- China

- /

- Electronic Equipment and Components

- /

- SZSE:002414

3 Global Growth Companies With Insider Ownership Up To 31%

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating interest rates and renewed concerns over technology valuations, investors are seeking stability amid the volatility. With major indices like the Dow Jones Industrial Average reaching all-time highs while others like the tech-heavy Nasdaq Composite face downward pressure, insider ownership in growth companies can offer a compelling signal of confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Rasan Information Technology (SASE:8313) | 31.1% | 21% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| CD Projekt (WSE:CDR) | 29.7% | 51.8% |

Let's explore several standout options from the results in the screener.

Wuhan Guide Infrared (SZSE:002414)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuhan Guide Infrared Co., Ltd. designs, manufactures, markets, and sells infrared thermal imaging detectors and modules as well as electro-optical systems both in China and internationally, with a market cap of CN¥54.24 billion.

Operations: The company's revenue primarily comes from the design, manufacture, marketing, and sale of infrared thermal imaging detectors and modules along with electro-optical systems in both domestic and international markets.

Insider Ownership: 27.1%

Wuhan Guide Infrared has demonstrated strong growth, with recent earnings showing a substantial increase in net income to CNY 581.94 million from CNY 50.21 million year-over-year. The company's revenue is forecast to grow at 27.4% annually, outpacing the market average of 14.5%. Despite trading below its estimated fair value and having no significant insider transactions recently, it became profitable this year but faces challenges with low forecasted return on equity at 12.3%.

- Click here to discover the nuances of Wuhan Guide Infrared with our detailed analytical future growth report.

- Our expertly prepared valuation report Wuhan Guide Infrared implies its share price may be too high.

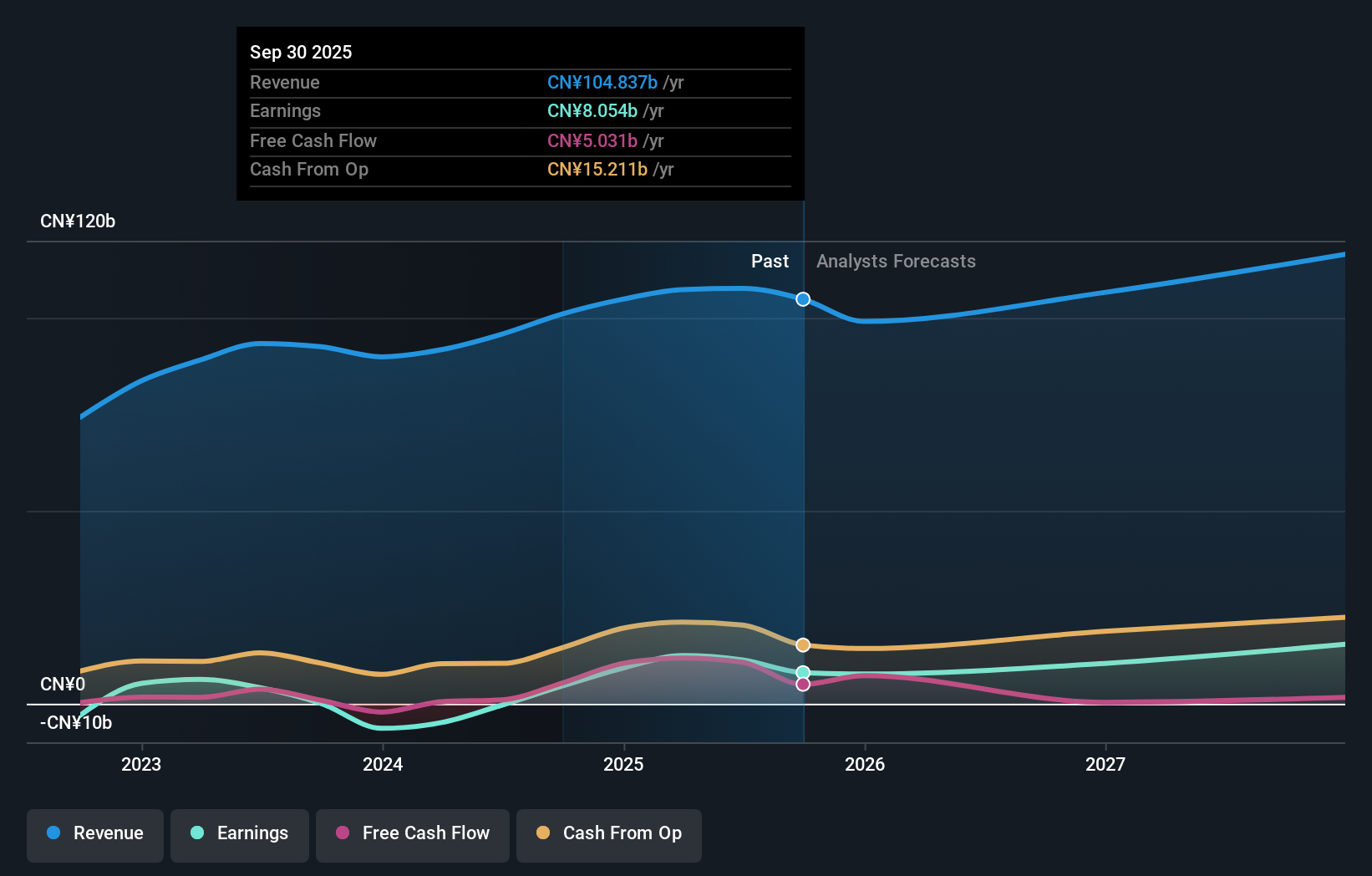

Wens Foodstuff Group (SZSE:300498)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wens Foodstuff Group Co., Ltd. operates as an agricultural and animal husbandry company in China, with a market cap of CN¥112.65 billion.

Operations: Wens Foodstuff Group Co., Ltd. generates revenue through its operations in agricultural and animal husbandry sectors within China.

Insider Ownership: 31.1%

Wens Foodstuff Group exhibits characteristics of a growth company with high insider ownership, despite recent financial challenges. Its earnings are forecast to grow significantly at 31.9% annually, surpassing the market average. Although revenue growth is slower than the market, the company trades at a favorable price-to-earnings ratio of 14x compared to peers. Recent amendments to its articles of association indicate strategic adjustments, and analysts anticipate a potential stock price increase by 25.2%.

- Click to explore a detailed breakdown of our findings in Wens Foodstuff Group's earnings growth report.

- The valuation report we've compiled suggests that Wens Foodstuff Group's current price could be quite moderate.

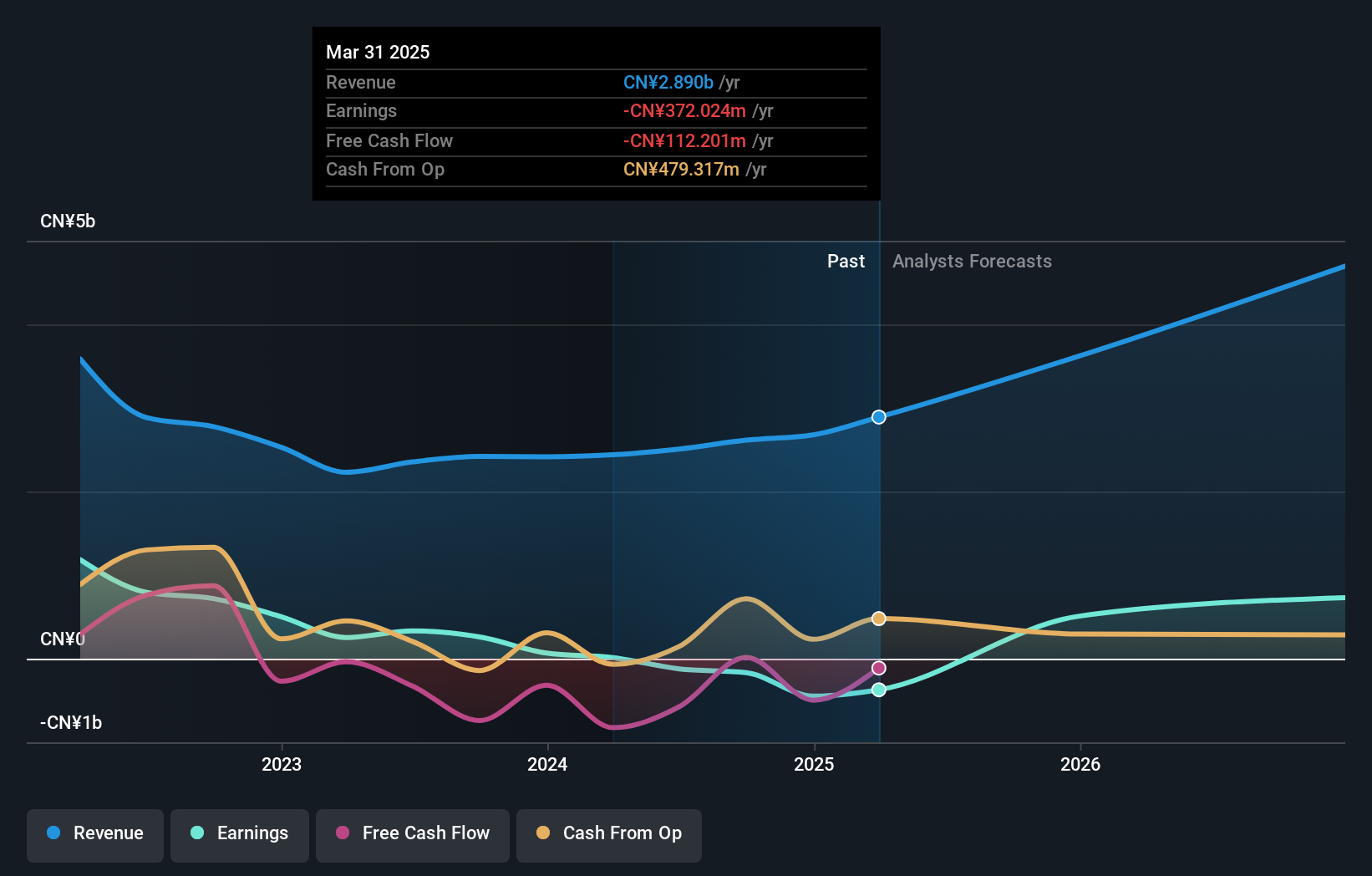

Maxscend Microelectronics (SZSE:300782)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Maxscend Microelectronics Company Limited focuses on the research, development, production, and sale of radio frequency integrated circuits in China with a market cap of CN¥37.54 billion.

Operations: Maxscend Microelectronics generates revenue through its research, development, production, and sale of radio frequency integrated circuits in the People's Republic of China.

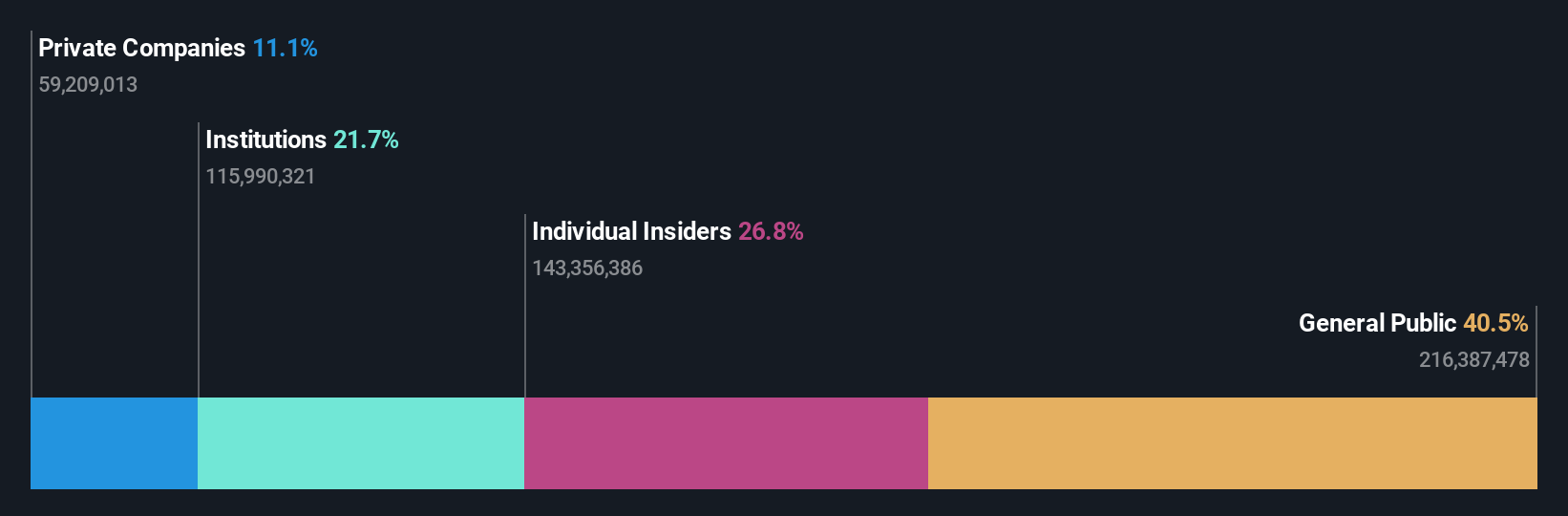

Insider Ownership: 26.8%

Maxscend Microelectronics demonstrates growth potential with forecasted revenue increases of 21.1% annually, outpacing the Chinese market. Despite recent financial setbacks, including a net loss of CNY 170.73 million for the first nine months of 2025 compared to a profit last year, earnings are expected to grow at 60.28% per year and become profitable within three years. However, its return on equity is projected to remain low at 13.1%.

- Unlock comprehensive insights into our analysis of Maxscend Microelectronics stock in this growth report.

- Our comprehensive valuation report raises the possibility that Maxscend Microelectronics is priced higher than what may be justified by its financials.

Make It Happen

- Dive into all 859 of the Fast Growing Global Companies With High Insider Ownership we have identified here.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Wuhan Guide Infrared might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002414

Wuhan Guide Infrared

Engages in the design, manufacture, marketing, and sale of infrared thermal imaging detectors and modules, and electro-optical systems in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)