- China

- /

- Electronic Equipment and Components

- /

- SZSE:300296

Leyard Optoelectronic Co., Ltd. (SZSE:300296) Surges 47% Yet Its Low P/S Is No Reason For Excitement

Leyard Optoelectronic Co., Ltd. (SZSE:300296) shareholders have had their patience rewarded with a 47% share price jump in the last month. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.8% in the last twelve months.

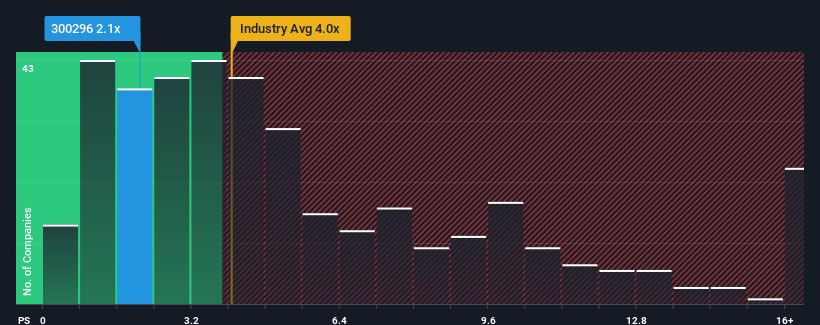

Even after such a large jump in price, Leyard Optoelectronic may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.1x, since almost half of all companies in the Electronic industry in China have P/S ratios greater than 4x and even P/S higher than 8x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Leyard Optoelectronic

How Leyard Optoelectronic Has Been Performing

While the industry has experienced revenue growth lately, Leyard Optoelectronic's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Leyard Optoelectronic's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Leyard Optoelectronic's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 1.4% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 22% during the coming year according to the dual analysts following the company. With the industry predicted to deliver 26% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Leyard Optoelectronic's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Leyard Optoelectronic's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Leyard Optoelectronic's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Leyard Optoelectronic that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300296

Leyard Optoelectronic

Operates as an audio-visual technology company in China and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives