- China

- /

- Communications

- /

- SZSE:300884

High Growth Tech And 2 Other Prominent Stocks With Potential Expansion

Reviewed by Simply Wall St

As global markets navigate mixed signals, with the S&P 500 and Nasdaq Composite marking significant annual gains despite recent economic data showing contraction in manufacturing activity, investors are keenly observing sectors poised for growth. In this context, identifying stocks with strong fundamentals and potential for expansion is crucial, especially amid fluctuating indices and economic indicators that impact market sentiment.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.24% | 56.34% | ★★★★★★ |

| TG Therapeutics | 30.06% | 44.32% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1263 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

DongGuan YuTong Optical TechnologyLtd (SZSE:300790)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DongGuan YuTong Optical Technology Co., Ltd. operates in the optical technology sector and has a market cap of CN¥6.73 billion.

Operations: DongGuan YuTong Optical Technology Ltd. focuses on the optical technology sector, generating revenue through its specialized products and services. The company strategically allocates resources to optimize its cost structures, contributing to its financial performance within the industry.

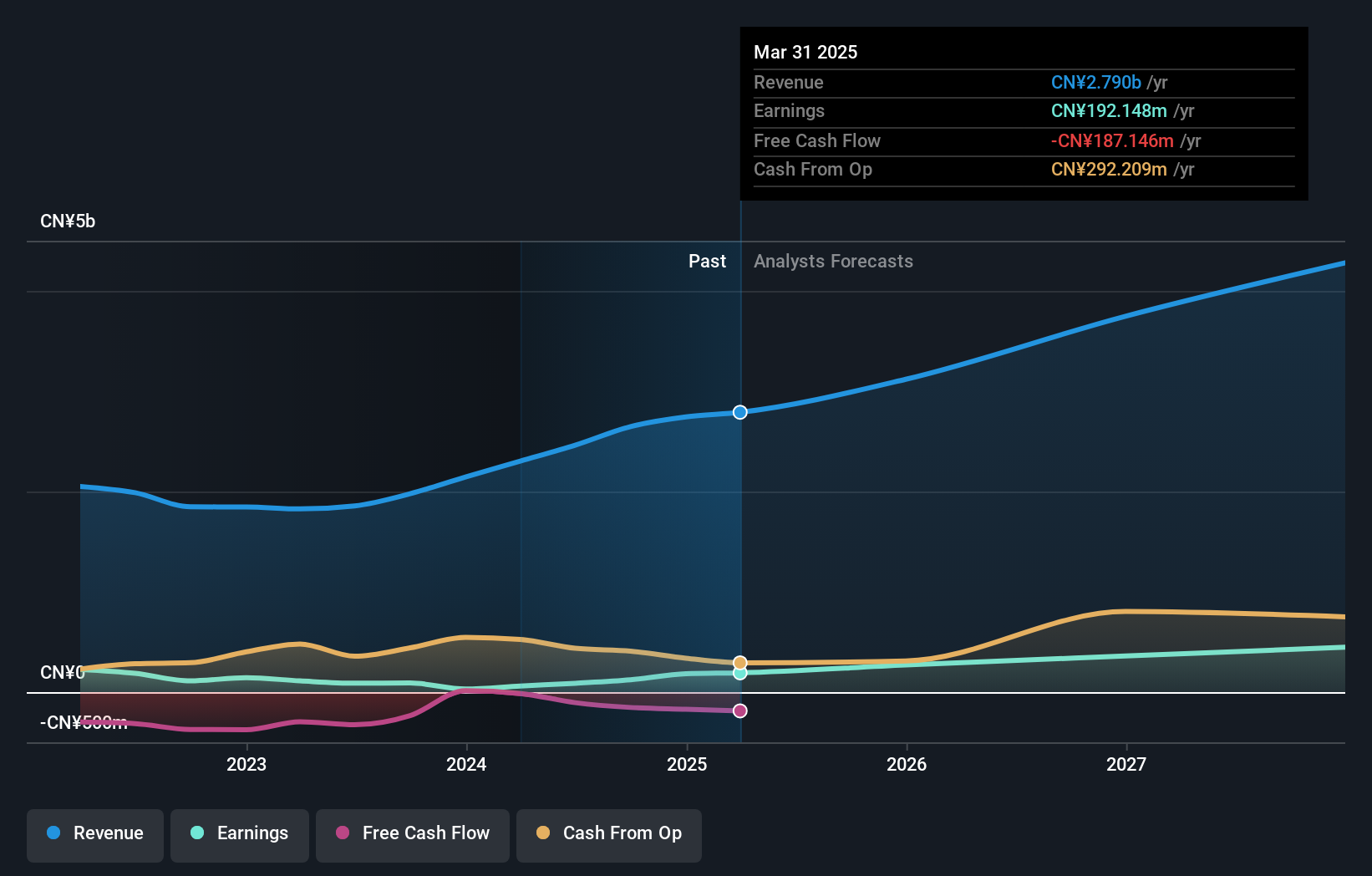

DongGuan YuTong Optical Technology has demonstrated robust performance with a significant 35.3% earnings growth over the past year, surpassing the electronic industry's average of 1.9%. This growth is underpinned by a notable increase in sales from CNY 1,491.33 million to CNY 1,993.44 million and net income soaring to CNY 133.31 million from CNY 41.48 million previously reported for the same period last year. The company's commitment to innovation and market expansion is further evidenced by its R&D investments which are crucial for maintaining technological leadership and fueling future revenue streams, currently growing at an annual rate