- China

- /

- Tech Hardware

- /

- SZSE:301606

Undiscovered Gems with Promising Potential This January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets have shown mixed results, with the S&P 500 and Nasdaq Composite closing out a strong year despite recent volatility influenced by economic indicators such as the Chicago PMI and GDP forecasts. In this dynamic environment, identifying stocks with promising potential involves looking for those that can navigate current market challenges while capitalizing on opportunities for growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahnhof | NA | 8.70% | 14.93% | ★★★★★★ |

| AB Traction | NA | 7.12% | 6.96% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Linc | NA | 12.52% | 16.39% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Whirlpool China (SHSE:600983)

Simply Wall St Value Rating: ★★★★★★

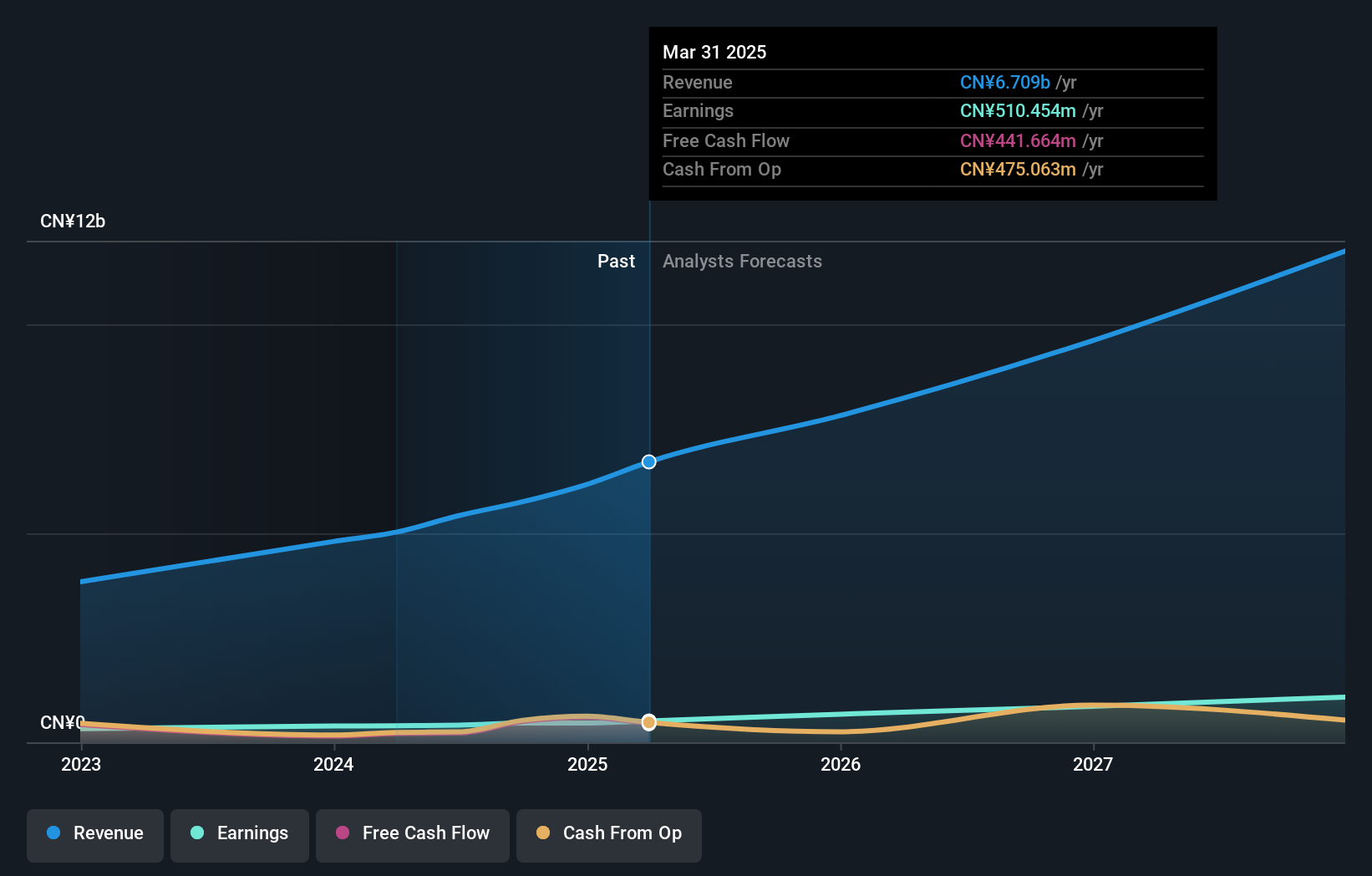

Overview: Whirlpool China Co., Ltd. focuses on the research, development, procurement, production, and sale of kitchen appliances both domestically and internationally, with a market cap of CN¥7.20 billion.

Operations: Whirlpool China's primary revenue stream is from the manufacture and sale of consumer electrical appliances, generating CN¥3.56 billion.

Whirlpool China, a smaller player in the industry, has shown resilience with earnings growth of 2.3% over the past year, outpacing the Consumer Durables sector's -0.2%. The company is debt-free now compared to five years ago when it had a debt-to-equity ratio of 1.5%, which likely strengthens its financial stability. Despite a drop in sales from CN¥2.96 billion to CN¥2.52 billion for the nine months ending September 2024, net income rose significantly from CN¥14 million to CN¥53 million, aided by a one-off gain of CN¥39.8 million impacting recent results positively.

- Navigate through the intricacies of Whirlpool China with our comprehensive health report here.

Understand Whirlpool China's track record by examining our Past report.

NINGBO HENGSHUAI (SZSE:300969)

Simply Wall St Value Rating: ★★★★★★

Overview: Ningbo Hengshuai Co., Ltd. is engaged in the global manufacturing and sale of automotive micro-motors and components, with a market capitalization of CN¥6.60 billion.

