- China

- /

- Electronic Equipment and Components

- /

- SZSE:300161

Wuhan Huazhong Numerical Control Co.,Ltd.'s (SZSE:300161) Shares Leap 26% Yet They're Still Not Telling The Full Story

Wuhan Huazhong Numerical Control Co.,Ltd. (SZSE:300161) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 47% over that time.

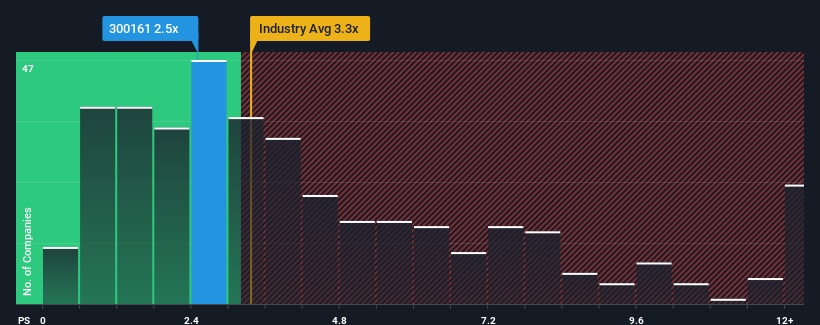

In spite of the firm bounce in price, Wuhan Huazhong Numerical ControlLtd may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 2.5x, considering almost half of all companies in the Electronic industry in China have P/S ratios greater than 3.3x and even P/S higher than 6x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Wuhan Huazhong Numerical ControlLtd

What Does Wuhan Huazhong Numerical ControlLtd's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Wuhan Huazhong Numerical ControlLtd's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Wuhan Huazhong Numerical ControlLtd will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Wuhan Huazhong Numerical ControlLtd?

The only time you'd be truly comfortable seeing a P/S as low as Wuhan Huazhong Numerical ControlLtd's is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.4%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 33% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 69% as estimated by the two analysts watching the company. With the industry only predicted to deliver 26%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Wuhan Huazhong Numerical ControlLtd's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Wuhan Huazhong Numerical ControlLtd's P/S

The latest share price surge wasn't enough to lift Wuhan Huazhong Numerical ControlLtd's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Wuhan Huazhong Numerical ControlLtd's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

It is also worth noting that we have found 2 warning signs for Wuhan Huazhong Numerical ControlLtd (1 is a bit concerning!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Wuhan Huazhong Numerical ControlLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Wuhan Huazhong Numerical ControlLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300161

Wuhan Huazhong Numerical ControlLtd

Wuhan Huazhong Numerical Control Co.,Ltd.

Fair value with mediocre balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)