of 14.4%. Despite challenges such as shareholder dilution over the past year and debt levels not well covered by operating cash flow, DongGuan YuTong continues to outperform market expectations with projected earnings growth of approximately 32% annually over the next three years, suggesting strong potential for sustained advancement in its sector.

Dnake (Xiamen) Intelligent Technology (SZSE:300884)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dnake (Xiamen) Intelligent Technology Co., Ltd. operates in the intelligent technology sector and has a market capitalization of approximately CN¥2.46 billion.

Operations: Dnake (Xiamen) Intelligent Technology primarily generates revenue through its intelligent technology solutions. The company's market cap stands at approximately CN¥2.46 billion, reflecting its position in the sector.

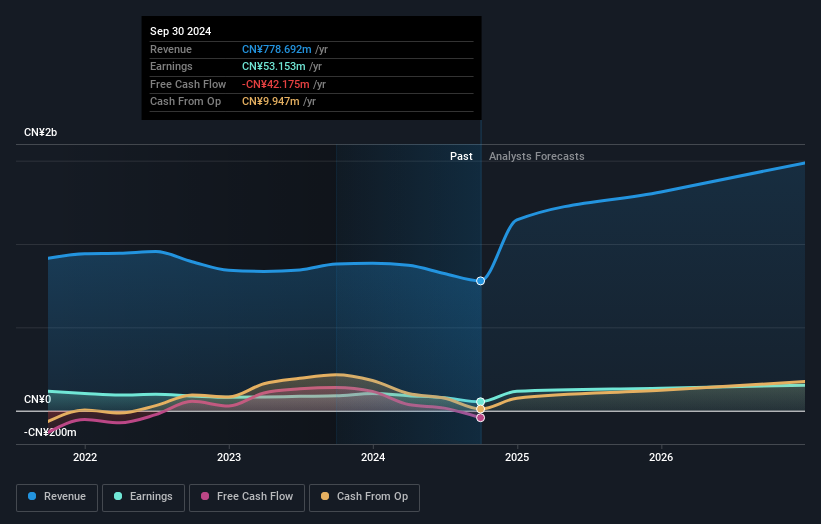

Despite a challenging year with revenue and net income seeing declines, Dnake (Xiamen) Intelligent Technology Co., Ltd. remains poised for recovery, backed by its strategic share repurchases totaling 4.73 million shares for CNY 43.18 million, enhancing shareholder value. The company's commitment to innovation is evident from its R&D focus, crucial in maintaining competitive edge in the tech sector. With forecasted earnings growth of 31% annually over the next three years and an expected revenue increase of 22.6% per year—surpassing the Chinese market average—Dnake is strategically positioned to leverage market opportunities despite current setbacks.

Pansoft (SZSE:300996)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pansoft Company Limited offers enterprise management information solutions and IT integrated services in China, with a market cap of CN¥3.32 billion.

Operations: Pansoft specializes in delivering enterprise management information solutions and IT integrated services across China. The company's revenue is primarily generated from these services, reflecting its focus on providing technological solutions to businesses.

