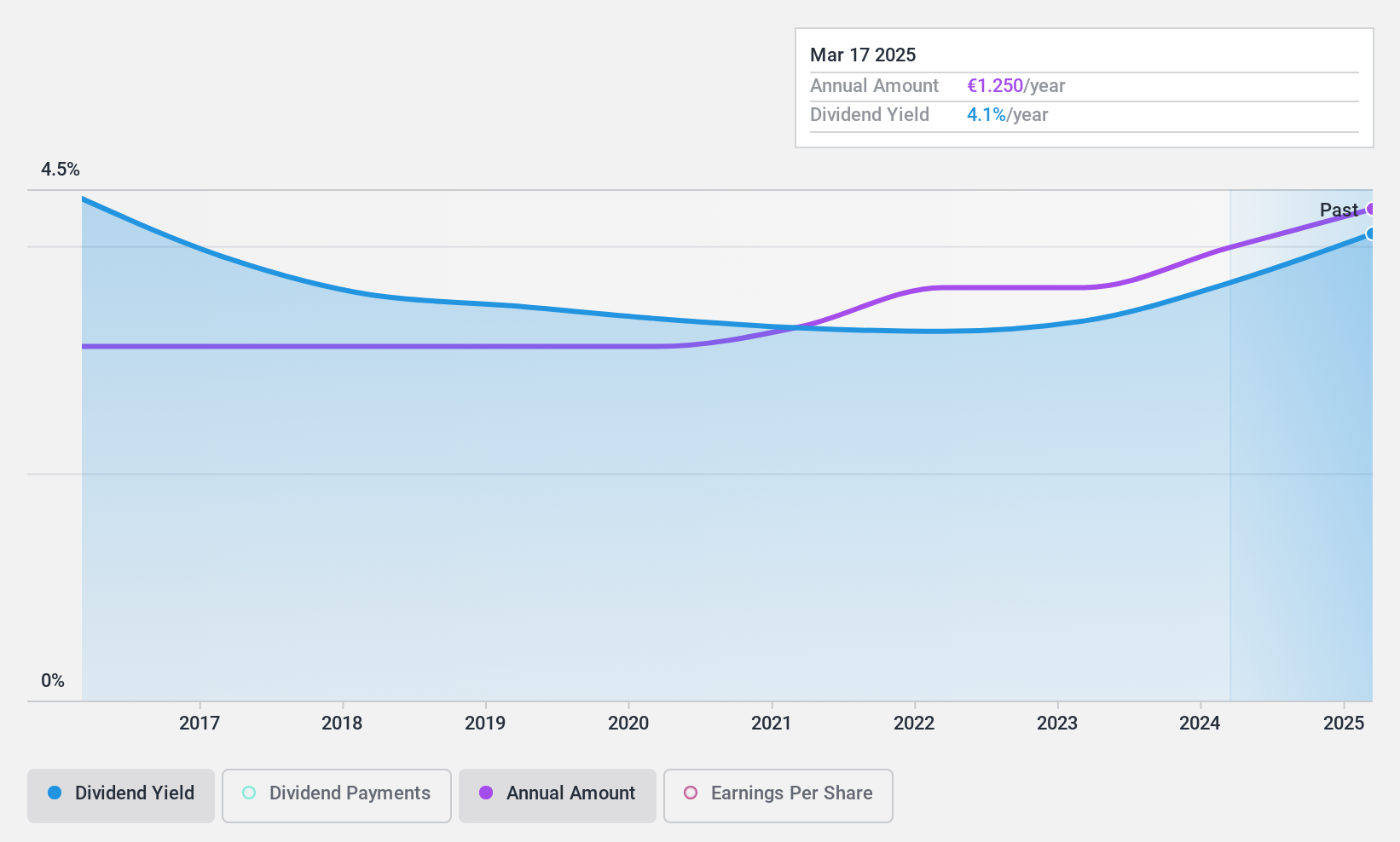

Dividend Yield: 3.9%

MVV Energie's dividend payments are well-supported by both earnings and cash flow, with a payout ratio of 51.8% and a cash payout ratio of 24.5%. The dividend yield stands at 3.93%, slightly below the top quartile in Germany, but remains stable and has grown over the past decade. Recent earnings showed decreased net income (EUR 34.57 million) compared to last year, which might impact future payouts as new CEO Dr. Gabriël Clemens takes charge in April 2025.

- Click to explore a detailed breakdown of our findings in MVV Energie's dividend report.

- According our valuation report, there's an indication that MVV Energie's share price might be on the cheaper side.

Summing It All Up

- Unlock our comprehensive list of 1976 Top Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603967

China Master Logistics

Operates as an integrated logistics company in China.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives