- China

- /

- Electronic Equipment and Components

- /

- SZSE:002456

Why Investors Shouldn't Be Surprised By OFILM Group Co., Ltd.'s (SZSE:002456) 26% Share Price Plunge

OFILM Group Co., Ltd. (SZSE:002456) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 58%, which is great even in a bull market.

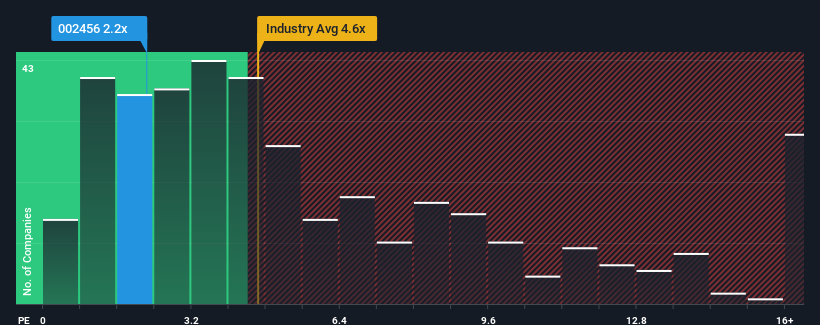

In spite of the heavy fall in price, OFILM Group may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 2.2x, considering almost half of all companies in the Electronic industry in China have P/S ratios greater than 4.6x and even P/S higher than 9x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for OFILM Group

How Has OFILM Group Performed Recently?

With revenue growth that's superior to most other companies of late, OFILM Group has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on OFILM Group.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, OFILM Group would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 38% gain to the company's top line. Still, revenue has fallen 28% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 22% during the coming year according to the three analysts following the company. That's shaping up to be materially lower than the 27% growth forecast for the broader industry.

In light of this, it's understandable that OFILM Group's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On OFILM Group's P/S

Shares in OFILM Group have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of OFILM Group's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - OFILM Group has 3 warning signs (and 1 which is concerning) we think you should know about.

If these risks are making you reconsider your opinion on OFILM Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002456

OFILM Group

Engages in the design, research, development, production, and sale of optoelectronic products and technologies in Mainland China and internationally.

Fair value with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.