As global markets navigate a complex landscape marked by volatile corporate earnings and geopolitical tensions, investors are seeking opportunities that balance potential growth with manageable risk. Penny stocks, while often seen as relics of earlier market days, still represent an intriguing investment area due to their association with smaller or less-established companies. By focusing on those with strong financial health and clear growth prospects, investors can uncover hidden gems that may offer both stability and potential upside in today's market conditions.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.74 | HK$44.23B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.86 | £471.38M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £174.08M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.09B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$141.28M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$1.15 | HK$710.96M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.22 | £154.81M | ★★★★★☆ |

Click here to see the full list of 5,706 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Digital China Holdings (SEHK:861)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Digital China Holdings Limited is an investment holding company that offers big data products and solutions to government and enterprise customers mainly in Mainland China, with a market capitalization of approximately HK$4.85 billion.

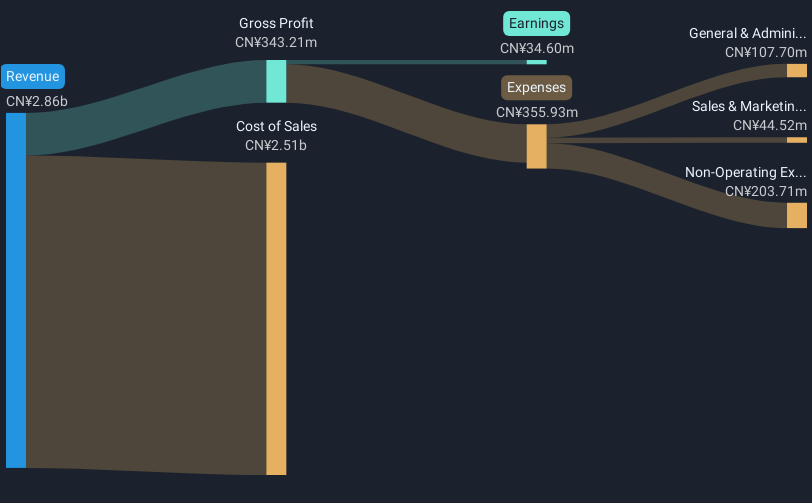

Operations: The company's revenue is primarily derived from three segments: Software and Operating Services (CN¥5.31 billion), Traditional and Localization Services (CN¥10.03 billion), and Big Data Products and Solutions (CN¥3.39 billion).

Market Cap: HK$4.85B

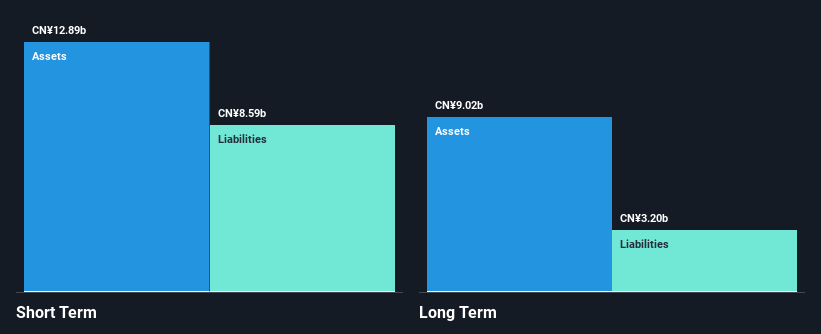

Digital China Holdings, with a market cap of approximately HK$4.85 billion, derives revenue from its Software and Operating Services (CN¥5.31 billion), Traditional and Localization Services (CN¥10.03 billion), and Big Data Products and Solutions (CN¥3.39 billion) segments. Despite trading at 43% below estimated fair value, the company is currently unprofitable with a negative return on equity (-18.09%). Its short-term assets exceed both short-term and long-term liabilities, indicating financial stability in the near term, although operating cash flow remains negative, posing challenges in debt coverage without sufficient earnings growth or profitability improvements forecasted at 42.12% annually.

- Get an in-depth perspective on Digital China Holdings' performance by reading our balance sheet health report here.

- Gain insights into Digital China Holdings' future direction by reviewing our growth report.

Wolong Resources Group (SHSE:600173)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Wolong Resources Group Co., Ltd. focuses on the development and sale of real estate properties in China, with a market capitalization of CN¥2.93 billion.

Operations: Wolong Resources Group Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥2.93B

Wolong Resources Group, with a market cap of CN¥2.93 billion, has experienced significant financial challenges recently due to a large one-off loss of CN¥143.3 million impacting its results for the year ending September 2024. Despite this setback, the company maintains strong liquidity as its short-term assets (CN¥4.5 billion) exceed both short-term and long-term liabilities significantly. The company's debt is well covered by operating cash flow at 53.1%, and it holds more cash than total debt, providing some financial cushion. However, recent earnings have declined sharply by 81.6%, presenting ongoing profitability concerns amidst a low return on equity of 0.9%.

- Take a closer look at Wolong Resources Group's potential here in our financial health report.

- Gain insights into Wolong Resources Group's historical outcomes by reviewing our past performance report.

Suzhou Victory Precision Manufacture (SZSE:002426)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Suzhou Victory Precision Manufacture Co., Ltd. operates in the precision manufacturing industry and has a market cap of CN¥9.56 billion.

Operations: Suzhou Victory Precision Manufacture Co., Ltd. does not report specific revenue segments.

Market Cap: CN¥9.56B

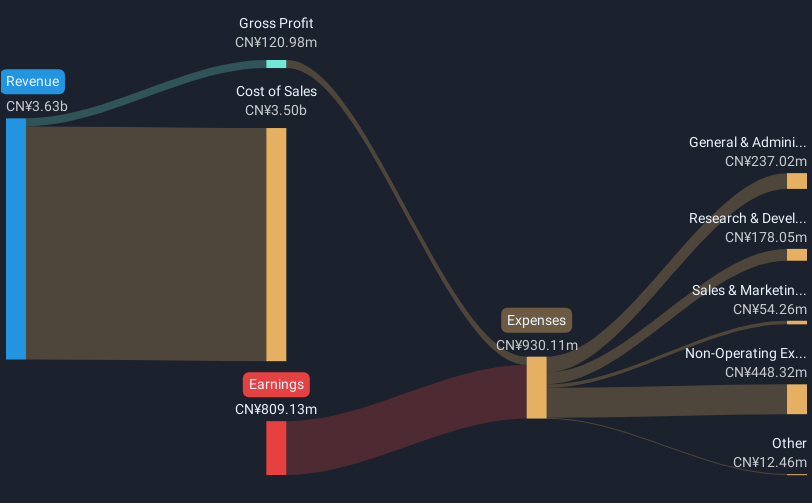

Suzhou Victory Precision Manufacture, with a market cap of CN¥9.56 billion, is navigating financial challenges as it remains unprofitable but has reduced losses by 35.2% annually over the past five years. The company plans a private placement to raise up to CN¥1.95 billion, reflecting strategic efforts to strengthen its financial position despite high net debt to equity at 49.3%. While short-term assets (CN¥2.8B) do not cover short-term liabilities (CN¥3.7B), long-term liabilities are well covered, and the company possesses sufficient cash runway for over three years based on current free cash flow trends.

- Click here to discover the nuances of Suzhou Victory Precision Manufacture with our detailed analytical financial health report.

- Understand Suzhou Victory Precision Manufacture's track record by examining our performance history report.

Seize The Opportunity

- Reveal the 5,706 hidden gems among our Penny Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:861

Digital China Holdings

An investment holding company, provides big data products and solutions for government and enterprise customers primarily in Mainland China.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives