- China

- /

- Communications

- /

- SZSE:300394

3 Stocks Including Zhongji Innolight That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As we enter 2025, global markets have shown mixed results with U.S. stocks closing a strong year despite recent volatility, while European and Asian markets grapple with economic uncertainties such as inflation and manufacturing slowdowns. Amid these fluctuations, the search for undervalued stocks becomes crucial for investors looking to capitalize on potential market opportunities. In today's environment, identifying stocks that may be trading below their estimated value involves analyzing factors like financial health, growth prospects, and market sentiment—all of which can provide insights into a stock's true worth beyond current price movements.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥28.58 | CN¥55.93 | 48.9% |

| Fevertree Drinks (AIM:FEVR) | £6.605 | £13.12 | 49.7% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.45 | CN¥43.36 | 50.5% |

| Zhende Medical (SHSE:603301) | CN¥20.99 | CN¥41.92 | 49.9% |

| AeroEdge (TSE:7409) | ¥1825.00 | ¥3504.91 | 47.9% |

| Mr. Cooper Group (NasdaqCM:COOP) | US$94.43 | US$187.71 | 49.7% |

| Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥24.05 | CN¥47.68 | 49.6% |

| Vault Minerals (ASX:VAU) | A$0.335 | A$0.66 | 48.9% |

| Vogo (ENXTPA:ALVGO) | €2.91 | €5.81 | 49.9% |

| Genscript Biotech (SEHK:1548) | HK$9.63 | HK$19.15 | 49.7% |

Let's explore several standout options from the results in the screener.

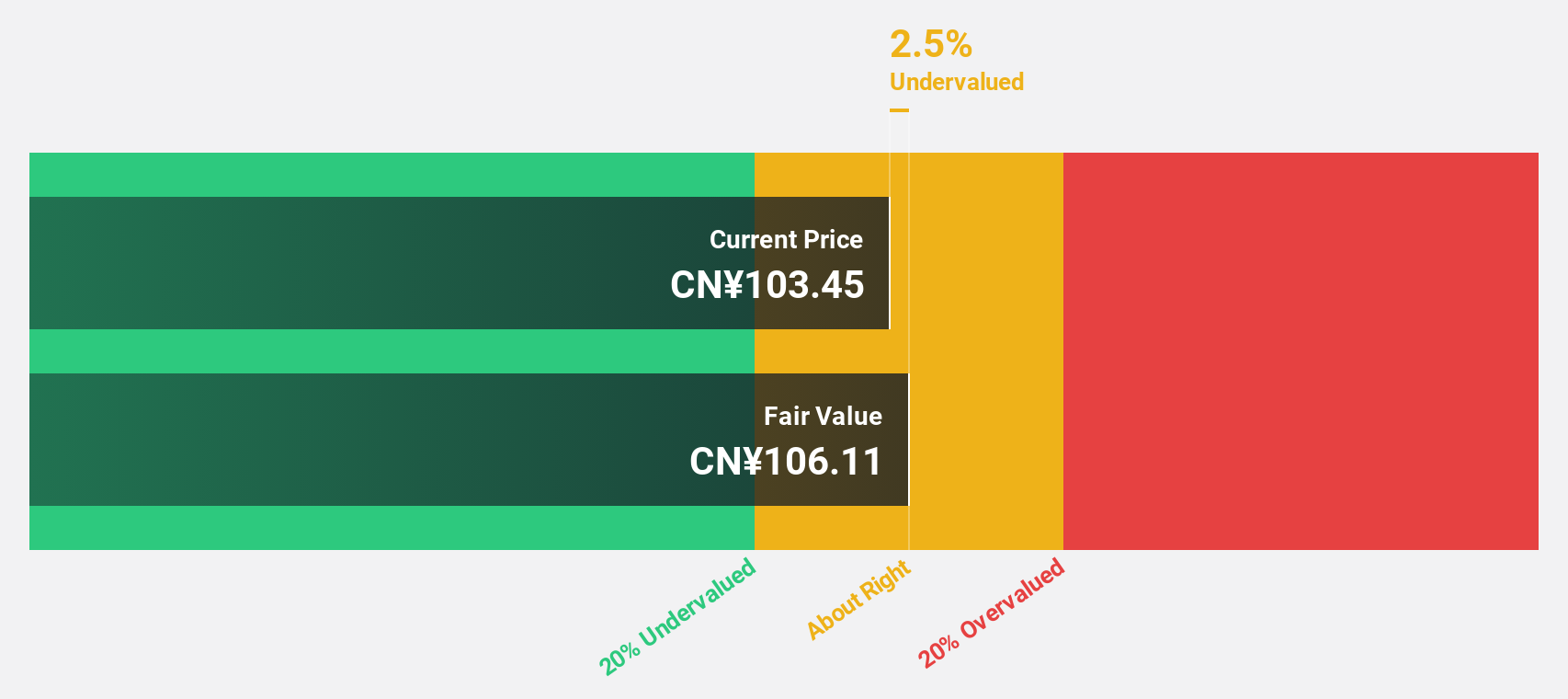

Zhongji Innolight (SZSE:300308)

Overview: Zhongji Innolight Co., Ltd. is engaged in the research, development, production, and sale of optical communication transceiver modules and optical devices in China, with a market cap of approximately CN¥138.63 billion.

Operations: The company's revenue is primarily derived from the sale of optical communication transceiver modules and optical devices within China.

Estimated Discount To Fair Value: 34.4%

Zhongji Innolight is trading at CN¥128.35, significantly below its estimated fair value of CN¥195.76, suggesting it may be undervalued based on cash flows. The company reported substantial growth in earnings and revenue for the nine months ending September 2024, with net income increasing to CN¥3.75 billion from CN¥1.30 billion a year ago. Analysts forecast earnings and revenue to grow significantly faster than the market over the next three years, supporting its potential undervaluation status.

- According our earnings growth report, there's an indication that Zhongji Innolight might be ready to expand.

- Click here to discover the nuances of Zhongji Innolight with our detailed financial health report.

