- China

- /

- Electronic Equipment and Components

- /

- SZSE:002436

Further Upside For Shenzhen Fastprint Circuit Tech Co.,Ltd. (SZSE:002436) Shares Could Introduce Price Risks After 26% Bounce

Shenzhen Fastprint Circuit Tech Co.,Ltd. (SZSE:002436) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Looking further back, the 18% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

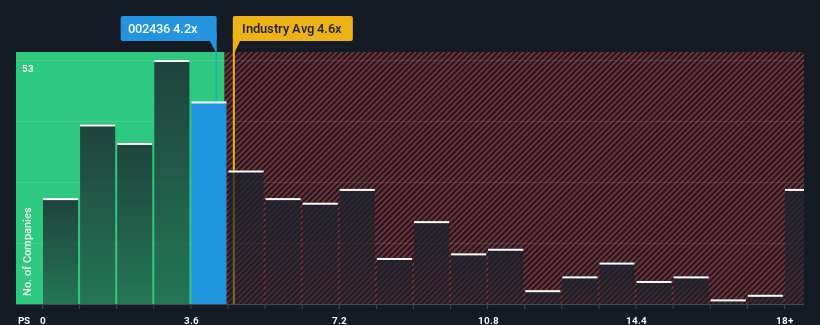

Although its price has surged higher, you could still be forgiven for feeling indifferent about Shenzhen Fastprint Circuit TechLtd's P/S ratio of 4.2x, since the median price-to-sales (or "P/S") ratio for the Electronic industry in China is also close to 4.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Shenzhen Fastprint Circuit TechLtd

What Does Shenzhen Fastprint Circuit TechLtd's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Shenzhen Fastprint Circuit TechLtd has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Shenzhen Fastprint Circuit TechLtd will help you uncover what's on the horizon.How Is Shenzhen Fastprint Circuit TechLtd's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Shenzhen Fastprint Circuit TechLtd's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. The latest three year period has also seen a 21% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 30% during the coming year according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 25%, which is noticeably less attractive.

In light of this, it's curious that Shenzhen Fastprint Circuit TechLtd's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Shenzhen Fastprint Circuit TechLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Shenzhen Fastprint Circuit TechLtd currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Shenzhen Fastprint Circuit TechLtd that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002436

Shenzhen Fastprint Circuit TechLtd

Designs, produces, and sells printed circuit boards in China and internationally.

Reasonable growth potential and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)