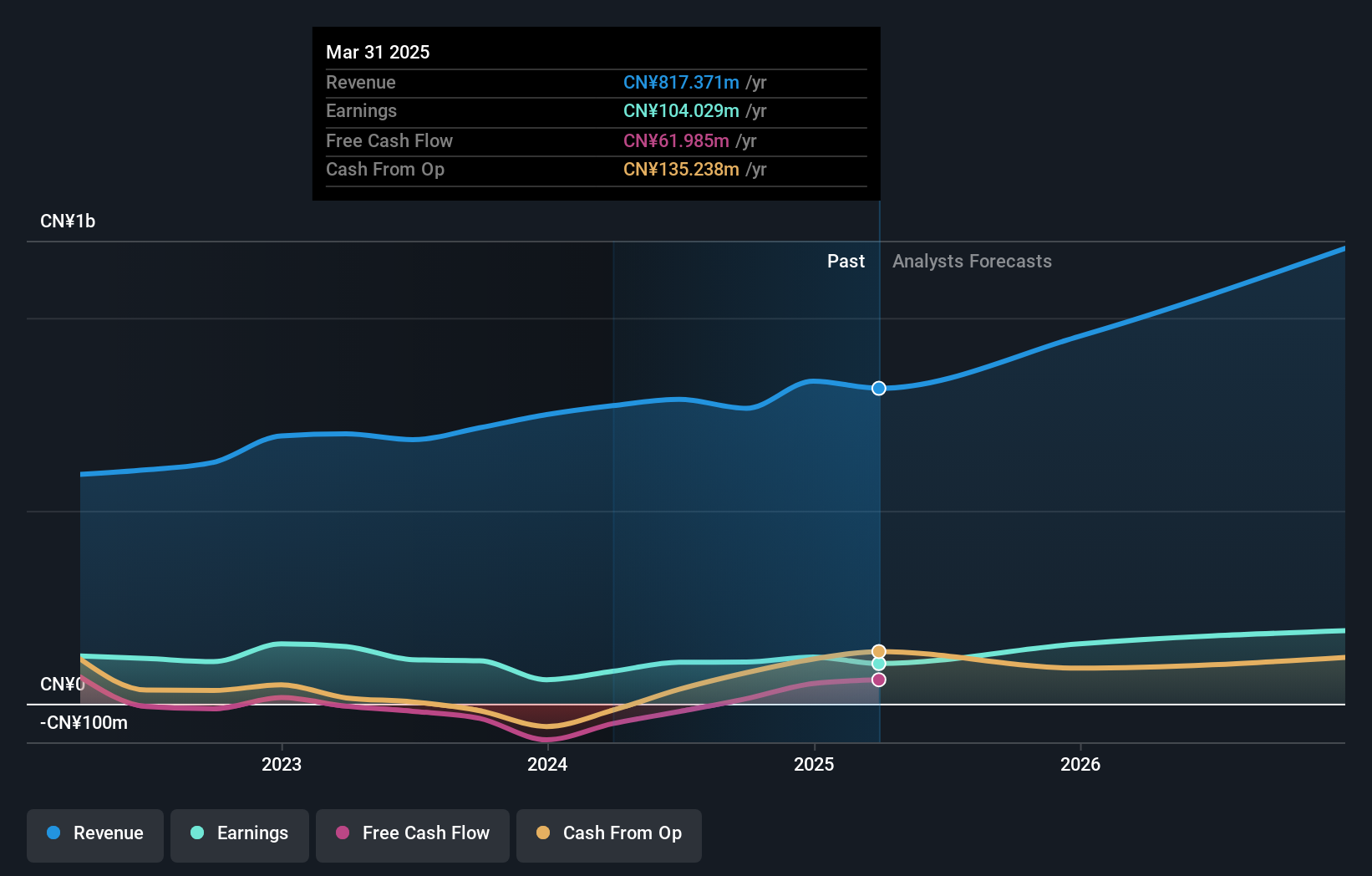

Pansoft has demonstrated a robust recovery, transforming a previous net loss into a CNY 14.93 million profit in the recent nine-month period, with revenues climbing to CNY 293.81 million from CNY 277.54 million year-over-year. This turnaround is underpinned by strategic amendments to corporate governance and business scope, positioning the company for sustained growth in dynamic tech landscapes. With earnings projected to surge by 27.8% annually and revenue expected to outpace the Chinese market by growing at 22.2% per year, Pansoft is aligning its operations for future scalability and market responsiveness, supported by a proactive approach to capital management and business agility shown in recent shareholder meetings.

Taking Advantage

- Click this link to deep-dive into the 1263 companies within our High Growth Tech and AI Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300884

Dnake (Xiamen) Intelligent Technology

Dnake (Xiamen) Intelligent Technology Co., Ltd.

Flawless balance sheet with high growth potential.