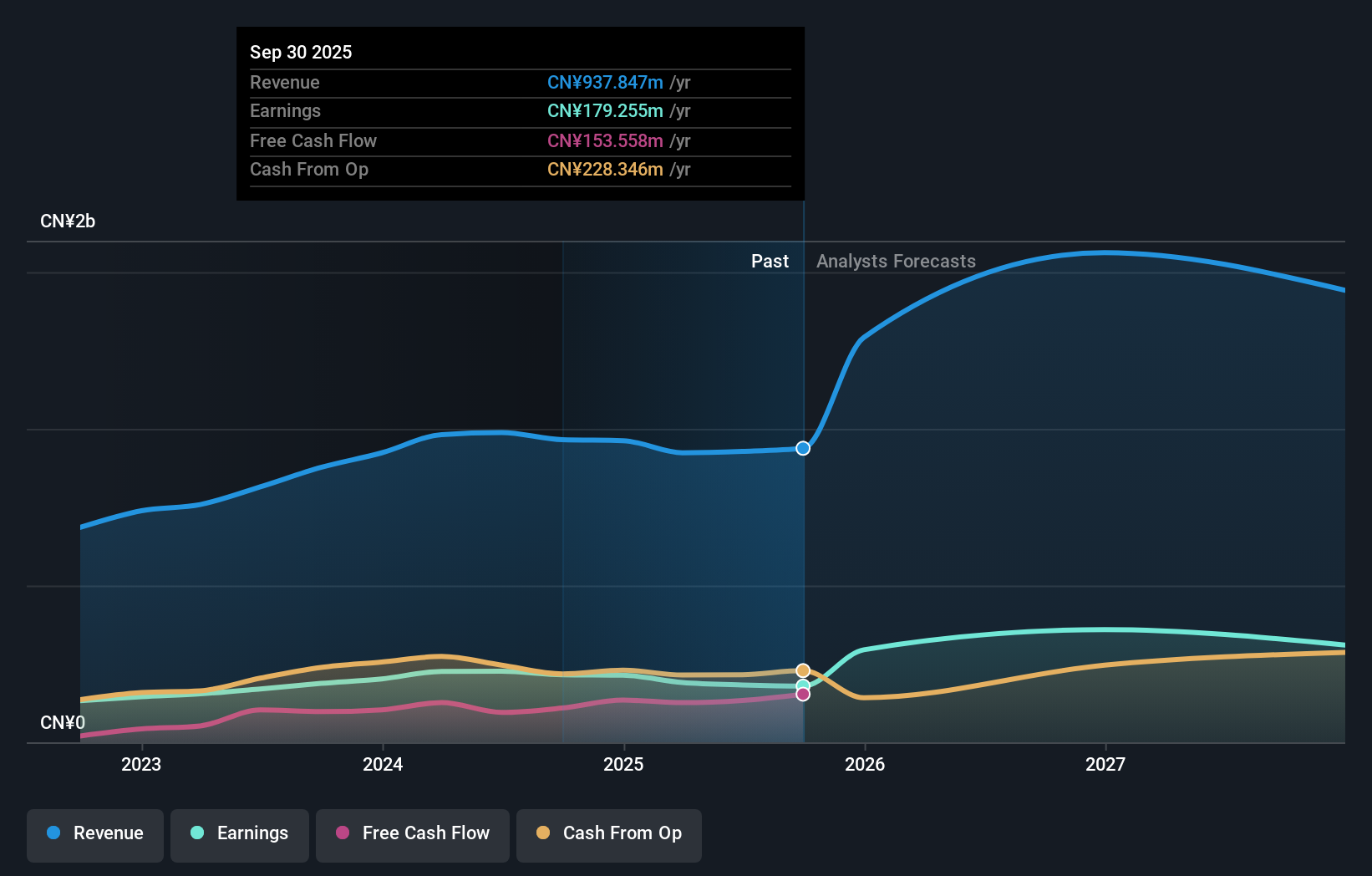

Operations: The primary revenue stream for Ningbo Hengshuai comes from its Auto Parts & Accessories segment, generating CN¥965.11 million. The company's market capitalization stands at CN¥6.60 billion.

Ningbo Hengshuai, a nimble player in the auto components sector, has demonstrated robust growth with earnings climbing 14.7% over the past year, outpacing the industry's 10.5%. The company stands debt-free now compared to five years ago when its debt-to-equity ratio was 2.1%, reflecting prudent financial management. Despite a volatile share price recently, it reported a net income of CNY 163.52 million for nine months ending September 2024 versus CNY 150.07 million previously, indicating solid performance. With its price-to-earnings ratio at 32.3x below the CN market average of 32.7x, it seems attractively valued for potential investors seeking growth prospects in this space.

- Click here and access our complete health analysis report to understand the dynamics of NINGBO HENGSHUAI.

Gain insights into NINGBO HENGSHUAI's past trends and performance with our Past report.

Ugreen Group (SZSE:301606)

Simply Wall St Value Rating: ★★★★★★

Overview: Ugreen Group Limited is involved in the research, development, design, production, and sale of consumer electronic products both in China and internationally, with a market cap of approximately CN¥13.90 billion.

Operations: Ugreen Group generates revenue primarily from its computer peripherals segment, amounting to CN¥5.76 billion.

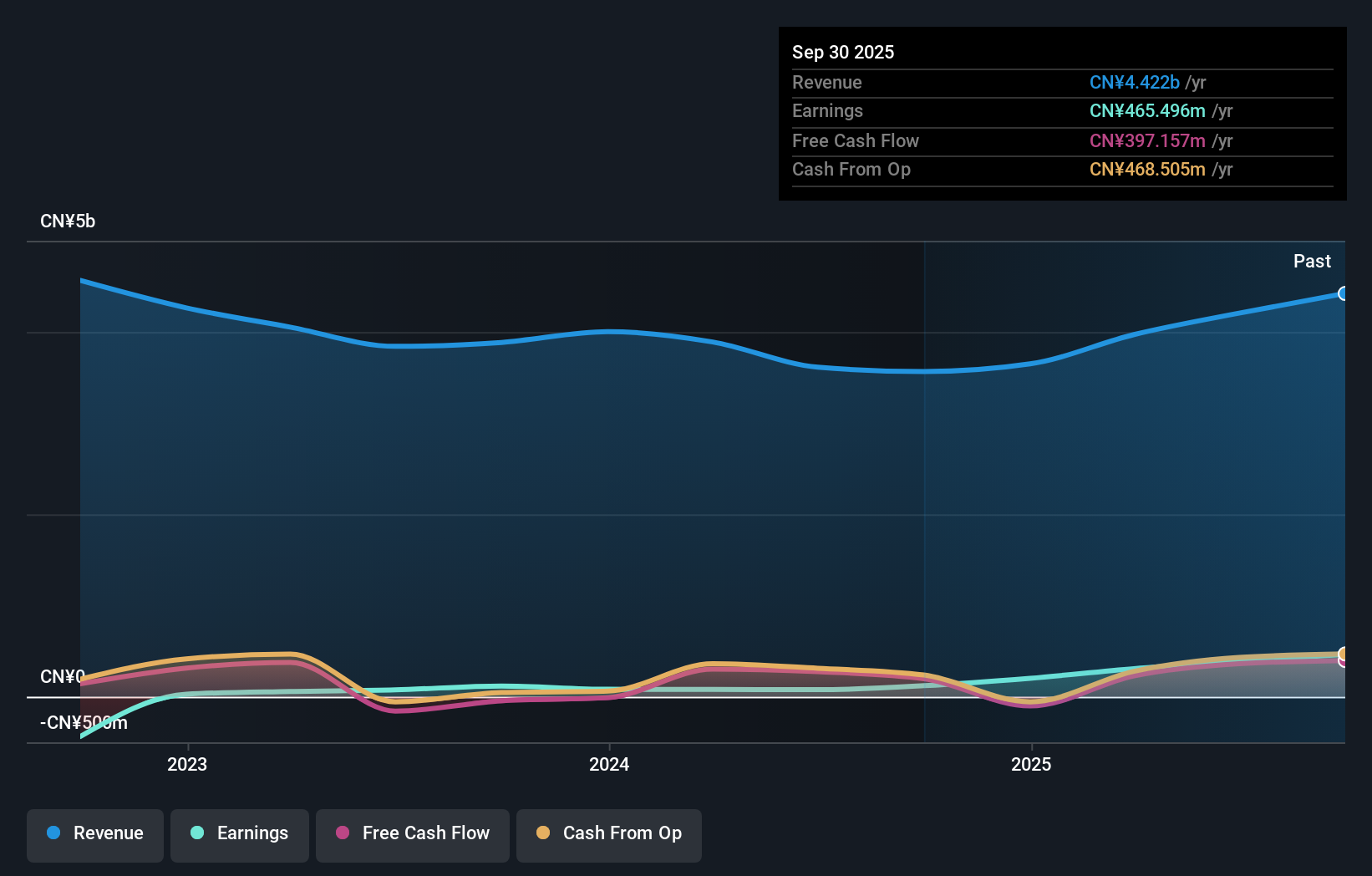

Ugreen Group, a nimble player in the tech sector, recently joined the S&P Global BMI Index and reported impressive earnings for nine months ending September 2024. Sales reached CNY 4.31 billion, up from CNY 3.35 billion the previous year, while net income climbed to CNY 321.77 million from CNY 249.55 million. The firm boasts a price-to-earnings ratio of 36x, undercutting the industry average of 51x, with earnings growth at a robust pace of 24% over last year—outpacing industry trends significantly despite its volatile share price and debt-free status for five years running.

- Click to explore a detailed breakdown of our findings in Ugreen Group's health report.

Examine Ugreen Group's past performance report to understand how it has performed in the past.

Make It Happen

- Click this link to deep-dive into the 4673 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301606

Ugreen Group

Engages in the research, development, design, production, and sale of 3C consumer electronic products in China and internationally.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives