As global markets navigate a complex landscape of cautious monetary policies and fluctuating economic indicators, Asian tech stocks have emerged as a focal point for investors seeking growth opportunities. In this dynamic environment, identifying high-growth tech stocks involves assessing factors such as innovation potential, market adaptability, and resilience to broader economic shifts.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 23.97% | 28.52% | ★★★★★★ |

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.55% | 44.13% | ★★★★★★ |

| Eoptolink Technology | 37.70% | 35.42% | ★★★★★★ |

| Zhongji Innolight | 28.79% | 30.71% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Foxconn Industrial Internet | 28.21% | 27.66% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Shenzhen Aisidi (SZSE:002416)

Simply Wall St Growth Rating: ★★★★☆☆

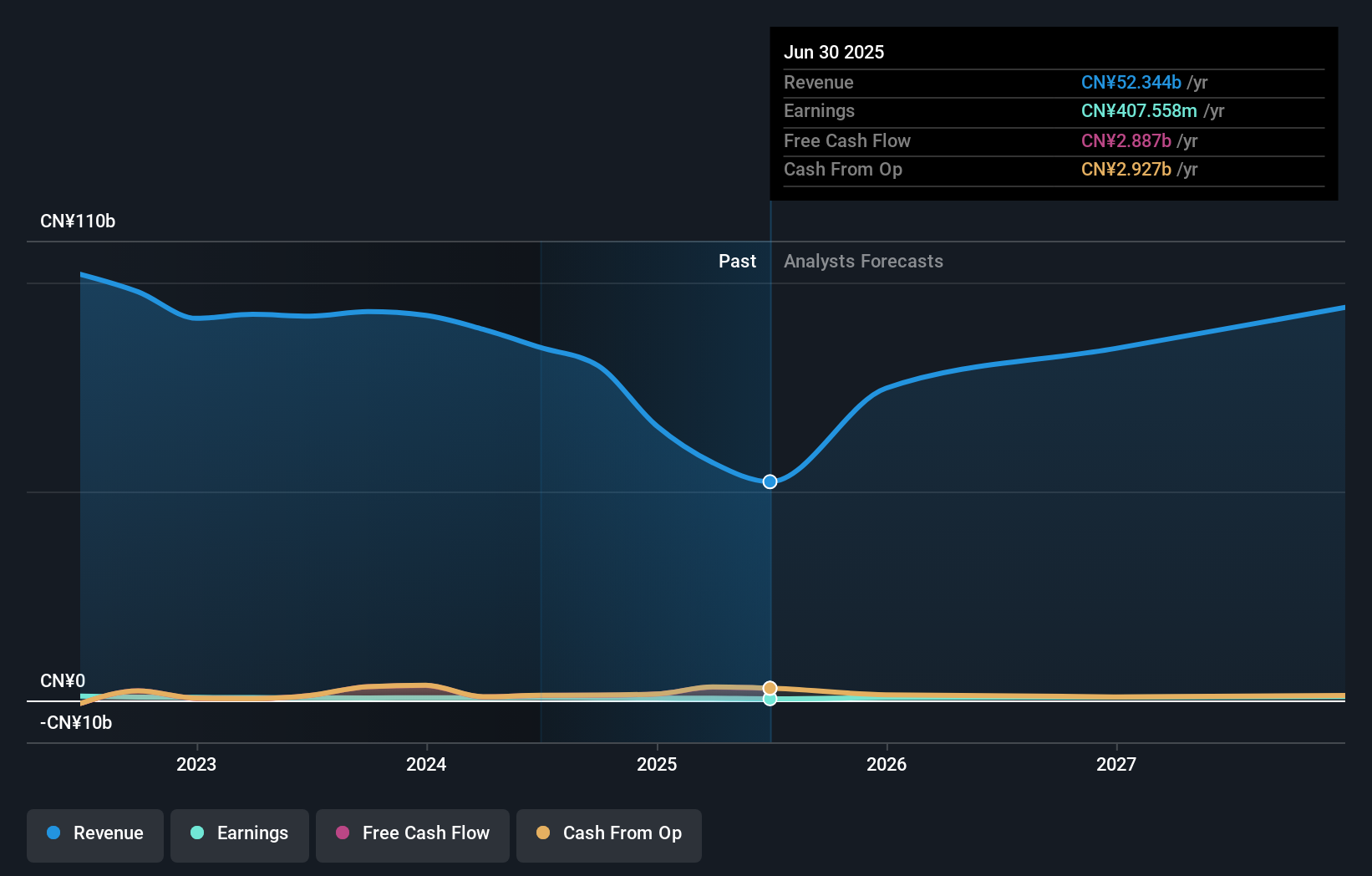

Overview: Shenzhen Aisidi Co., Ltd. operates in the digital distribution and retail sectors both within China and globally, with a market cap of approximately CN¥15.12 billion.

Operations: Shenzhen Aisidi derives its revenue primarily from its digital distribution business, which generated CN¥33.86 billion, and its digital retail business, contributing CN¥18.72 billion.

Shenzhen Aisidi, navigating through a challenging fiscal period with a significant revenue drop to CNY 25.37 billion from CNY 38.85 billion year-over-year, still shows promise with an expected annual earnings growth of 28%. This outpaces the Chinese market projection of 26.7%, signaling potential resilience and adaptability in its operations. Despite recent setbacks including a net income fall to CNY 221.56 million, the company's strategic amendments in corporate bylaws and proactive shareholder meetings suggest a forward-looking approach to governance and financial management. The firm is poised for recovery, leveraging robust projected growth rates and strategic corporate adjustments amidst prevailing market challenges.

- Click here and access our complete health analysis report to understand the dynamics of Shenzhen Aisidi.

Explore historical data to track Shenzhen Aisidi's performance over time in our Past section.

Hualan Biological Vaccine (SZSE:301207)

Simply Wall St Growth Rating: ★★★★★☆

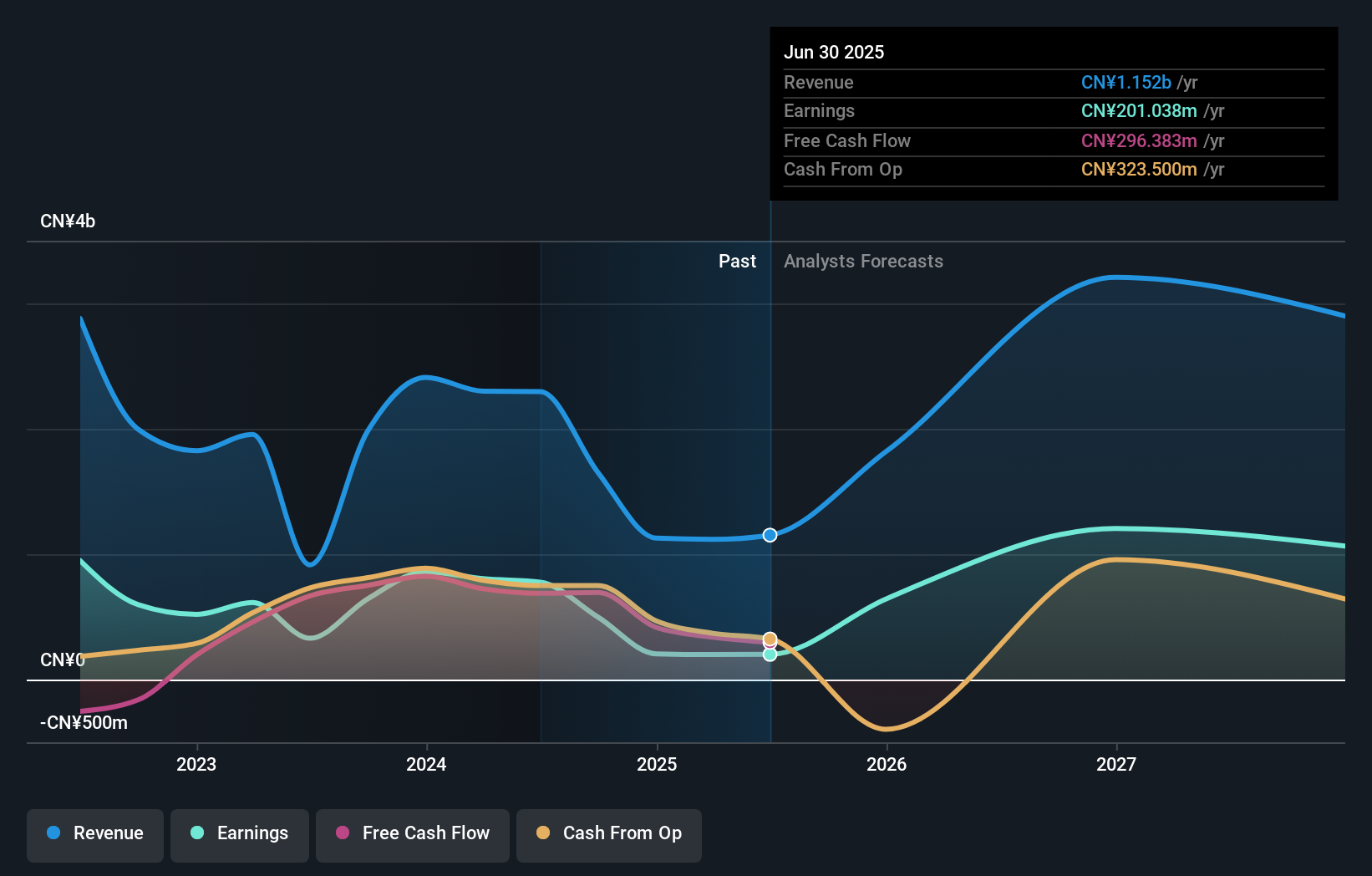

Overview: Hualan Biological Vaccine Inc. focuses on the research, development, production, and sale of vaccines and genetic engineering biological products in China with a market cap of CN¥10.28 billion.

Operations: Hualan Biological Vaccine generates revenue primarily through the sale of vaccines and genetic engineering biological products in China. The company's financial performance is supported by its focus on research and development, which drives its product offerings in the biotechnology sector.

Hualan Biological Vaccine, amidst a dynamic biotech landscape in Asia, demonstrates robust growth with a 38.3% annual revenue increase and an even more impressive earnings forecast of 53.4% per year. Despite a challenging industry environment where many peers faced negative growth, Hualan stands out with its strategic focus on R&D, dedicating significant resources that underscore its commitment to innovation and market leadership. Recent shareholder meetings and dividend affirmations reflect confidence in the company's financial health and strategic direction, reinforcing its potential in the high-growth biotech sector.

- Navigate through the intricacies of Hualan Biological Vaccine with our comprehensive health report here.

Understand Hualan Biological Vaccine's track record by examining our Past report.

ANYCOLOR (TSE:5032)

Simply Wall St Growth Rating: ★★★★☆☆

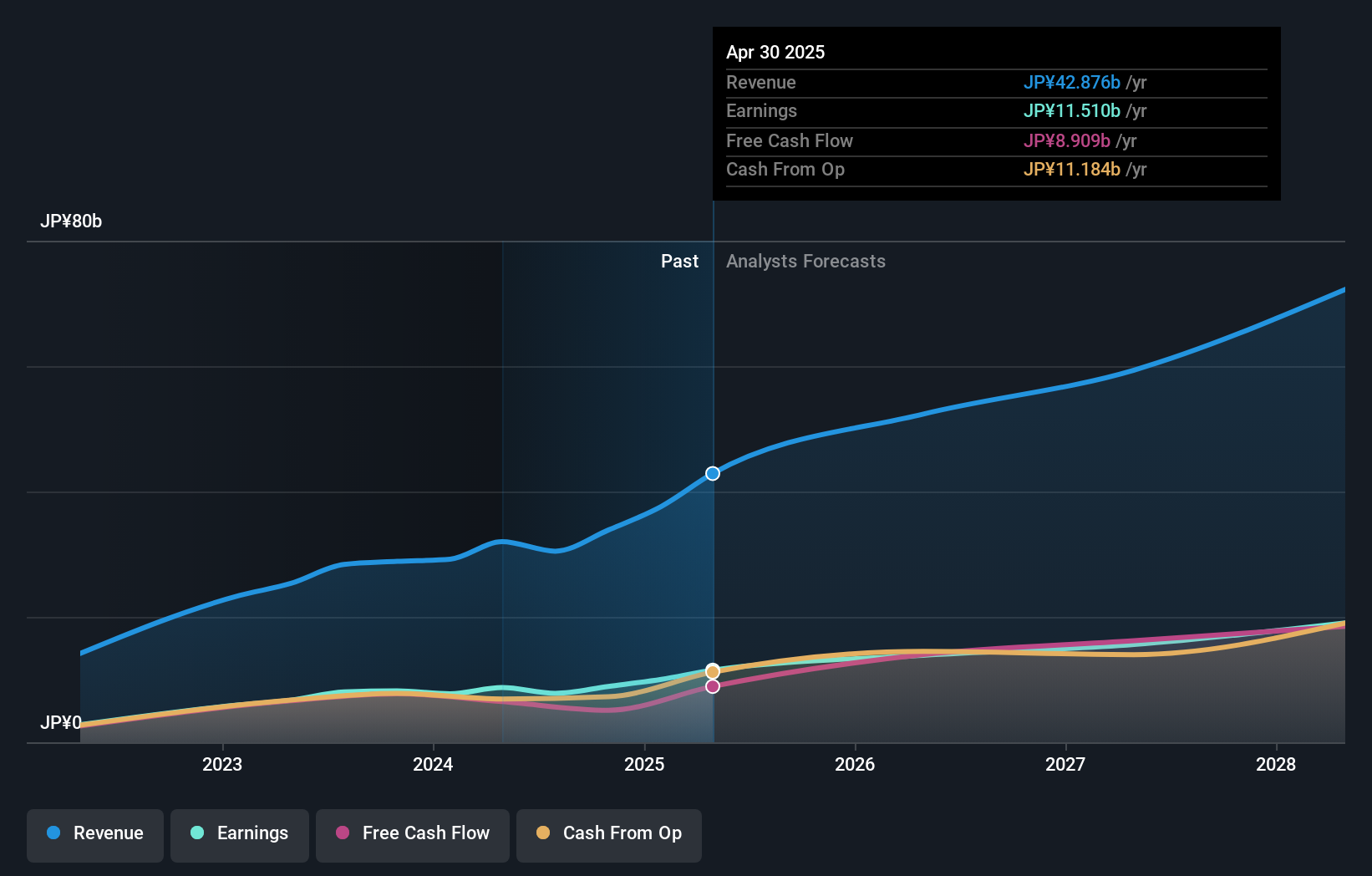

Overview: ANYCOLOR Inc. is an entertainment company operating in Japan and internationally, with a market cap of ¥343.96 billion.

Operations: The company generates revenue primarily through its digital entertainment services, focusing on virtual YouTubers and related content. It leverages a diverse range of monetization strategies, including merchandise sales, live events, and digital content distribution. The business model emphasizes scalability in the online entertainment sector.

Amidst a vibrant tech landscape, ANYCOLOR Inc. stands out with its recent upward revision in earnings guidance for FY 2026, reflecting robust growth driven by innovative VTuber initiatives and strong event revenues. This adjustment anticipates net sales between JPY 50 billion to JPY 52 billion and net profit between JPY 14.22 billion to JPY 14.92 billion, showcasing an impressive operational execution that outstrips initial forecasts due to strategic merchandise and event planning efficiencies. The company's focus on emerging digital entertainment formats like VTubers, combined with effective cost management, positions it favorably within Asia's competitive tech sector, hinting at sustained profitability and market adaptability in future fiscal periods.

- Click here to discover the nuances of ANYCOLOR with our detailed analytical health report.

Assess ANYCOLOR's past performance with our detailed historical performance reports.

Key Takeaways

- Access the full spectrum of 186 Asian High Growth Tech and AI Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hualan Biological Vaccine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301207

Hualan Biological Vaccine

Engages in the research and development, production, and sale of vaccines and genetic engineering biological products in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives