- China

- /

- Communications

- /

- SZSE:300101

Chengdu CORPRO Technology Co.,Ltd.'s (SZSE:300101) 26% Jump Shows Its Popularity With Investors

Those holding Chengdu CORPRO Technology Co.,Ltd. (SZSE:300101) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 44% over that time.

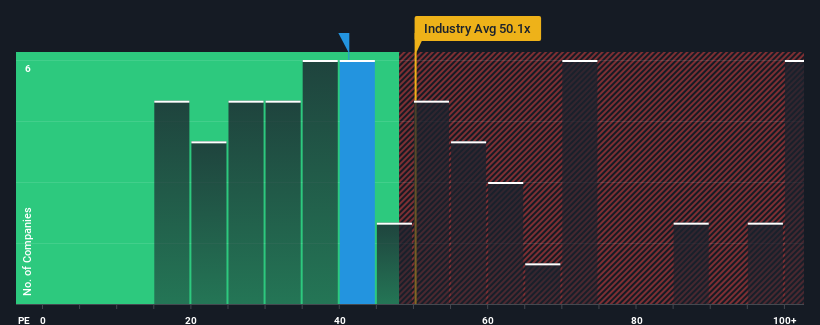

After such a large jump in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 30x, you may consider Chengdu CORPRO TechnologyLtd as a stock to potentially avoid with its 41.2x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

As an illustration, earnings have deteriorated at Chengdu CORPRO TechnologyLtd over the last year, which is not ideal at all. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Chengdu CORPRO TechnologyLtd

Is There Enough Growth For Chengdu CORPRO TechnologyLtd?

There's an inherent assumption that a company should outperform the market for P/E ratios like Chengdu CORPRO TechnologyLtd's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 4.3%. Even so, admirably EPS has lifted 383% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 41% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Chengdu CORPRO TechnologyLtd is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On Chengdu CORPRO TechnologyLtd's P/E

Chengdu CORPRO TechnologyLtd shares have received a push in the right direction, but its P/E is elevated too. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Chengdu CORPRO TechnologyLtd revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Chengdu CORPRO TechnologyLtd, and understanding should be part of your investment process.

Of course, you might also be able to find a better stock than Chengdu CORPRO TechnologyLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300101

Chengdu CORPRO TechnologyLtd

Provides satellite navigation components and terminals.

Excellent balance sheet with acceptable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026