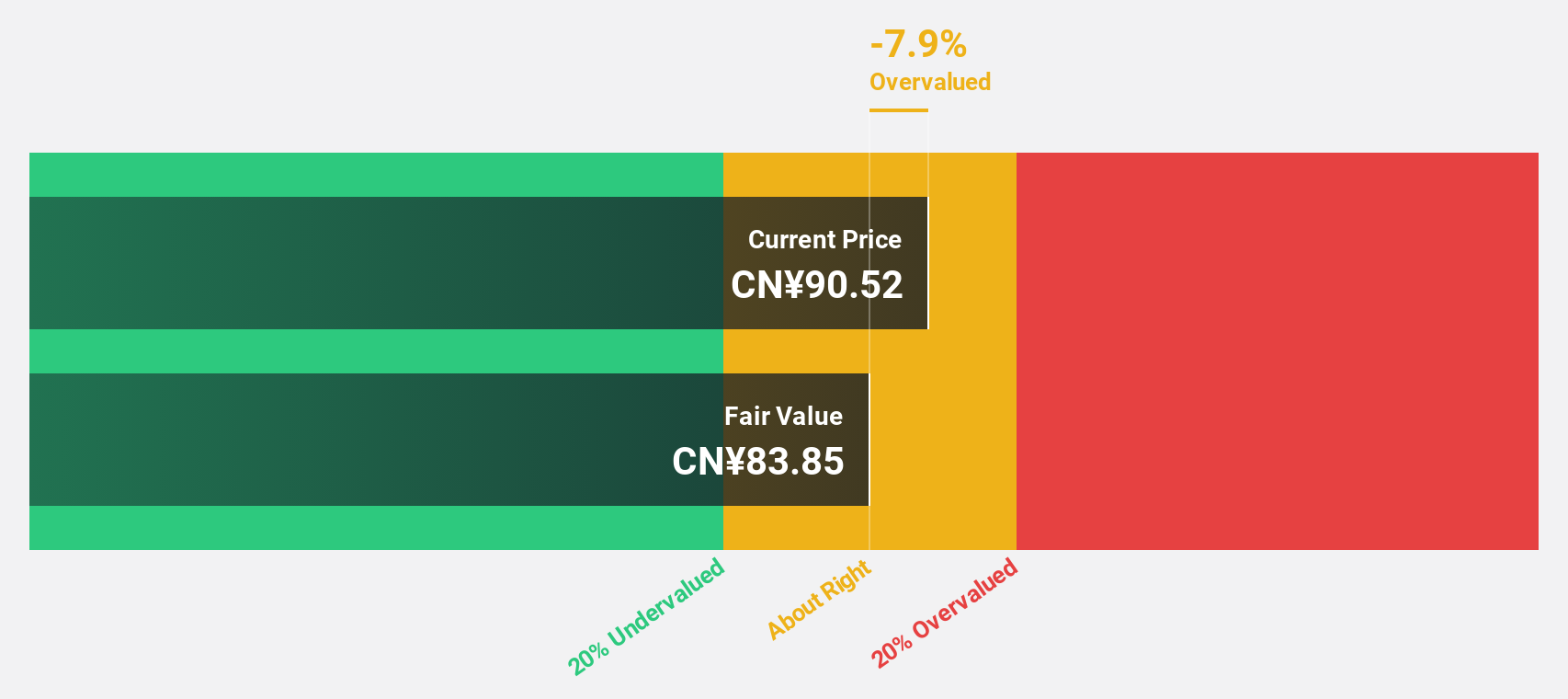

Suzhou TFC Optical Communication (SZSE:300394)

Overview: Suzhou TFC Optical Communication Co., Ltd. operates in the optical communication industry and has a market cap of CN¥49.12 billion.

Operations: The company generates revenue primarily from its Optical Communication Device segment, amounting to CN¥3.12 billion.

Estimated Discount To Fair Value: 33.8%

Suzhou TFC Optical Communication is trading at CN¥95.07, below its estimated fair value of CN¥143.6, highlighting potential undervaluation based on cash flows. The company reported strong earnings growth for the nine months ending September 2024, with net income rising to CNY 976.45 million from CNY 439.08 million a year ago. Analysts expect earnings and revenue to grow significantly faster than the market over the next three years, reinforcing its undervaluation potential despite recent share price volatility.

- The growth report we've compiled suggests that Suzhou TFC Optical Communication's future prospects could be on the up.

- Dive into the specifics of Suzhou TFC Optical Communication here with our thorough financial health report.

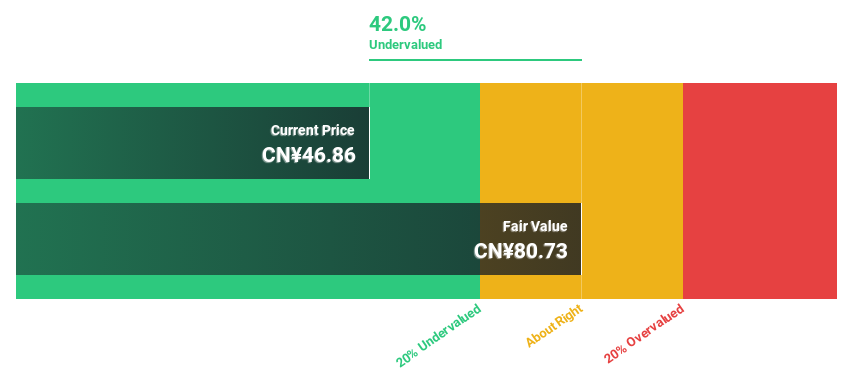

Gambol Pet Group (SZSE:301498)

Overview: Gambol Pet Group Co., Ltd. is involved in the research, development, production, and sale of pet food products in China with a market cap of CN¥31.09 billion.

Operations: The company generates revenue from its pet food and supplies segment, amounting to CN¥4.89 billion.

Estimated Discount To Fair Value: 12.1%

Gambol Pet Group is trading at CN¥80, slightly below its fair value estimate of CN¥91.05, indicating some undervaluation based on cash flows. The company reported strong earnings growth for the nine months ending September 2024, with net income rising to CN¥470.42 million from CN¥314.36 million a year ago. Analysts anticipate revenue growth of 20.5% annually over the next three years, outpacing market expectations despite a relatively low forecasted return on equity of 16.7%.

- Upon reviewing our latest growth report, Gambol Pet Group's projected financial performance appears quite optimistic.

- Navigate through the intricacies of Gambol Pet Group with our comprehensive financial health report here.

Turning Ideas Into Actions

- Reveal the 893 hidden gems among our Undervalued Stocks Based On Cash Flows screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300394

Suzhou TFC Optical Communication

Suzhou TFC Optical Communication Co., Ltd.

Exceptional growth potential, undervalued and pays a dividend.