- China

- /

- Electronic Equipment and Components

- /

- SZSE:300502

3 Growth Stocks With High Insider Ownership Targeting 36% Earnings Growth

Reviewed by Simply Wall St

As global markets wrapped up a mixed week, U.S. stocks managed to close out another strong year despite some year-end slumps, highlighting the resilience and volatility that investors have navigated recently. With indices like the S&P 500 marking significant gains over the past two years, attention is increasingly turning to growth companies with high insider ownership as potential opportunities for robust earnings expansion. In such an environment, stocks with substantial insider ownership can be appealing due to the alignment of interests between company insiders and shareholders, potentially driving targeted earnings growth even amidst fluctuating market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 27.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's uncover some gems from our specialized screener.

Eoptolink Technology (SZSE:300502)

Simply Wall St Growth Rating: ★★★★★★

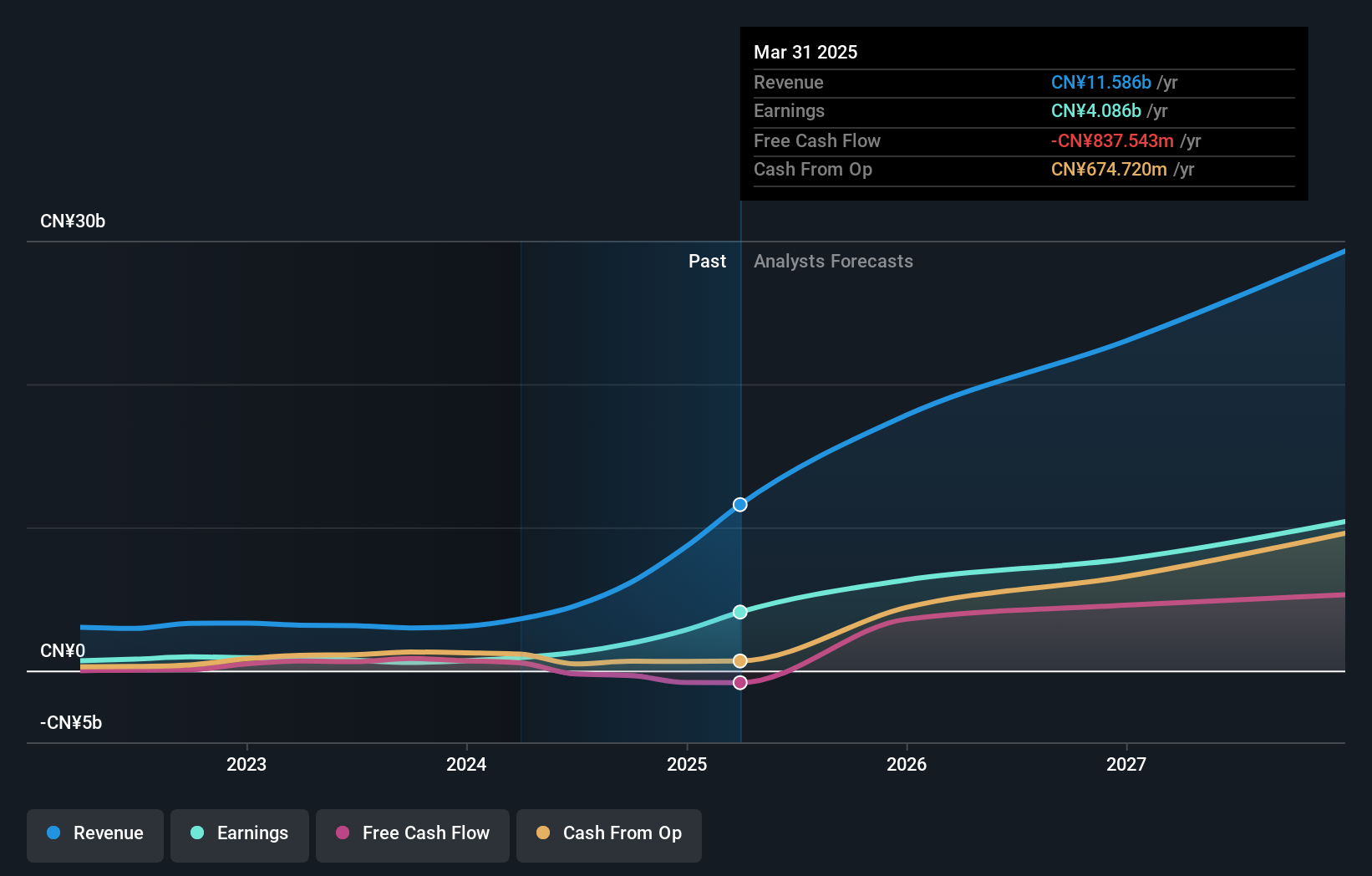

Overview: Eoptolink Technology Inc., Ltd. specializes in the research, development, manufacture, and sale of optical transceivers both in China and internationally, with a market cap of CN¥82.94 billion.

Operations: The company generates its revenue from the Optical Communication Equipment segment, amounting to CN¥6.14 billion.

Insider Ownership: 23%

Earnings Growth Forecast: 36.7% p.a.

Eoptolink Technology has demonstrated impressive growth, with revenue for the first nine months of 2024 reaching CNY 5.13 billion, a significant increase from CNY 2.09 billion the previous year. Net income rose to CNY 1.65 billion from CNY 429.56 million, reflecting strong earnings growth of over 233% year-on-year. The company's revenue and earnings are forecast to grow significantly faster than the market average in China, indicating robust future potential despite no recent insider trading activity noted.

- Dive into the specifics of Eoptolink Technology here with our thorough growth forecast report.

- Our valuation report here indicates Eoptolink Technology may be overvalued.

Zhejiang Zhaolong Interconnect TechnologyLtd (SZSE:300913)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Zhaolong Interconnect Technology Co., Ltd. operates in the technology sector and specializes in interconnect solutions, with a market capitalization of approximately CN¥15.25 billion.

Operations: The company generates revenue from the Digital Communication Cable Industry, amounting to CN¥1.75 billion.

Insider Ownership: 24.3%

Earnings Growth Forecast: 25.3% p.a.

Zhejiang Zhaolong Interconnect Technology has shown solid growth, with earnings increasing by 18.1% over the past year and revenue reaching CNY 1.34 billion for the first nine months of 2024, up from CNY 1.14 billion a year ago. Earnings are expected to grow significantly at 25.3% annually, outperforming the Chinese market average despite high share price volatility and low forecasted return on equity of 13.6%. Recent shareholder meetings focused on extending share offering resolutions indicate strategic planning efforts.

- Get an in-depth perspective on Zhejiang Zhaolong Interconnect TechnologyLtd's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Zhejiang Zhaolong Interconnect TechnologyLtd shares in the market.

GENDA (TSE:9166)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GENDA Inc., with a market cap of ¥193.57 billion, operates amusement arcades in Japan primarily under the GiGO brand through its subsidiaries.

Operations: GENDA Inc.'s revenue is derived from its Entertainment Content segment, contributing ¥12.28 billion, and its Entertainment Platform segment, contributing ¥85.01 billion.

Insider Ownership: 19.3%

Earnings Growth Forecast: 20.6% p.a.

GENDA has demonstrated strong growth, with revenue surging by 77.4% over the past year. Earnings are projected to grow significantly at 20.6% annually, outpacing the Japanese market average of 7.8%. However, profit margins have decreased from 7.5% to 3.7%, and the company's debt is not well covered by operating cash flow, indicating financial challenges despite substantial insider ownership and no significant insider trading activity in recent months.

- Unlock comprehensive insights into our analysis of GENDA stock in this growth report.

- The analysis detailed in our GENDA valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Navigate through the entire inventory of 1494 Fast Growing Companies With High Insider Ownership here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Eoptolink Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300502

Eoptolink Technology

Engages in the research and development, manufacture, and sale of optical transceivers in China and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives